How Maternity and Parental Benefits Work

In Canada, maternity and parental benefits are processed through EI or Employment Insurance. They provide financial assistance to new parents that meet the following criteria:

- Those who are leaving their work because of pregnancy or giving birth.

- They are a parent who are away from work to take care of their newborn or newly adopted child.

In the province of Quebec, the provincial government is responsible for providing maternity, paternity, parental and adoption benefits to its residents instead of the federal government.

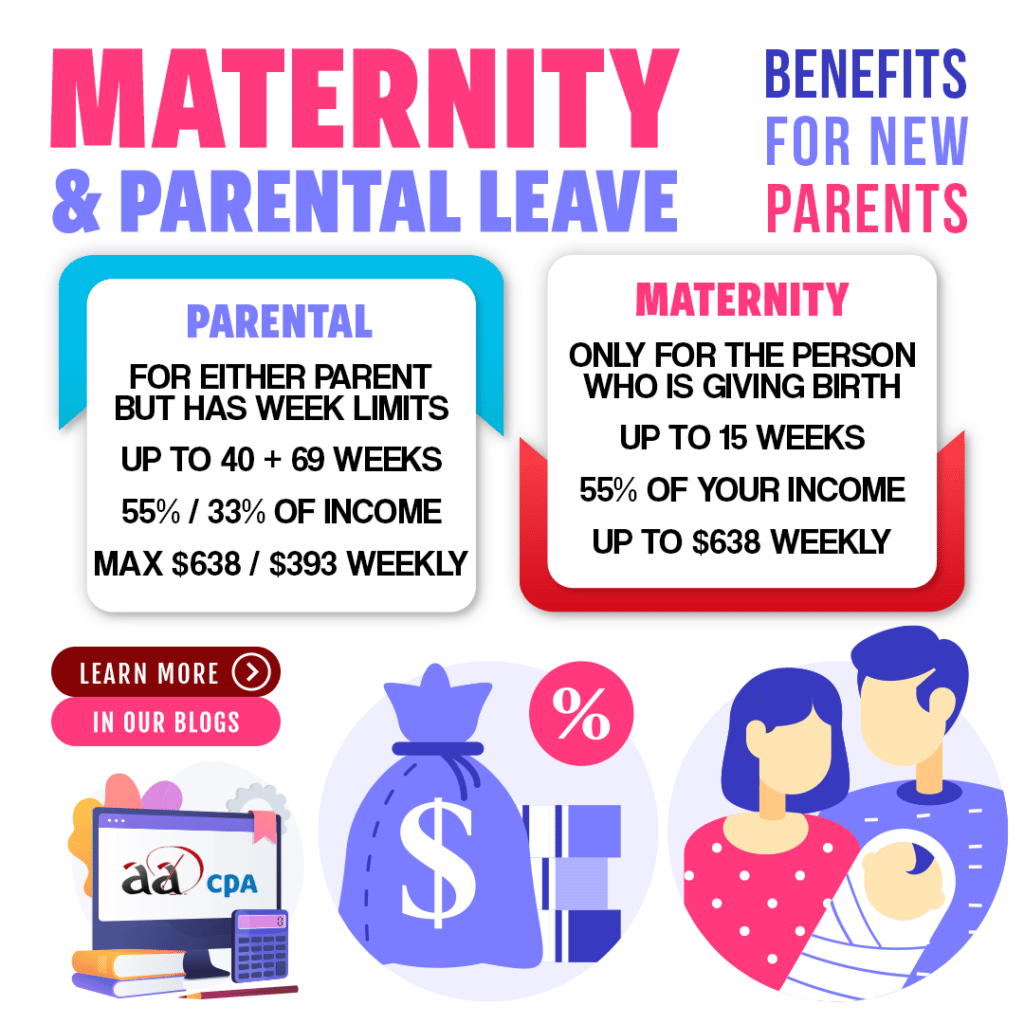

Maternity Benefits

These benefits apply only to people who are away from work due to pregnancy or giving birth and can not be shared between parents. Those eligible for maternity benefits may also be eligible for parental benefits. There is a maximum of 15 weeks allowed for maternity benefits. Maternity benefits provide 55% of the individual’s income as benefit. This caps out at a weekly maximum of $638.

Parental Benefits

After maternity benefits have concluded, those eligible are able to receive parental benefits to assist in the care of a newborn or newly adopted child. They come in 2 different styles, standard and extended parental benefits. Each option comes with a different amount of weeks and weekly amounts for the benefit. While they don’t have to be consecutive, it must be taken withing specific periods that start from the week of the child’s birth or when a child is placed with you for adoption.

Keep in mind that before you apply, carefully select which option is better for you. Once a parental benefits payment has been made for the birth or adoption, you can not change between standard or extended parental benefits.

| Benefit Option | Maximum Weeks | Rate of Income | Weekly Max |

| Standard Parental Benefit | Eligibile parents can take up to 40 weeks and can be shared between parents. One parent can not receive more than 35 weeks of standard benefits. | 55% | Up to $638 |

| Extended Parental Benefit | Eligibile parents can take up to 69 weeks and can be shared between parents. One parent can not receive more than 61 weeks of standard benefits. | 33% | Up to $383 |

Examples of Maternity and Parental Benefits

Maternity Benefits Followed Up with Standard Parental Benefits

A person gave birth to a child and is sharing parental benefits with their partner. They are taking the maximum allowable weeks.

- 15 Weeks of Maternity Benefits

- 55% of Income to a Maximum of $638 per Week

- 35 Weeks of Standard Parental Benefits

- 55% of Income to a Maximum of $638 per Week

- This Totals 50 Weeks of Benefits for the Person who Gave Birth

The partner is eligible to apply for up to 5 weeks of standard parental benefits. If the partner who gave birth chooses to take fewer weeks of parental benefits, the partner may apply for more.

Maternity Benefits Followed Up with Extended Parental Benefits

A person gave birth to a child and is sharing parental benefits with their partner. They are taking the maximum allowable weeks.

- 15 Weeks of Maternity Benefits

- 55% of Income to a Maximum of $638 per Week

- 61 Weeks of Standard Parental Benefits

- 33% of Income to a Maximum of $383 per Week

- This Totals 76 Weeks of Benefits for the Person who Gave Birth

The partner is eligible to apply for up to 8 weeks of standard parental benefits. If the partner who gave birth chooses to take fewer weeks of parental benefits, the partner may apply for more.

If you’d like to find out more, visit the CRA’s information piece on EI Maternity and Parental benefits here.