What are the Northern Resident Tax Deductions?

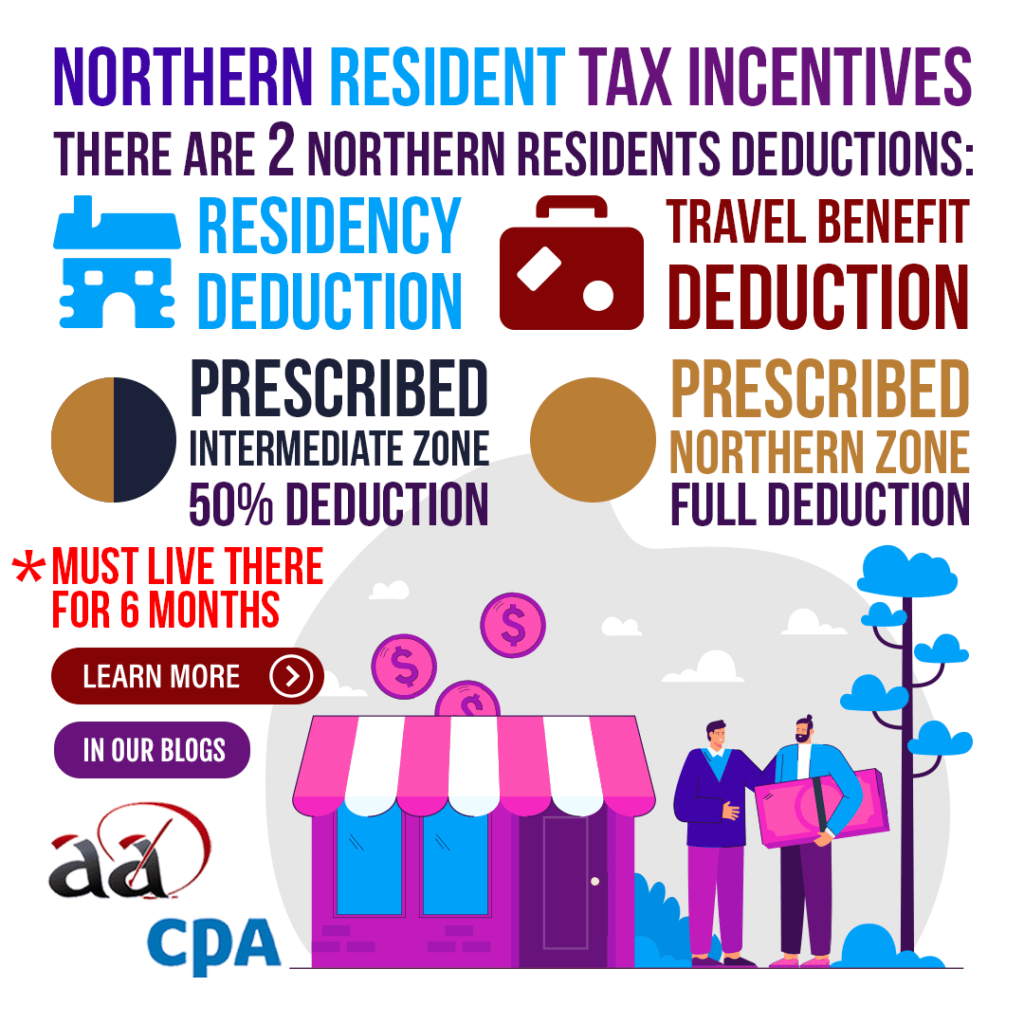

Northern Resident Tax Deductions involve the following two deductions. There is a residency deduction that applies if you live in a prescribed zone and a deduction for travel benefits. This refers to whether you are employed in a prescribed zone that is a part of your income.

How to Qualify for this Deduction

To qualify as a northern resident, you must have permanently lived in a prescribed northern or intermediate zone for at least 6 months in a row. The period can end in the tax year being filed for or start within, either way, you qualify for the deduction. Moving within a prescribed zone does and absences do not affect your qualification as long as you permanently live in a prescribed zone.

Calculating Your Residency Deduction

There are two parts to calculating the residency deduction, the basic residency amount and the additional residency amount.

- The basic residency amount is based on the number of days in the year that you lived in a prescribed zone.

- The additional residency amount is to be claimed for the days in your basic residency amount but only if you maintained and lived in a dwelling during that time and you are the only person in the dwelling that is claiming the amount.

- A self-contained domestic establishment is considered a dwelling that contains a kitchen, bathroom, sleeping facilities, and its private access. Houses, apartments, and mobile homes are included in this definition but bunkhouses, dormitories, hotel rooms, and rooms in boarding houses are not applicable.

- Even if you live there rent-free due to the employer paying your costs, you may still consider it your dwelling but only one person can claim the basic residency amount for the dwelling.

Prescribed Northern Zone (Zone A)

- Basic residency amount of $11.00 per day.

- Additional residency amount of $11.00 per day as long as you are the only person who is claiming the basic amount in the dwelling.

Prescribed Intermediate Zone (Zone B)

- Basic residency amount of $5.50 per day.

- Additional residency amount of $5.50 per day as long as you are the only person who is claiming the basic amount in the dwelling.

Special work sites may also qualify you for this deduction even if it is not in any prescribed zone. You must live there for at least six months consecutively unless the site is 30 km or less from the nearest boundary point from a population center with at least 40,000 people.

Northern Resident Tax Deduction for Travel Benefits

If you are an employee dealing at arm’s length with your employer and have included the taxable benefits in your income from employment in a prescribed zone, then you are eligible to make this claim.

The taxable benefits include travel assistance such as airline tickets and a travel allowance received from the employer for travel expenses incurred.

Your maximum claimable deduction for each trip is the lowest from the following:

- The value of the taxable travel benefits or a portion of the $1,200 standard amount that you allocate to the trip for the person traveling.

- The total expenses paid for the trip.

- The cost of the lowest return airline ticket that is available at the time of the trip between the closest airport to your residence and the nearest designated city to that airport.

You cannot claim a travel deduction if you or anyone in your household received non-taxable amounts for travel assistance, such as a travel allowance or reimbursement for travel expenses. Additionally, if someone else has already claimed the deduction for the same trip, you cannot claim it as well.

You can claim up to two trips for non-medical reasons and up to two trips for each eligible family member. For medical services, if they were not available in your area, there is no limit on the number of medical trips you can claim. To ensure you’re following the correct guidelines, consider consulting an accounting company in Canada for professional advice on your travel deductions and other financial matters.

Recently, the government has updated the travel deduction to be available even if there was no taxable travel benefit received for the trip.