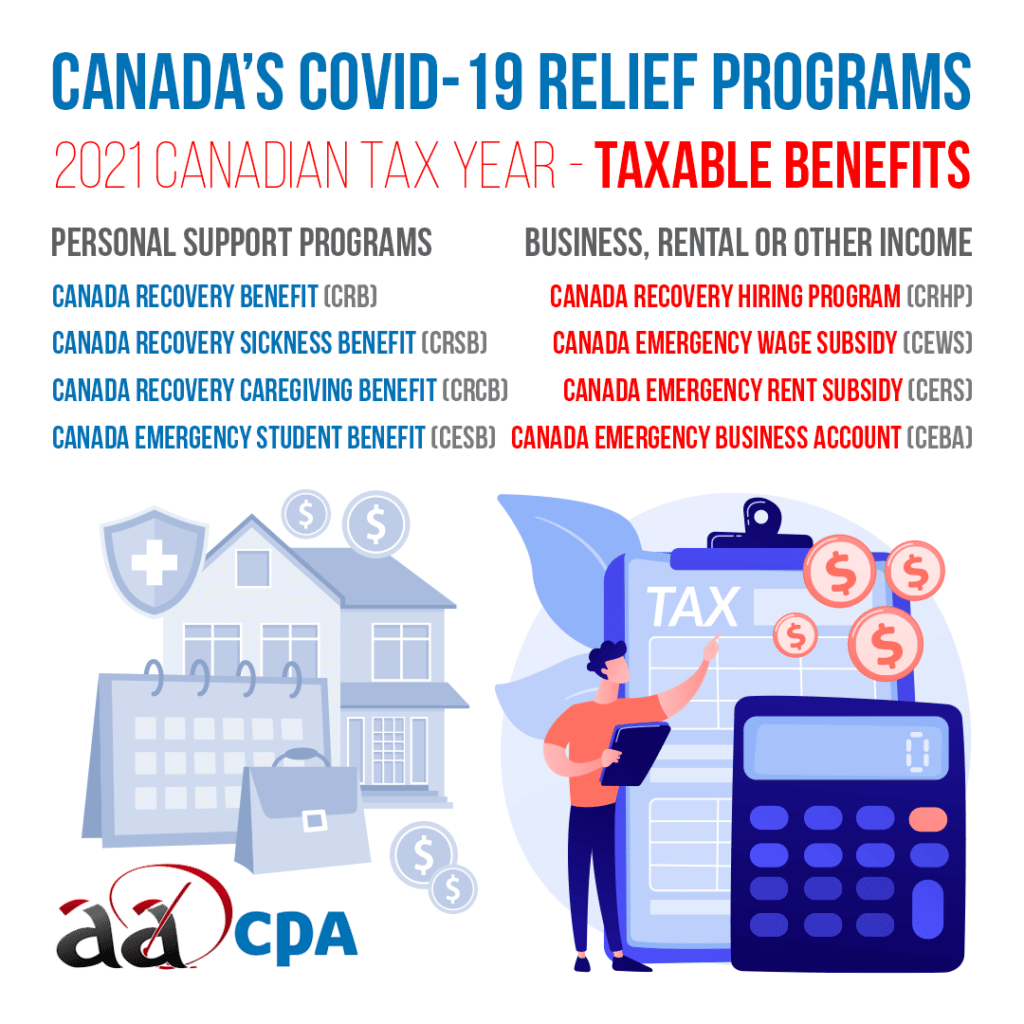

Canada’s COVID-19 Relief Programs

We’ve made a list of the primary COVID-19 relief and support programs that are taxable but make sure you keep an eye out for official tax slips. If you haven’t been issued one, let us know. We’ll be able to assist you with it and make sure that it’s applied to your tax return this year.

COVID-19 Relief:

Personal Support Programs

Canada Recovery Benefit (CRB)

- $1,000 ($900 after tax) or $600 ($540 after tax) payments for a 2-week period, taxed at 10% by the source.

- If your net income is over $38,000 on your 2021 income tax return, you will need to reimburse $0.50 of the CRB for every dollar of net income you earned over the threshold.

Canada Recovery Sickness Benefit (CRSB)

- $500 ($450 after tax) payment for a 1-week period up to a total of 6 weeks which is taxed at 10% at the source.

Canada Recovery Caregiving Benefit (CRCB)

- $500 ($450 after tax) payments for a 1-week period up to a total of 44 weeks and is taxed at 10% at the source.

Business, Rental or Other Income Support

Canada Emergency Wage Subsidy (CEWS)

- Employers in Canada who have had a drop in revenue during the COVID-19 pandemic received subsidies to cover part of employee wages.

Canada Emergency Rent Subsidy (CERS)

- As a business, NPO or charity in Canada, if your revenue dropped during the pandemic, commercial rent or property expenses were subsidized.

Canada Recovery Hiring Program (CRHP)

- As an employer in Canada during the pandemic, this subsidy covered parts of your wages to hire new employees and increase existing employees’ wages or hours.

Canada Emergency Business Account (CEBA)

- If this interest-free loan of up to $60,000 for small business and NPOs was repaid on or before December 31, 2023, you may be eligible for a loan forgiveness of up to 33% ($20,000).

If you’ve received any income from COVID-19 relief programs, you may owe taxes on them. Official tax slips may have been issued, but if they haven’t, make sure that you provide your accountant with a detailed record of the type and amount received.

If you’ve repaid any of these benefits, make sure you let us know so that you can make the most out of your tax return filing. By working with a qualified tax accountant from a top accounting firm in Canada, you can save time, reduce stress, and maximize your tax refund. Contact us today to learn more about our personal tax services.

Read more on the Canadian tax website at Canada.ca.