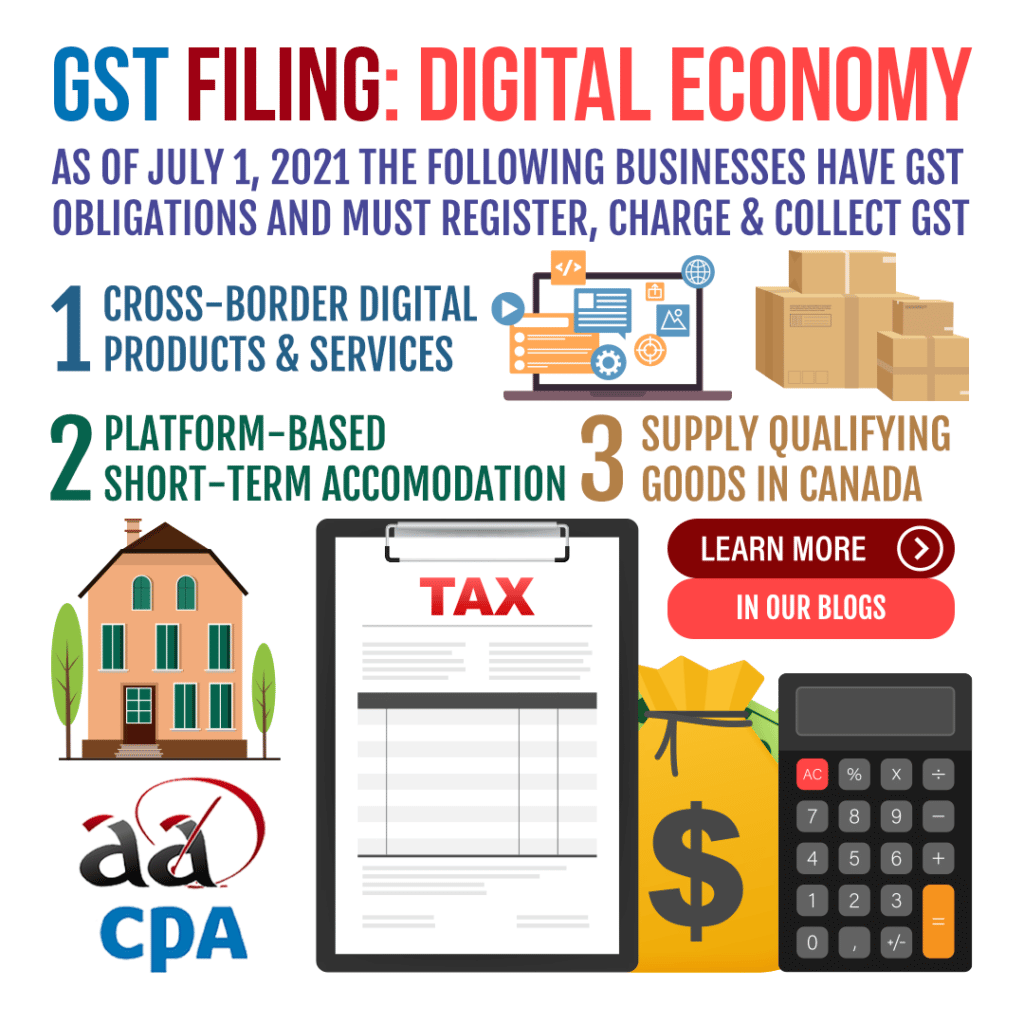

GST Filing for Digital Economy Businesses

GST Filing has changed in Canada as of July 1, 2021. This change meant that digital economy businesses including platform operators may have potential GST filing obligations. There are 3 main types of businesses affected which may need to register, charge, and collect GST as well as ensure customers are paying GST on the specified digital platforms for your supplies.

GST Filing for Cross-Border Digital Products and Services

If you are a non-resident vendor or distribution platform vendor that sells taxable digital products or services to Canadian consumers and entities, you may have GST filing obligations. This includes online music streaming or even more traditional services. Included in this are distribution platform operators which are described below.

Distribution Platform Operators

Distribution platform operators refer to a supply of property or service that is made through a specified distribution platform and:

- Controls or sets the main elements of the transaction between the supplier and the recipient.

- If that does not apply, then is involved directly or through third parties in collecting, receiving, or charging the consideration for the supply and transmitting it to the supplier.

- Is a prescribed person to operate the platform.

Find out more about Distribution Platform Operators by clicking here.

GST Filing for Suppliers of Qualifying Goods in Canada

This refers to non-resident vendors or distribution platform operator vendors who make the supply of qualifying goods or qualifying tangible personal property supply. These goods are delivered or made available in Canada through methods such as fulfillment warehouses or by shipping goods to purchasers in Canada.

GST Filing for Platform-Based Short Term Accommodation

These suppliers bring the taxable supplies of short-term accommodation in Canada or are accommodation platform operators that facilitate these accommodations through their own platforms.

Accommodation Platform Operators

An accommodation platform operator refers to one that supplies short-term accommodations that are made through an accommodation platform. This refers to a person who meets the following criteria in the list to the right. For more information, view this link to definitions of the digital economy.

- They control or set the essential elements of the transaction between the supplier and recipient.

- If that doesn’t apply, they are involved directly or through third parties to collect, receive, or charge the consideration for the supply and transmission to the supplier.

Other GST Filing Information

You have to register for a GST account if you make taxable sales, leases, or other supplies in Canada unless your only taxable supplies are of real property sold other than in the course of business and are not a small supplier. Find out more details on the Canadian government’s website at this link.