Taxable Benefits and Allowances for Employees

Cash and gifts that are paid or provided to employees could be considered to be taxable benefits or allowances. These can include meal allowances, gifts, or even parking spaces so it is very important to know when to include it in an employees income. Whether it will be taxable or not depends on the type of benefit or allowance and the reason for providing it.

Identifying Taxable Benefits, Allowances and Reimbursements

Benefits

If you pay or give something that is personal in nature to an employee, they’ve received a benefit. It must be either directly to your employee or to someone who does not deal at arm’s length with the employee. This includes their spouse, child or sibling and is a good or service given by the employer to the employee. A third party can provide it as well and could even involve access for free use of property owned by the employer or third party. Allowances or reimbursements of an employee’s personal expense are a benefit as well.

Allowances

These are any periodic or lump-sum amounts that are paid to employees on top of salary or wages. The allowance or advance helps them pay for upcoming expenses without having them support it. Some of the criteria could be the following:

- An arbitrary amount that is set without the actual cost.

- Used for a specific purpose.

- Used based on the employees preference and they do not provide receipts.

The calculation can be done through distance, time, or other methods. This includes a motor vehicle allowance using the distance driven or a meal allowance based on the type and number of meals per day.

Reimbursements

An amount that is paid to your employee in order to repay expenses incurred while carrying out duties of employment is a reimbursement. They must keep detailed receipts or any other proper records to suppor the expenses and provide them to the employer.

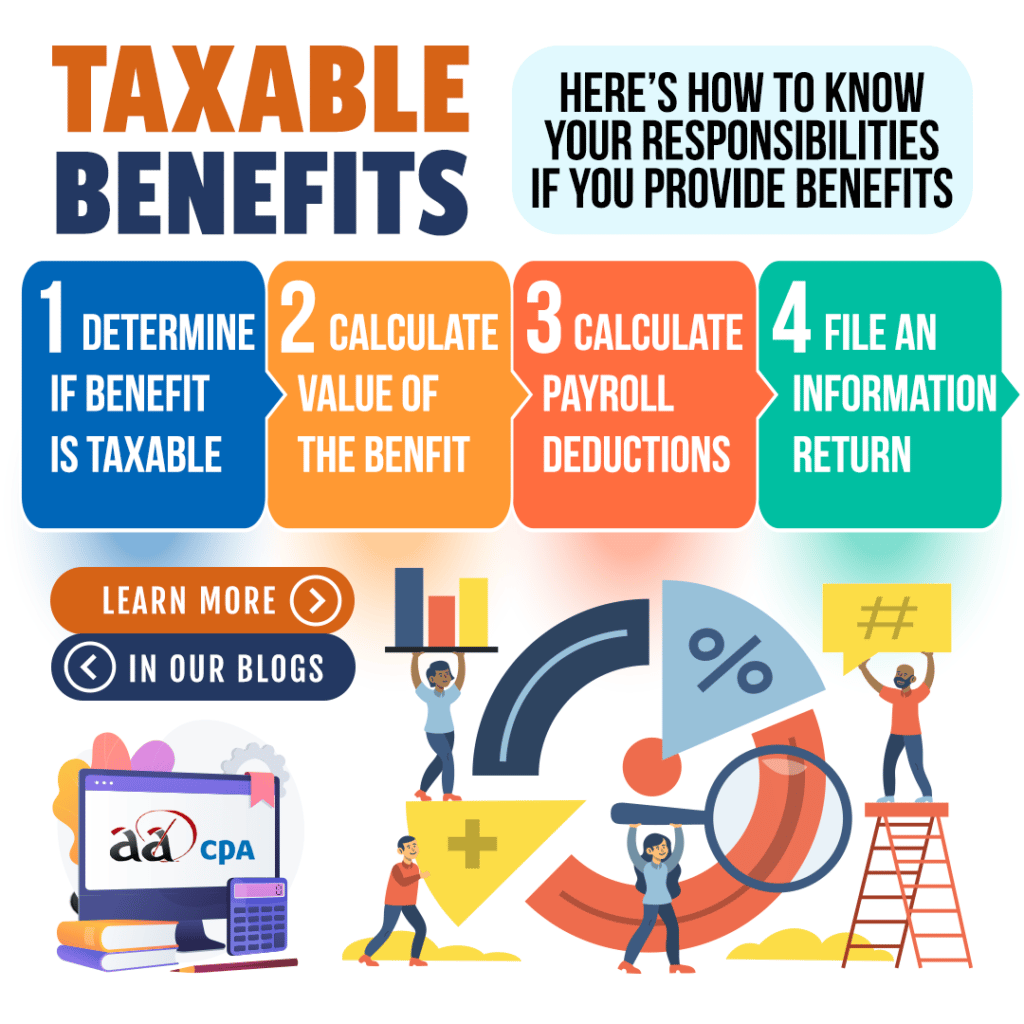

Employer Responsibilities for Taxable Benefits

When determining what to do with a taxable benefit, there are a few standard steps as follows:

- Determine if the benefit is taxable.

- Calculate the value of the benefit.

- Calculate payroll deductions.

- File an information return.

Determining if it’s a Taxable Benefit

To find out if a benefit is taxable depends on whether they receive an economic advantage that can be measured in money. Additionally, it depends on whether they are the primary beneficiary of the benefit.

Calculating the Value of the Taxable Benefit

If the benefit is taxable, the value is usually its fair market value. This is the amount the employee would have paid for the benefit in the same circumstance if there was no employment. A cost of this property, good, or service can also be used if it accurately represents the fair market value.

Calculating the Payroll Deductions

After the value of the benefit is calculated along with any taxes that could apply (GST, PST, or HST), add it to the employee’s income for each pay period they received the benefit. The result is the total amount of income that the payroll deductions have to be made from. The deductions are then withheld from the employee’s total pay in the pay period. Depending on whether the benefit is cash, non-cash, or near cash, it will affect the EI premiums that need to be paid.

Learn more about this topic in the CRA’s Employers’ Guide to Taxable Benefits and Allowances here. At Advanced Tax, we take care of this for you along with managing the entire payroll process. We set out the deductions and ensure that your business is compliant with the CRA’s rules on payroll deductions. Contact us today to start making your payroll process accurate and easier.