Learn About the Interim Canada Dental Benefit

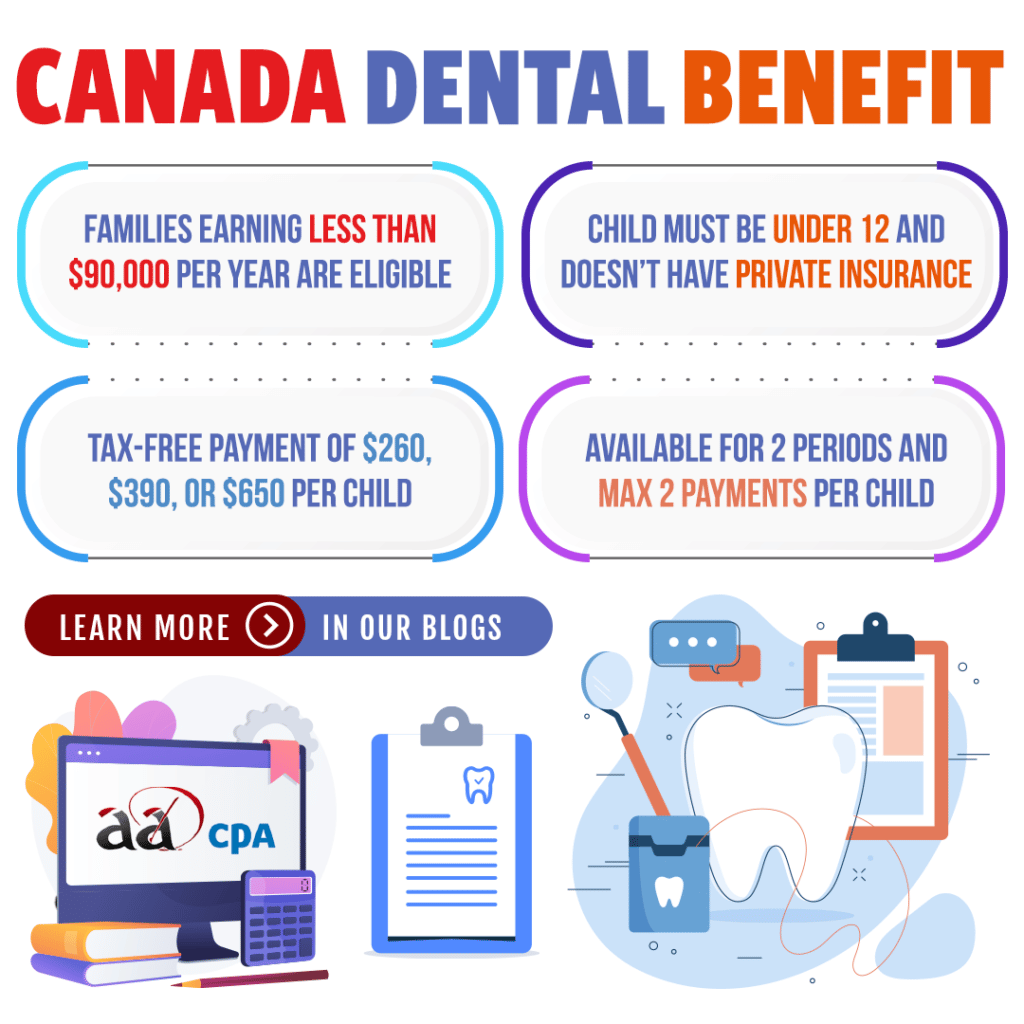

The Canadian government has brought in the interim Canada Dental Benefit. This helps lower dental costs for eligible families earning less than $90,000 annually. It applies if the child receiving dental care is under 12 years old and doesn’t have access to a private dental plan. Children eligible must be under 12 years old as of December 1, 2022 and receive dental care between October 1, 2022 and June 30, 2023.

Dental Benefit Payments

Depending on your adjusted family net income, AFNI, the dental benefit involves a tax-free payment per child of:

- $260

- $390

- $650

Each eligible child can get a maximum of 2 payments and the interim dental benefit is available for only 2 periods.

Eligibility for the First Dental Benefit Period

To qualify for the first benefit period of October 1, 2022 to June 30, 2023, this criteria must be met:

- Born on or after December 2, 2010, thus they will be less than 12 years old as of December 1, 2022.

- The child receives dental care services in Canada from October 1, 2022 until June 30, 2023.

- This includes services from a dentisst, a denturist, or a dental hygienist.

- The eligible child’s dental costs must not be fully covered by another dental program from any level of government.

- You must be the person who is eligible to receive CCB payments for the child as of December 1, 2022 to apply.

- The parent or caregiver’s and their spouse or common-law partner’s 2021 taxes must have been filed or you do not have a spouse or common-law partner as of December 1, 2022.

- Your adjusted family net income is less than $90,000 in 2021.

Eligibility for the Second Dental Benefit Period

The second benefit period is from July 1, 2023 to June 30, 2024 and has the same criteria as the first benefit with the following differences:

- The child was born on or after July 2, 2011 and is under 12 years old as of July 1, 2023.

- Dental care services are received in Canada between July 1, 2023 and June 30, 2024.

- The child does not have access to a private dental insurance plan.

- You and your spouse or common-law partner have filed your 2022 tax return.

- The adjusted family net income is less than $90,000 in 2022.

- No one has applied for the additional payment for the dental costs in the first benefit period.

The Additional Payment for Higher Dental Costs

If you are not applying for both benefit periods and the child‘s dental costs are more than 0 in the period of application, you may meet the criteria for an additional payment. This payment will be available starting on July 1, 2023. You must have already applied and been eligible to qualify for the additional payment.

Benefit Amounts by Adjusted Family Net Income

| Adjusted Family Net Income | Full Custody Amount |

| Less than $70,000 | $650 |

| $70,000 to $79,999 | $390 |

| $80,000 to $89,999 | $260 |

| $90,000 or More | Not Eligible |

For more details, check out the CRA’s guide to the Canada Dental Benefit by clicking here or contact us.