Here’s Are the Tax Updates You Need to Know!

We’re at that time where documents are being gather, receipts are being collected, and everyone is preparing for their personal tax return. Knowing the tax updates will make sure you get the most out of your filing and preparation. Read about some of the key changes this year to keep in mind.

Tax Updates to Watch Out For

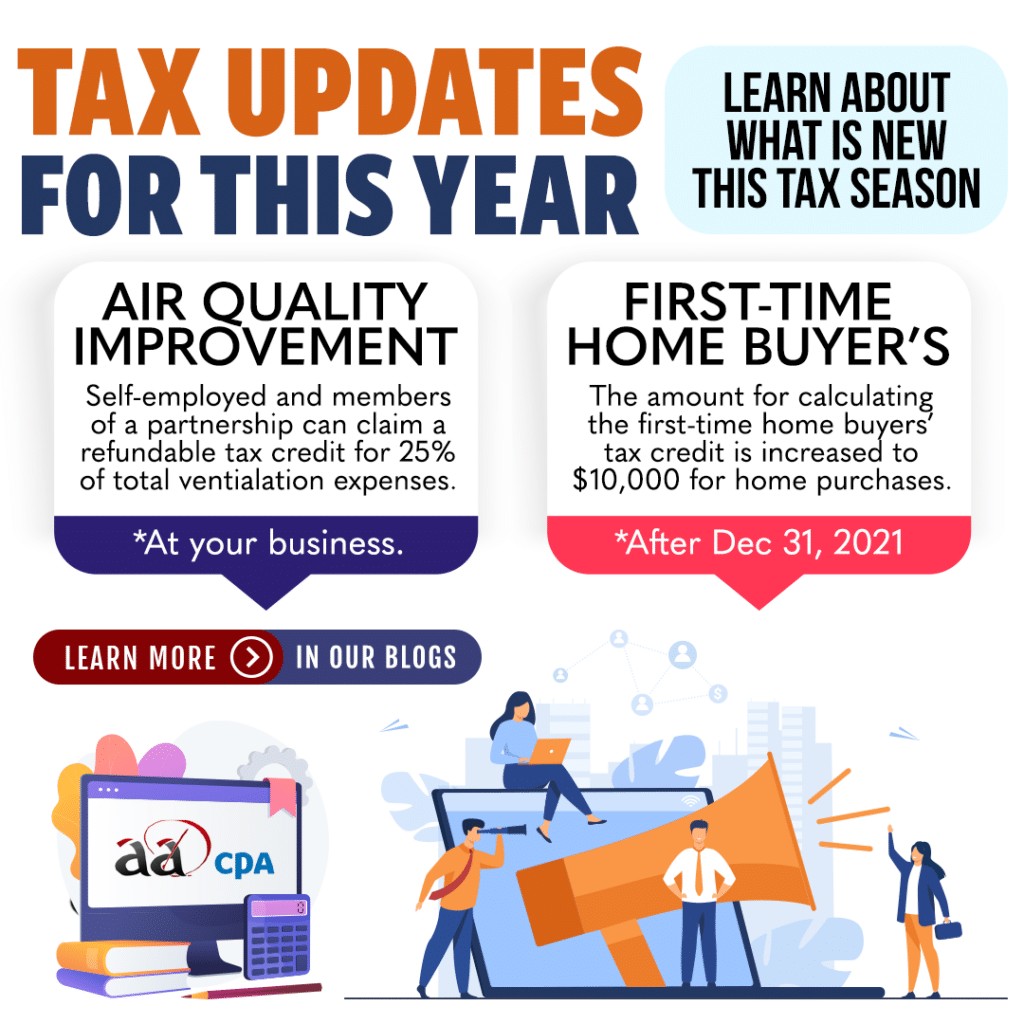

Air Quality Improvement Credit

For those that are self-employed, or in partnerships during 2022, they are eligible for a refundable tax credit. Claiming it will give a credit that equals 25% of your total ventilation costs used to improve ventilation or air quality at your business.

This includes any qualifying expenditures made or incurred during the qualifying period of September 1, 2021 to December 31, 2022. There is a maximum of $10,000 for each qualified location and a maximum of $50,000 for total ventilation expenses across all locations.

First-Time Home Buyer’s Tax Credit

For qualifying homes purchased after December 31, 2021, the first-time home buyers’ tax credit has increased to ,000. You, your spouse or commmon-law partner must not live in another home that you or they owned in the year of the purchase or in any of the four years before.

To be considered a qualifying home, it must be registered in your, your spouse’s or common law partner’s name as per its applicable land registration system. It must be in Canada and includes home that either exist or are under construction. Here is a list of qualifying homes:

- Single-Family Houses

- Semi-Detached Houses

- Townhouses

- Mobile Homes

- Condominium Units

- Apartments in Duplexes, Triplexes, Fourplexes, or Apartment Buildings

- A share in a co-operative housing.

- This share must let you own it and gives an equity interest.

- If the share only allows tenancy in the housing unit, it doesn’t count.

Keep in mind that you, or someone related to you with a disability, will live in the home as a principle place of residence. This must be done before 1 year from acquiring it.

For more information on what’s new in this tax season, check out the CRA’s page on tax updates here.