Rules on Taxes for Personal Service Businesses

As a sole proprietor, regardless of your incorporation, the CRA may have unique rules on addressing your taxes. There is a set of rules applying to personal service businesses that incur unique tax requirements as per the CRA. Personal service businesses or PSB’s have special considerations that apply when services are provided through a corporation and whoever is doing the work would otherwise be considered an employee if provided services directly to the client.

What Do Personal Service Businesses Involve?

There are times when instead of hiring employers directly, individuals are contracted out duties as non-employees to perform services. These employees can file as self-employed individuals or incorporate as sole proprietors which affects their tax obligations. Incorporated businesses are held under corporate tax rules but if considered an employee by the CRA, certain expense deductions may be denied and CPP, EI, income tax, and penalties may be owed.

What are the Consequences?

If considered a personal service business by the CRA, the corporation would not be eligible for the small business deduction. Instead an additional 5 percent tax rate would apply, along with provincial taxes. Along with the increased taxes, the only deductions a PSB qualifies for would be its salary paid to the incorporated employee (as the individual is considered an employee by CRA), employment benefits for the individual, expenses that are allowed if they were a commissioned salesperson, and legal expenses that the corporation undergoes to collect money it is owed.

Incorporated Employees and Personal Service Businesses

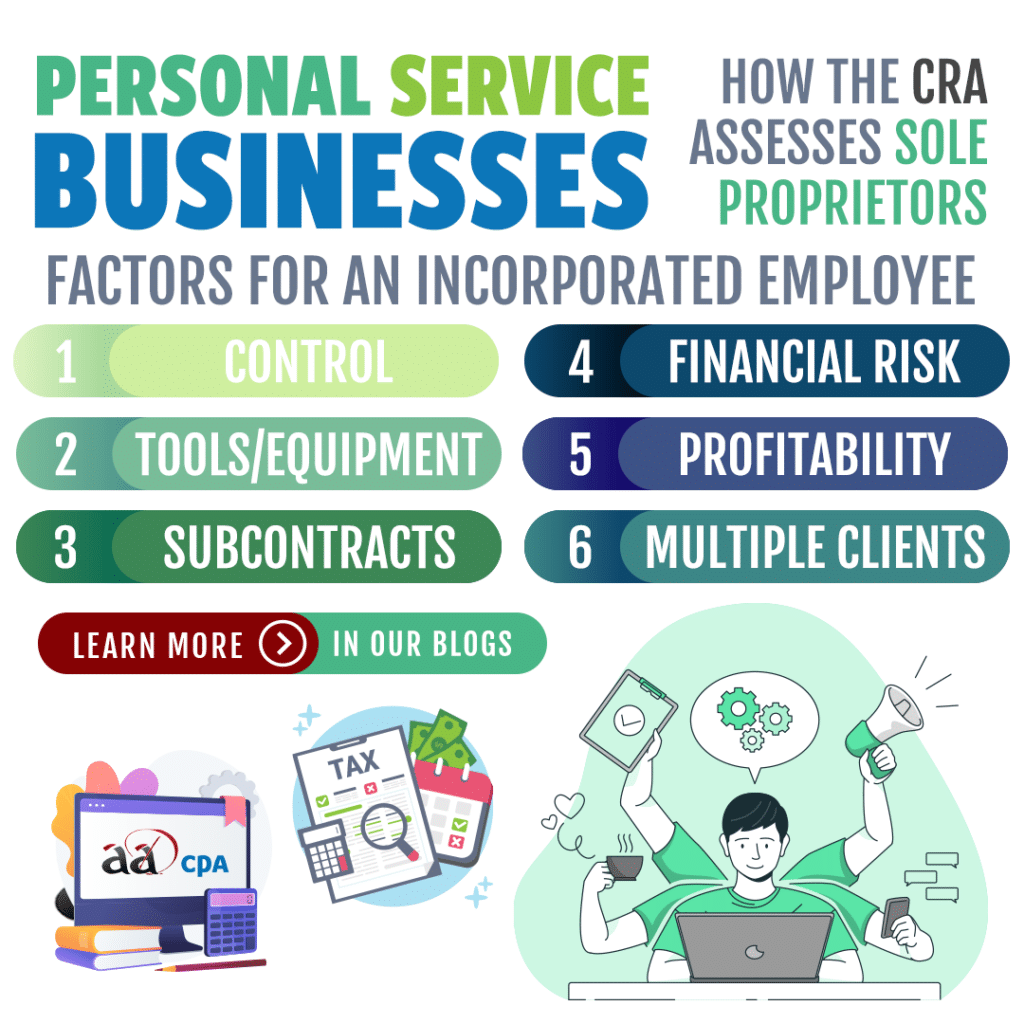

The key factor that incurs these special tax rules are when the service provider (sole proprietor offering services) can be considered an employee of the corporation. This is done through certain factors as a test and are similar to determining whether the individual is employed or self-employed.

Factors to Qualify as an Incorporated Employee

- Control: More control over the service providers duties provides higher indications of an employment relationship.

- Tools and Equipment: If the payer uses their own tools to perform the services, there is less likelihood of being considered an incorporated employee.

- Ability to Subcontract: If the service provider can hire or subcontract work or duties, they are also less likely to be considered an incorporated employee.

- Financial Risk: If the service provider has an investment in the business duties like paying for costs before billing, they may not be considered an incorporated employee.

- Opportunity for Profit: Just like financial risk, the service providers level of chances in profit and loss determine employment. If they can receive additional profit, it is less likely to be considered an employee of the client.

- Multiple Clients: Providing similar services to other clients also indicates self-employment.

- Intent: If the payer was going to request services from the provider regardless of their business, there is a likelihood of being considered an incorporated employee. For example, if the business was looking to hire someone anyways as an employee but settled on working with a sole proprietor, then there would be a factor leading to a consideration of employment.

To find out more about managing risk as personal services businesses, visit the CPA website by clicking here. Read about tips and practices that can be implemented to navigate the more complex tax structures of personal services businesses.