Ways Canada Provides Income Assistance

Canadians have access to various government programs and initiatives that provide financial support when in need of income assistance. They come into play when individuals or families are going through financial hardship or can’t meet basic needs. Provincial governments offer their own programs as well which vary across different provinces and territories.

Income Assistance through Employment Insurance

This federal program provides income support for individuals who have lost their jobs or can’t work due to sickness, maternity or parental leave, or to care for a family member. To qualify, the individual must have worked for a specific number of hours ata minimum and paid EI premiums. Amounts and the duration of benefits is dependent on previous earnings and regional unemployment rates. It ranges from 420 to 700 hours of insurable employment to qualify for regular benefits and the qualifying period is whichever of the following is shorter:

- 52 week period immediately before the start date of your claim.

- Period from the start of a previous benefit period to the start of the new benefit period.

- This is if you applied for benefits earlier and had an approved application in the last 52 weeks.

Types of Employment Insurance

Depending on which category you fall under, the qualifying requirements, amounts, and durations may be affected. Here is a list of the main considerations for this type of income assistance:

- Workers and/or Residents Outside Canada

- Benefits for Self-Employed People

- Regular Benefits

- Sickness Benefits

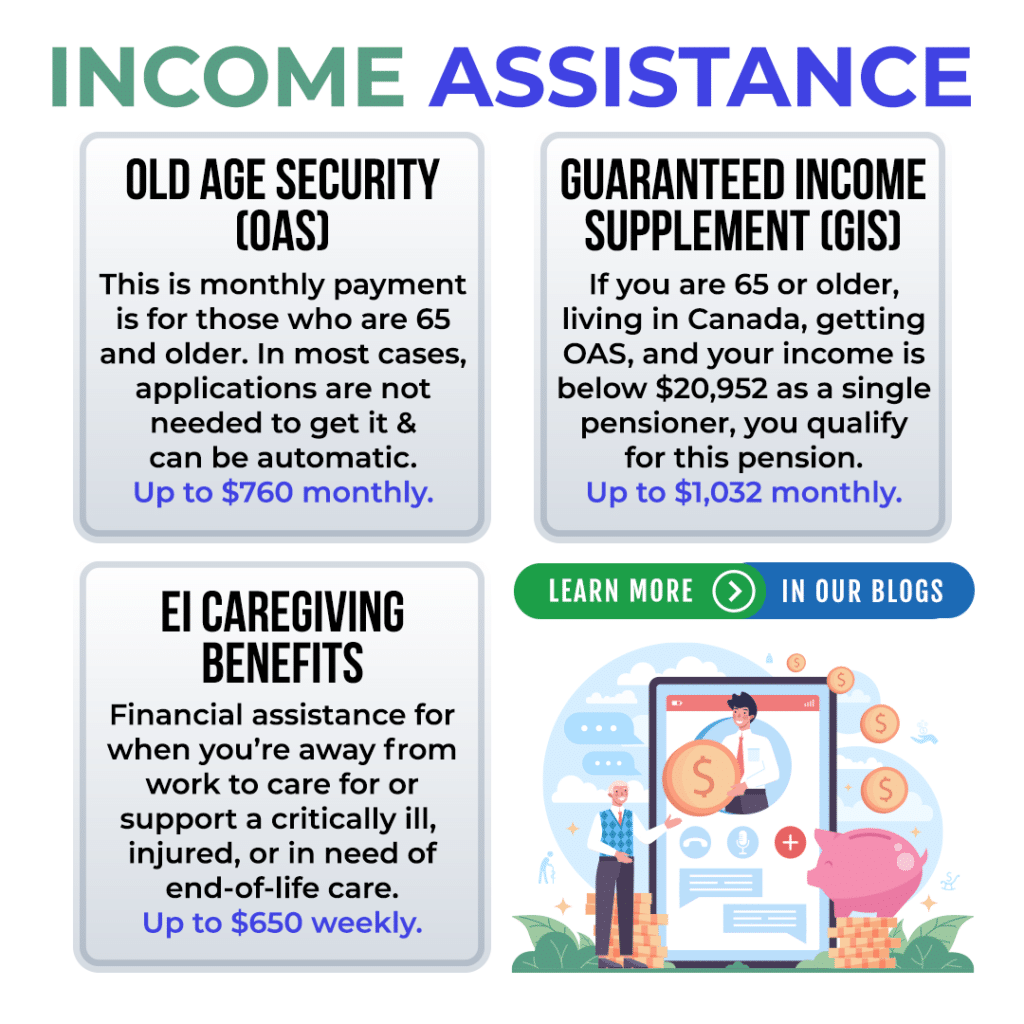

- Family Caregiving Benefits

- Fishing Benefits

- Benefits for Military Families

- Family Supplement

- Maternity and Parental Benefits

Old Age Security as Income Assistance

Old Age Security or OAS pension is a monthly payment for those who are 65 and older. Sometimes, individuals can be automatically enrolled but if this doesn’t happen, you can apply. The first payment comes the month after you turn 65. Here’s how much you can get for OAS based on income in 2021:

| Age | Maximum Monthly Payment | Annual Net World Income in 2021 Threshold |

| 65 – 74 | $691.00 | Less than $129,757 |

| 75 + | $760.10 | Less than $129,757 |

Guaranteed Income Supplement

This monthly payment comes in addition to OAS but has a few more qualifying factors. These include:

- Your age is 65 or over

- You live in Canada

- You get the Old Age Security pension

- Your income is below the maximum annual income threshold

The amount is available to low-income Old Age Security pensioners and is not taxable.

| Situation | Maximum Monthly Payment Amount | Annual Income Threshold (Including Spouse/Common-Law Partner’s Income) |

| Single, Widowed, or Divorced | $1,032.10 | Less than $20,952 |

| Spouse/Common-Law Partner Receives Full OAS | $621.25 | Less than $27,648 |

| Spouse/Common-Law Partner Receiving an Allowance | $621.25 | Less than $38,736 |

| Spouse/Common-Law Partner Does Not Receive any OAS | $1,032.10 | Less than $50,208 |

We’ve talked about some of the most common forms of income assistance in Canada above but there are many more depending on individual sitations. The CRA has an extensive list with links to relevant information at the link here. For more information, feel free to contact our team and we can get you the financial support you need.