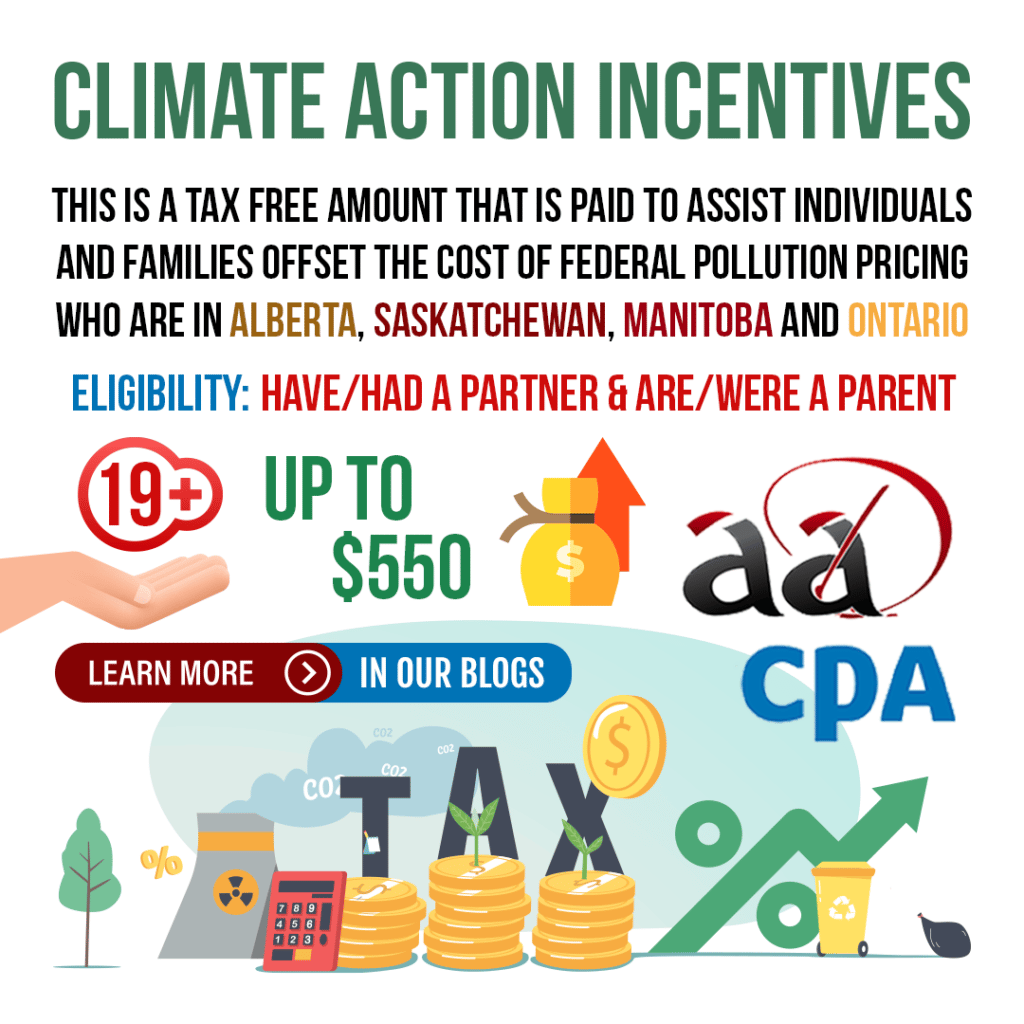

Changes in the Federal Climate Action Incentive (CAI)

Due to Canada’s stance on climate change, they introduced the CAIP or Climate Action Incentive Payments to assist individuals and families offset the cost of federal pollution pricing. Certain provinces have voluntarily adopted this system and so their governments receive the proceeds directly. Other provinces such as Ontario, Manitoba, Saskatchewan, and Alberta provide a payment directly to their residents which consists of around 90 percent of the proceeds. The rest is used on small businesses, farmers and Indigenous groups. This is because these jurisdictions do not have their own systems that are meeting the federal benchmark.

What is Changing with the Federal Climate Action Incentives?

Formerly, the Canadian government provided a refundable tax credit in consideration of their Climate Action Incentive. Recently, the Government of Canada has opted to change this payment into quarterly tax free payments instead, as long as the resident completes their tax filing.

These payments will start in July 2022 with a “double-up” payment that returns proceeds from the first two quarters of the 2022-23 fuel charge year. The relevant time period is as follows:

- April to June 2022

- July to September 2022

Once the double-up payments have been sent, the payments will change to single quarterly ones and will come in October 2022 and January 2023. Residents of small and rural communitites may be eligible for the extra 10 percent amount but will need to fill out this form and file it with their tax return. Regardless, the federal Government of Canada does not keep any of the proceeds from pollution pricing and returns them to the provinces or territories of origin.

Who is Eligible for the CAIP (Climate Action Incentive Payment)?

Firstly you must reside in Alberta, Saskatchewan, Manitoba or Ontario during the first day of the payment month as well as the last day of the previous month and are:

- 19 years of age or older

- Have or had a spouse or common-law partner

- Or were a parent and live or lived with your child

Child Eligibility

At the beginning of the payment month, your child must be:

- Your child is under 19 years of age

- Your child lives with you

- You are primarily responsible for the care and upbringing of your child

- Your child is registered for the CCB (Canada Child Benefit)

How Do You Apply for the CAIP?

You don’t need to apply for the Climate Action Incentive Payment. Instead, the CRA will send you payments for them once you file your income tax and benefit return. Only one partner may receive the credit for the family and it is based on whichever tax return is assessed first. The expected amounts are as follows and depend on your province of residence:

- First Adult

- From $373 to $550

- Second Adult

- From $186 to $275

- First Child

- From $93 to $138

- Second Child

- From $93 to $138

If you would like more information on the Climate Action Incentive Payments, check the Canadian government website and visit the following links: