The Importance of Bookkeeping for Law Firms: Ensuring Trust and Accuracy

Welcome to our blog dedicated to discussing the crucial topic of bookkeeping for law firms. As a Certified Public Accounting (CPA) firm providing specialized services to legal professionals, we understand the significance of accurate accounting in the legal industry. In this article, we’ll delve into the essential aspects of law firm bookkeeping, including trust accounting, legal bookkeeping, and the benefits of seeking professional accounting services for lawyers.

Understanding Trust Accounting and Bookkeeping for Law Firms

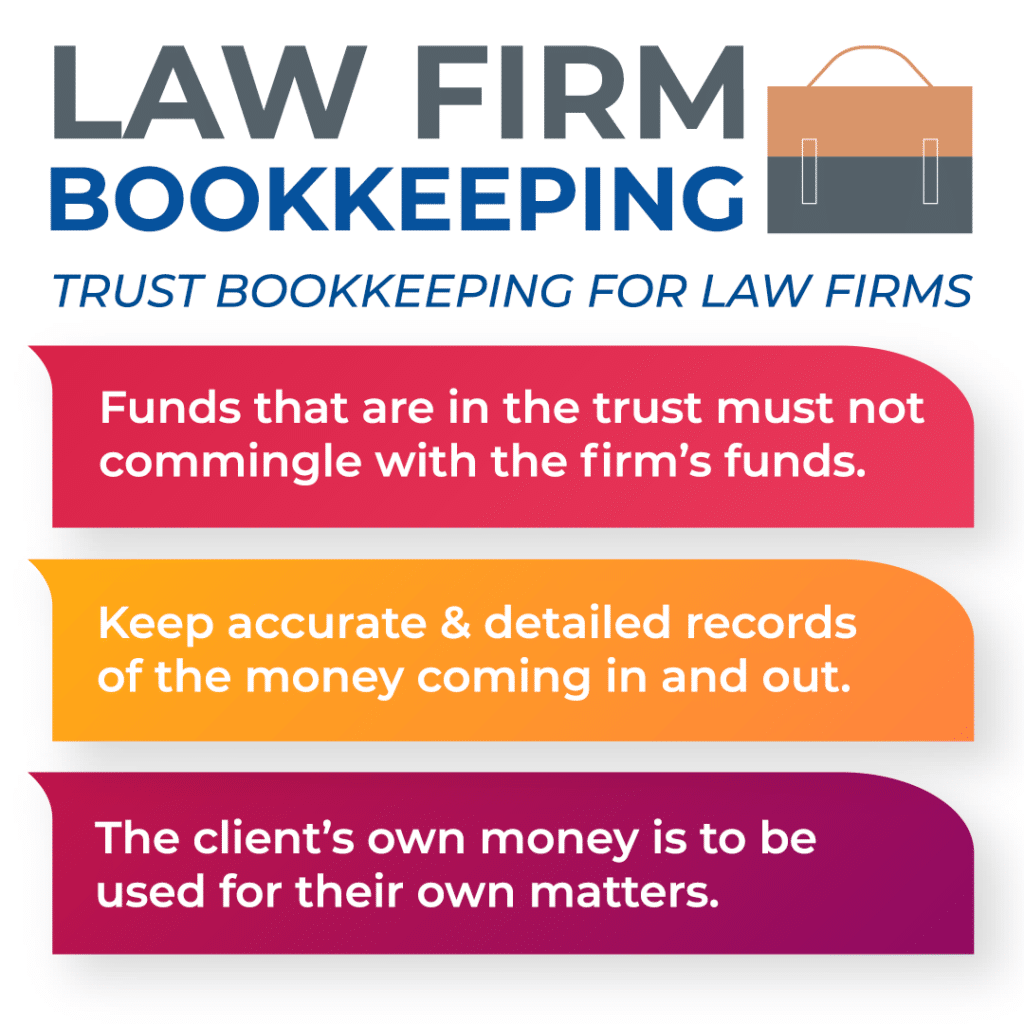

In the legal world, trust accounting is of utmost importance. As lawyers, you often hold funds on behalf of clients for various purposes, such as settlements, retainers, or disbursements. To maintain transparency and adhere to ethical guidelines, these client funds must be kept separate from your firm’s operational accounts. Trust accounting is the practice of meticulously tracking these funds to ensure they are utilized only for their intended purposes.

The Significance of Legal Bookkeeping for Lawyers

Accurate legal bookkeeping goes beyond just fulfilling regulatory requirements; it plays a crucial role in informed decision-making for lawyers. By maintaining precise accounting records, you gain valuable insights into your firm’s financial health. Additionally, it helps track expenses and identify areas for growth and cost-saving opportunities. Additionally, well-organized books streamline tax preparation and facilitate the auditing process.

Tips for Effective Law Firm Bookkeeping

- Embrace Law Firm Bookkeeping Software: Investing in reliable bookkeeping software designed specifically for law firms can simplify your financial management. These platforms offer specialized features tailored to legal accounting needs, making trust accounting, report generation, and real-time financial insights more accessible. Some examples include PC Law, CosmoLex, Clio, and Caret.

- Separate Operating and Trust Accounts: To avoid any confusion and ensure accurate financial records, it is essential to maintain separate bank accounts for your law firm’s operational expenses and client trust funds. This segregation prevents funds from being mixed and simplifies the reconciliation process.

- Mastering the Trust Cheque: A trust cheque is a check drawn from the client trust account to disburse funds as needed. To ensure accuracy, verify client balances and recipients before writing a trust cheque, and maintain detailed records of each transaction.

- Regular Reconciliations: Performing periodic reconciliations between your law firm’s accounting records and bank statements is crucial. This practice helps identify any discrepancies and ensures that all transactions are accurately recorded.

- Engage Professional Accountants for Lawyers: Collaborating with experienced accountants familiar with legal accounting practices can be highly beneficial. Their expertise can streamline your financial operations, minimize errors, and provide valuable insights to enhance your firm’s financial performance.

The Role of Specialized CPA Firms

Partnering with a specialized CPA firm that offers bookkeeping services tailored to law firms can be a game-changer. Seasoned accountants for lawyers understand the unique challenges of legal accounting and can ensure compliance with all relevant regulations. They assist in maintaining proper trust accounting, meticulous record-keeping, and implementing efficient bookkeeping systems, allowing you to concentrate on your legal practice with confidence.

Why it’s Important to Have Effective Bookkeeping for Law Firms

In conclusion, maintaining accurate and trustworthy financial records is vital for the success and credibility of your law firm. Embracing specialized law firm bookkeeping practices, leveraging advanced legal accounting software, and seeking the assistance of professional accountants experienced in serving the legal industry can significantly benefit your firm. This makes sure you are compliant, can make informed financial decisions, and have your legal practice thrive with high levels of client trust.

Find out more about how specialized bookkeeping and accounting services in Canada for lawyers can improve your practice’s financial management and growth by filling out our contact form. We look forward to helping you navigate the intricacies of law firm bookkeeping.