The Sharing Economy & Platform Industry Tax Compliance

What is the platform & sharing economy? Well, if you work off of a system that connects buyers and consumers with sellers or service providers, then you are part of this industry. 4 main types of businesses fall under this industry and they are:

- Sharing Economy:

- When you use personal or shared assets to generate income such as with Airbnb, Uber, Lyft, Uber Eats, DoorDash, Skip the Dishes, and more.

- Gig Economy:

- This refers to platforms that support freelance or short-term contract-based work like Clickworker, Crowsource, Upwork, Fiverr, or TaskRabbit.

- Peer-to-Peer (P2P):

- Selling goods directly from one person or party to another on platforms similar to Etsy, eBay, Amazon, and even Facebook Marketplace.

- Social Media (including Social Influencers):

- This is when you earn income through social media platforms with advertisement revenue, subscriptions, product placement, or product promotions on YouTube, Instagram, Twitch, Facebook, TikTok, and Twitter.

Self-Employment & Tax Filing

- Report & pay tax on income earned from taxable activities as listed above.

- File form T2125 (Statement of Business or Professional Activities) with income and expenses.

- Contribute to CPP (Canada Pension Plan) is required if you are over 18 and work in Canada (except Quebec) and make more than $3,500 per year.

- Quebec residents must pay the QPP (Quebec Pension Plan) instead.

- Maintain records on all your transactions regarding earning income or paying expenses.

- Report taxable income from all sources which will increase RRSP contribution limits as well as maximum amounts for mortgages or loans.

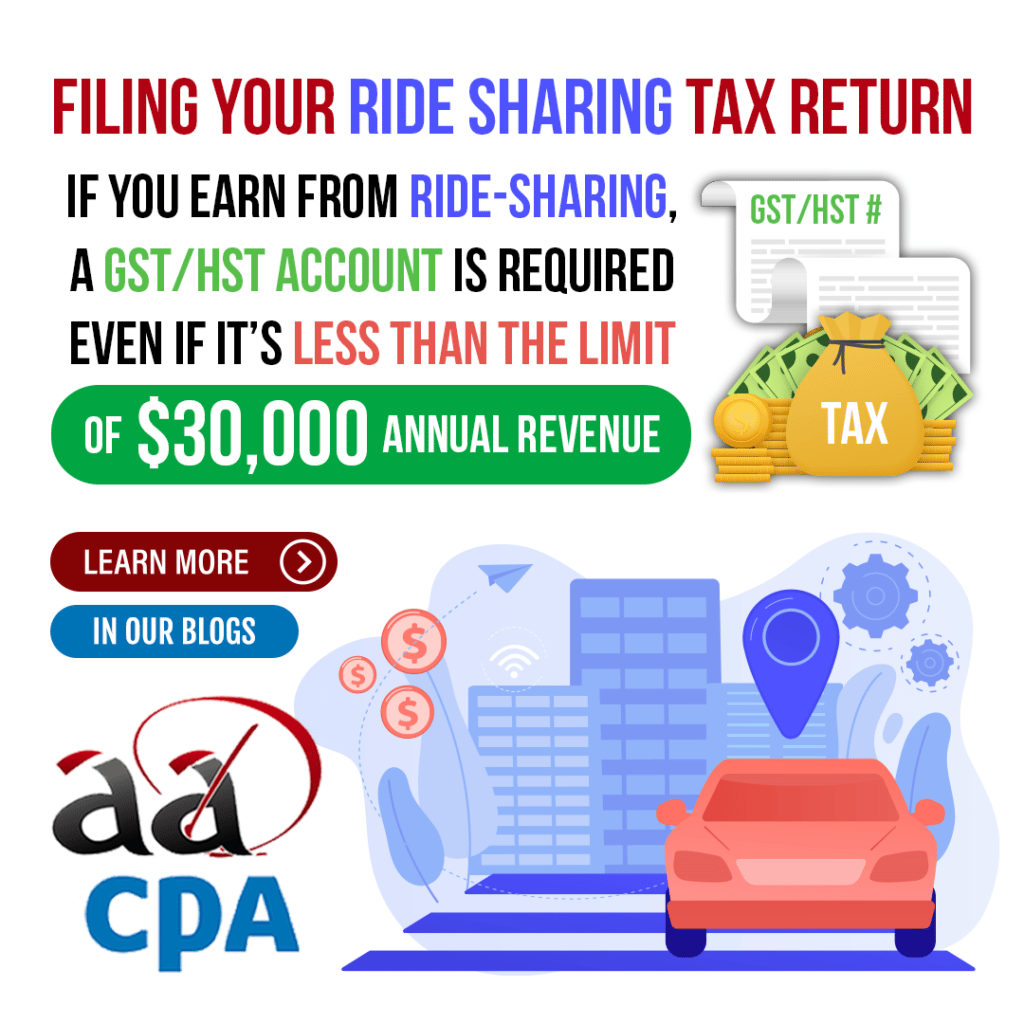

GST/HST Expectations

Are you wondering if you need to register for a GST/HST account? There are 3 main distinctions when deciding whether to register for an account or not.

- Small supplier making less than $30,000 over four consecutive calendar quarters:

- You do not have to register but if you have already or choose to do so voluntarily, your effective registration date is the date you ask for the account or up to 30 days earlier.

- Once registered, you have to collect and pay GST/HST to the CRA regardless of revenue on taxable sales. If you earn income from ridesharing, you must register regardless of whether the revenue is over $30,000 or not.

- A supplier who has exceeded $30,000 in revenue over one calendar quarter or the previous 4 or fewer consecutive calendar quarters.

- You aren’t a small supplier anymore so you must register for a GST/HST account and report/remit the appropriate tax amounts.

To find out more information, continue reading on the Canadian Government website in the section about Compliance in the Platform Economy.