Property Transfer Tax Rates & Rules in BC

Once you’ve purchased or gained interest in property registered at the Land Title Office in British Columbia, a property transfer tax return must be filed. This involves paying the property transfer tax unless there is an exemption you qualify for.

The property transfer tax is based on the fair market value of the property which includes land and improvements. The fair market value is absed on the day it was registered with the Land Title Office unless it is a purchase of a pre-sold strata unit. These taxes are not property taxes which are paid annually while property transfer tax is on the purchase.

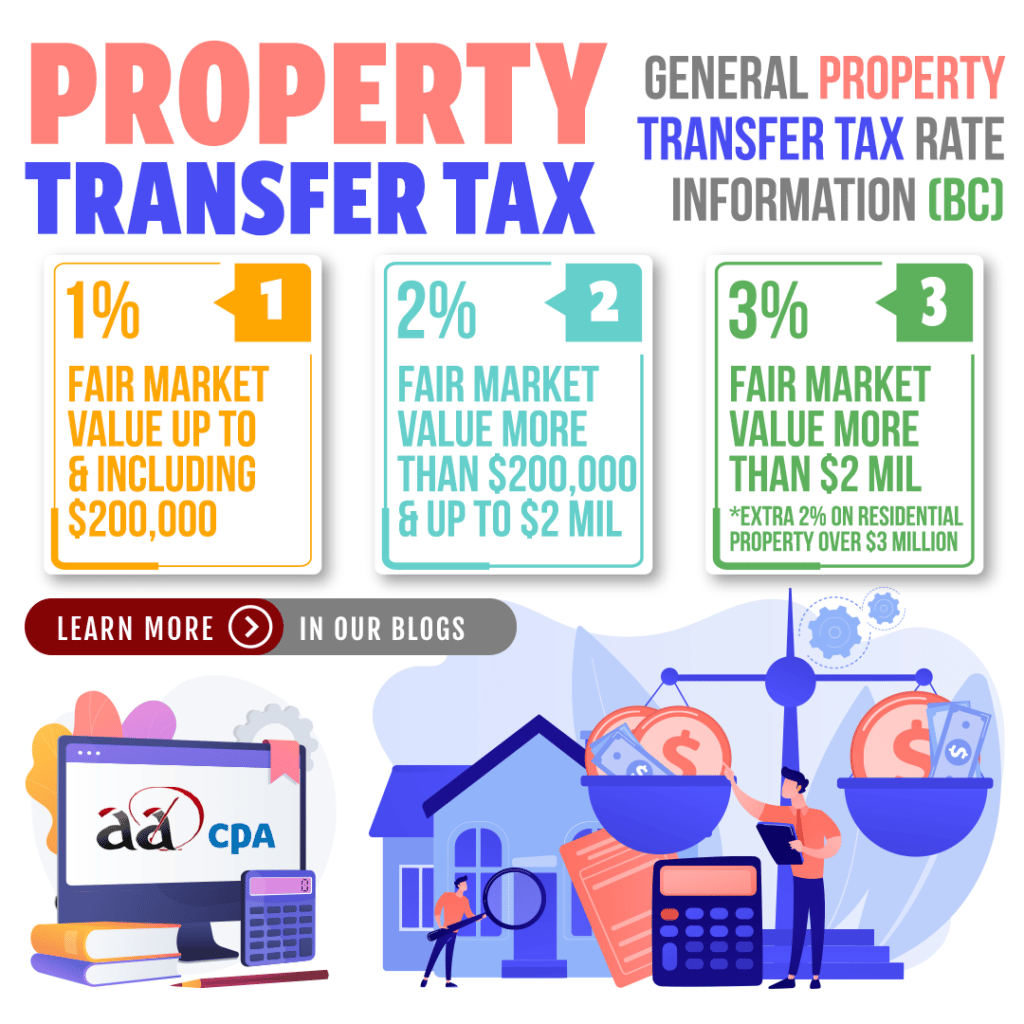

General Property Transfer Tax Rates

The general property transfer tax rates are:

- 1% of the fair market value up to (and including) $200,000.

- 2% of the fair market value greater than $200,000 and up to (and including) $2,000,000.

- 3% of the fair market value above $2,000,000.

- 2% additional on residential property worth over $3,000,000.

- If the property is mixed class, so is considered residential and commercial, the extra 2% is only on the residential portion of the property.

For properties that includes land classed as a farm only because it is an owner’s or farmer’s dwelling, up to 0.5 hectaries will be considered residential property.

Fair Market Value in Property Transfer Tax

The definition here for fair market value is the price that would be paid by a willin purchaser to a willing seller for a property. This includes land and improvements in the open market upon the date of registration.

Open Market Transfers

An open market transfer refers to a property transfer that anyone likely to be interested in purchasing the property can make an offer. This could be when a seller lists the property with a realtor or advertises the sale. In most situations, the purchase price is considered the fiar market value. This is as long as it is sold in the open market and registered within a few months of signing the sales contract.

If the following criteria is met, you need to verify that the purchase price is fair market value:

- The value changed significantly between the sale and registration date.

- The condition of the property (land and improvements) changed between the sale and registration date.

- It was not purchased in the open market.

Non-Open Market Transfers

If the property transfer didn’t take place in the open market, fair market value can be determined by a recent independent appraisal or the BC Assessment property valuation. BC Assessment property valuations show the property’s fair market value as of July 1 of the pervious year and the state of the property at October 31 of the same year.

The BC Assessment property valuation should not be used when:

- Changes were made to the property like rezoning since assessment.

- Market conditions in the property area have changed since assessment.

- New or additional construction has finished since the assessment.

- The land is classified as farm land.

For more information, visit BC’s website on property transfer tax. You can do so by clicking here.