The 2022 Update to Automobile Deductions Canadian Tax

On December 23, 2021, the Department of Finance Canada announced some changes to the automobile deductions limit for income tax as well as expense benefit rates that applied in 2022.

Here’s a breakdown of the changes to limits and rates which were effective as of January 1, 2022:

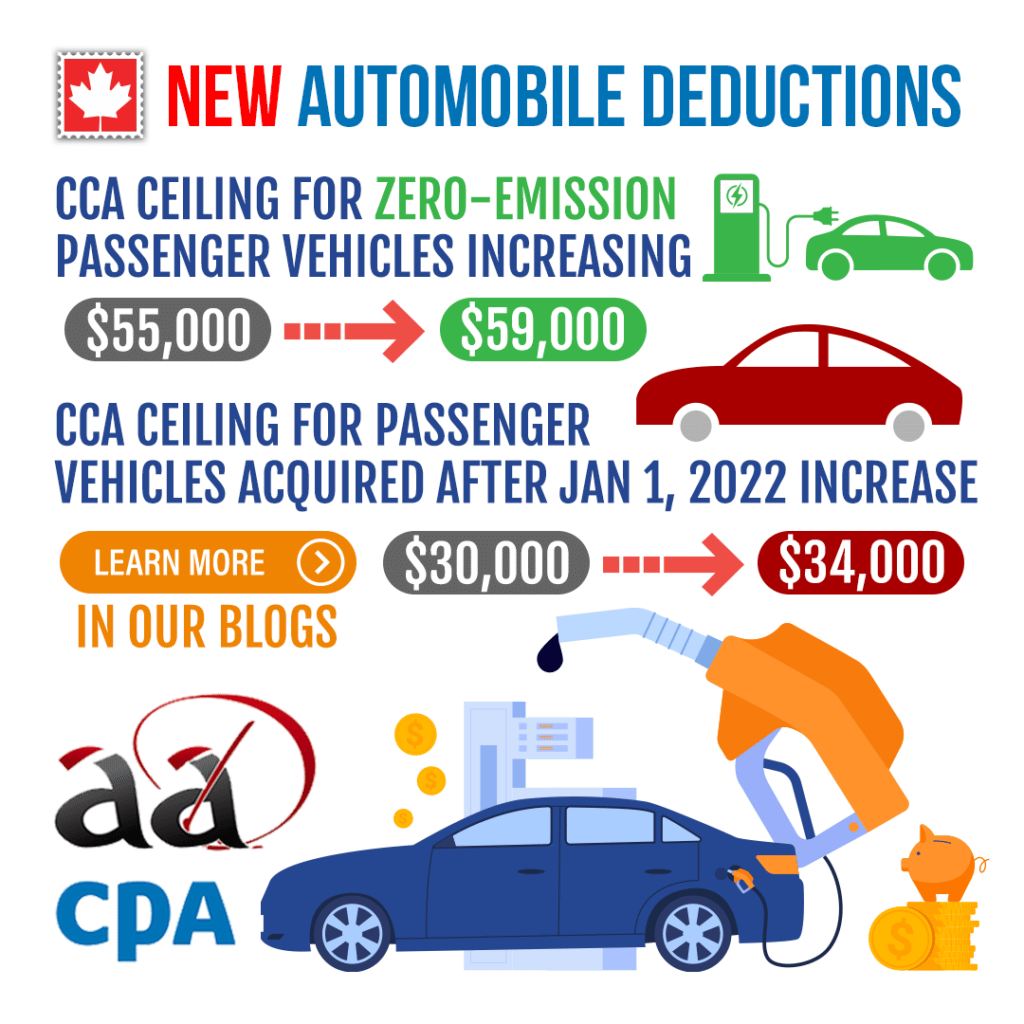

- The Capital Cost Allowances (CCA) ceiling for zero-emission* passenger vehicles has increased from $55,000 to $59,000 before tax.

- The CCA ceiling for passenger vehicles in general has increased from $30,000 to $34,000 before tax.

- For both CCA ceiling changes, vehicles new or used must be acquired on or after January 1, 2022.

- New deductible leasing costs are now increased from $800 per month to $900 per month before tax for new leases.

- Limits on the deduction of tax-exempt allowances paid by employers to employees who use their vehicles for business purposes in provinces have increased by $0.02. This brings it to $0.61 per km in the first 5,000 km and each additional km receives a deduction of $0.55.

- If you are in the territories the limit is increased by $0.02 as well but has increased to $0.65 for the first 5,000 km and $0.59 for all additional km driven.

- There was also an increase of $0.02 in the general prescribed rate for the taxable benefit of employees regarding their portion of automobile expenses paid by employers, bringing it to $0.29 per km.

*Keep in mind that for a zero-emission passenger vehicle to be eligible, it can be a plug-in hybrid with a battery capacity of at least 7 kWh, be fully electric, or fully powered by hydrogen.

Have any questions? Give us a call at (604) 227-1120 to find out more, email us at info@advancedtax.ca or visit Canada.ca.