Property Tax Assessment Factors for British Columbian Residents

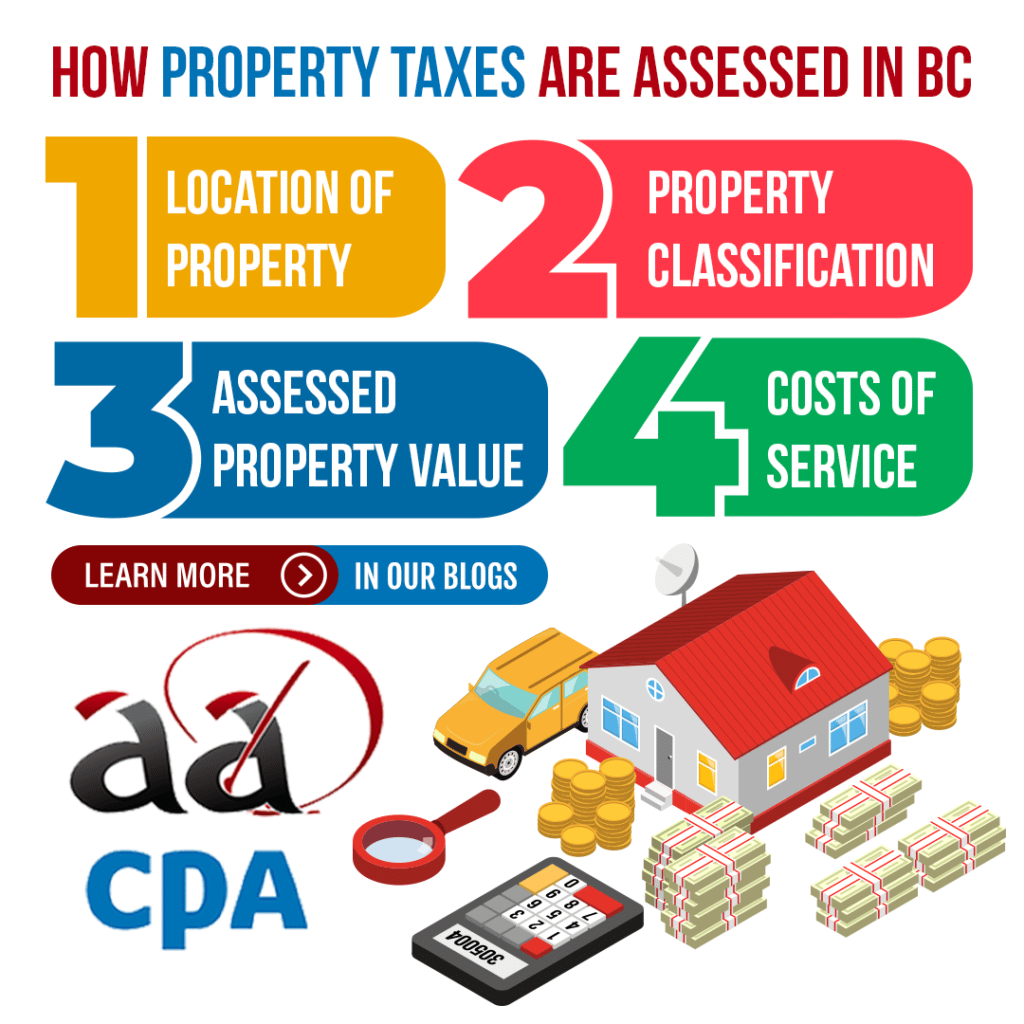

Have you been wondering why your property tax is so high in these years? Well, in British Columbia property tax is calculated based on some key factors and we’ve broken it down below.

There are 4 key factors in assessing your property tax and they are based on services available in your locality. The factors are as follows:

Property Location

This simply refers to the municipality or region your property is found in. Those that are closer to urban centers will often find higher evaluations for this factor.

Property Classification

Class 1 refers to Residential Property and contains single-family residences, multi-family residences, duplexes, apartments, condominiums, nursing homes, seasonal dwellings, manufactured homes, some vacant land, farm buildings, and daycare facilities.

Class 2 is Utilities and refers to structures and land used for railway transportation, pipelines, electrical generation or transmission utilities, or telecommunications transmitters.

Class 3 would be Supportive Housing and is only applicable for eligible supportive housing property that has been stated by the Cabinet. These support people who were previously homeless, at risk of homelessness and those affected by mental illness or are recovering from drug or alcohol addictions and have obstacles towards housing.

Class 4 involves Major Industry which would be land and improvements of industrial plants and includes lumber and pulp mills, mines, smelters, large manufacturing plants, shipbuilding, and loading terminals for sea-faring ships.

Class 5 is Light Industry and these properties are used for extracting, processing, manufacturing, or transporting products including scrap metal yards, wineries, and boat-building facilities.

Class 6 is Business Other but refers to offices, retail, warehousing, hotels, and motels.

Class 7 refers to Managed Forest Land and is simply privately owned forest land that is managed according to regulation.

Class 8 properties are Recreational Properties and NPO which is broken down as follows:

- Recreational Land includes outdoor recreational facilities or land that are used for overnight commercial accommodation to facilitate outdoor recreational activities.

- Non-profit organization Land and Improvements requires that the land be a place of public worship or as a meeting hall for at least 150 days per year.

Class 9 would be a Farm and to qualify, the land must produce a specific amount of qualifying agricultural products for sale like crops and livestock.

- Keep in mind that property with multiple distinct uses can be classified as more than one class.

Property Assessed Value

- The Value of the Land

- The Value of the Buildings or Structures

- The number of Lots on the Property

- The Size of the Property

- The Length of Land that Fronts a Public Work

Cost of Services

Simply, this refers to the services offered to your property and can include services for schools or waste management.

Property Taxes:

The BC Home Owner Grant

Regular Grant:

- The amount is $570 and applies to properties found in the Capital Regional District, the Metro Vancouver Regional District, and the Fraser Valley Regional District.

- All other areas in BC get $770.

- You must pay at least $350 in property taxes regardless.

Additional Grant:

- If you fall into one of these categories, you may qualify for an additional grant so make sure to let your accountant know.

- Seniors

- Veterans

- A person with a Disability

- Living with a Spouse or Relative with a Disability

- Spouse or Relative of a Deceased Owner

For more information, give us a shout or check out the following pages: