How Bankruptcy in Canada Works

The legal process for a person to be discharged from their debts is called bankruptcy. It’s used by a debtor, someone who has a debt, to be released from them. There are reasonable conditions that must be met first, but this process relies on honesty and does have consequences afterwards. Businesses claim bankruptcy go through a slightly different process and it is based on their structure.

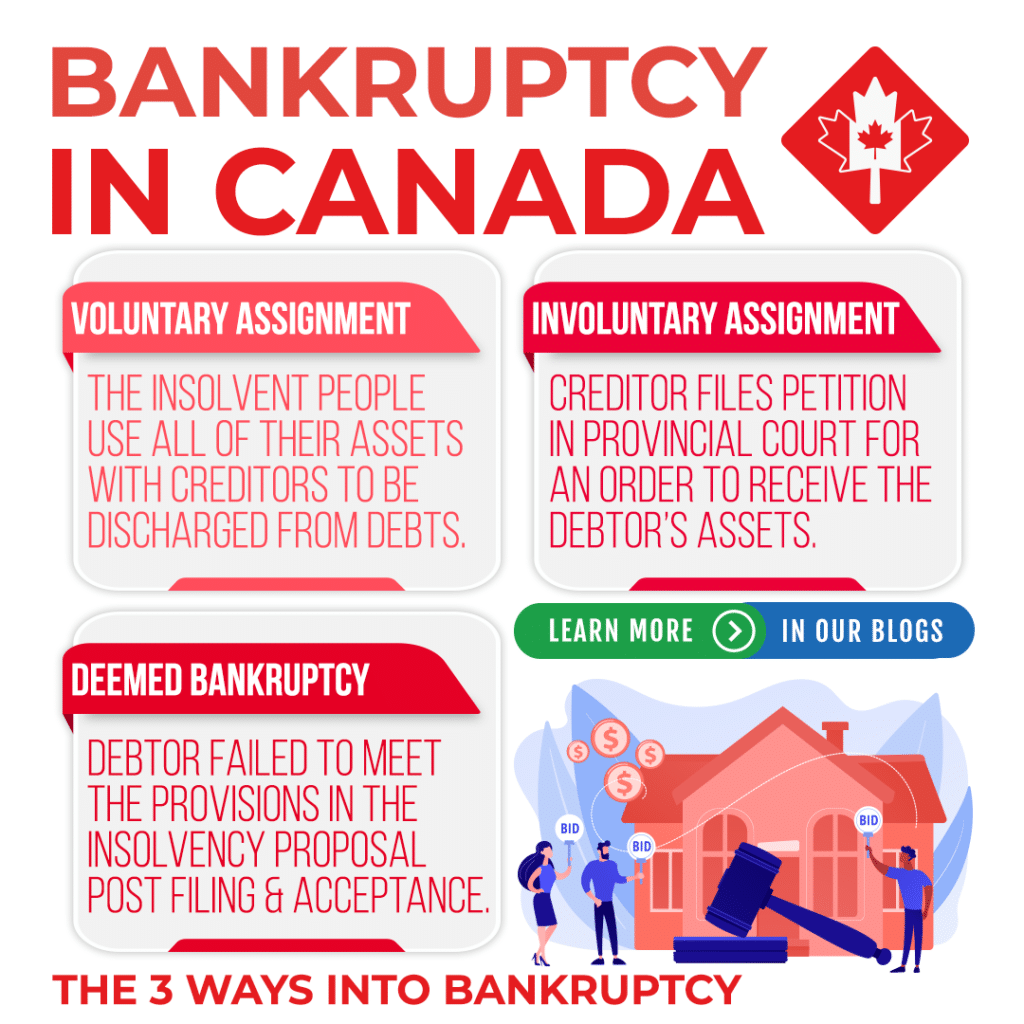

The Three Different Ways to Go into Bankruptcy

Voluntary Assignment

This is where an insolvent person or people who can’t pay their debts assign all their assets for benefit of all creditors.

Involuntary Assignment

For an involuntary assignment, the creditor begins the legal process by submitting a petition to a provincial court. They request a receiving order over the debtor’s assets and is also known as being petitioned into bankruptcy.

Deemed Bankruptcy

When a debtor who has already started the bankruptcy or insolvency process doesn’t meet certain conditions, they are deemed bankrupt. This is caused by the debtor either not meeting the conditions for a Division 1 proposal or failure to comply with an accepted proposal by creditors or the court. A Division 1 proposal is an offer made to the credibtors to change the amount and/or payment terms of the debt. It is only available to individuals with more than $250,000 in debt but excludes main residence mortgages.

Starting the Bankruptcy Process

If any of these circumstances occur, the debtor or their representative may need to send a copy of the court-issued bankruptcy notice, document titled “First Meeting of Creditors”, or an assignment in bankruptcy to an Insolvency Intake Center. Bankrupt businesses will have their business number or BN closed after the discharge.

Individual & Business Bankruptcy

Regardless of this process, the bankrupt has the right to earn a living. This means that they are allowed to conduct business activity outside the estate after a bankruptcy.

The Trustee in Bankruptcy

The trustee in a bankruptcy is the agent of the bankrupt employer when a liquidation, assignment, or bankruptcy occurs. They hold CPP contributions, EI premiums, and income tax amounts that have not been remitted to the CRA. The amounts are not part of the estate in bankruptcy but are kept separate from it. To continue the business, the trustee would need a new business number.

Sole Proprietorship

Because the individual and the business are the same legal entity in this case, the sole proprietor is considered a new legal entity on the day after being assigned into bankruptcy.

Partnership

If the partnership has two individuals and one declares bankruptcy, the partnership can’t continue. If there are more than than, it can still continue if they come to an agreement.

Corporation

Unless the bankrupt corporation pays all debts owed at the time of bankruptcy, the company won’t exist anymore. A governing body needs. tobe contacted to have it dissolved or start a new one.

Individuals

Besides losing all your assets, bankruptcy can affect those who co-signed any loans with the bankrupt debtor. They may be responsible for some of the debt to and will be liable to creditors. Bankruptcy damages individual credit scores causing loans to potentially be declined or at higher interest rates and worse terms than normal. The information can stay on a credit report for up to ten years and can hinder your ability to even get a credit card.

If you or someone you know feels that they may need resources to help them navigate the bankruptcy process, please contact us to get the help you deserve. Our tax accountants in Richmond are experts in navigating any financial circumstance found in Canadian businesses.