Canada Tax Guide for Filing & Deadlines in 2025

Table of Contents

Canada Tax Guide

Canada Tax Dates & Deadlines in 2025: A Comprehensive Guide

Welcome to the Canada Tax Guide for 2025, where you will find all the info you need to navigate this year’s tax season confidently. This is our comprehensive guide for everyone, no matter your tax situation or organizational structure. At Advanced Tax, we have a deep understanding of tax, bookkeeping, and accounting services, and we are ready to get you through this process. With help from our experts, we’ve compiled the key details and deadlines you need to know to get prepared and organized for the 2025 personal income tax season.

Need to Get Your Canadian Tax Return Filed?

Our accountants are just a click away. Call or send us a message to start maximizing your tax savings.

Canada Tax Update 2025

GST/HST Tax Break for the Holidays

To help consumers save a little more during the holiday season, The federal government has enacted new legislation that is in effect between December 14, 2024, and February 15, 2025, in which GST/HST is not charged on certain products, groceries, and restaurants. CRA has provided a detailed list of eligible products for this tax break on their website here.

Income Tax Bracket Adjustment

Each year the Canadian Government adjusts the 5 different income brackets based on inflation. For the 2025 tax year, the new income tax brackets were increased by 2.7% from 2024 but the tax rate stays the same.

| Federal Tax Rate | 2024 Tax Bracket | 2025 Tax Bracket |

| 15% | $55,867 or less | $57,375 or less |

| 20.5% | $55,867.01 to $111,733 | $57,375.01 to $114,750 |

| 26% | $111,733.01 to $173,205 | $114,750.01 to $177,882 |

| 29% | $173,205.01 to $246,752 | $177,882.01 to $253,414 |

| 33% | Above $246,752.01 | Above $253,414.01 |

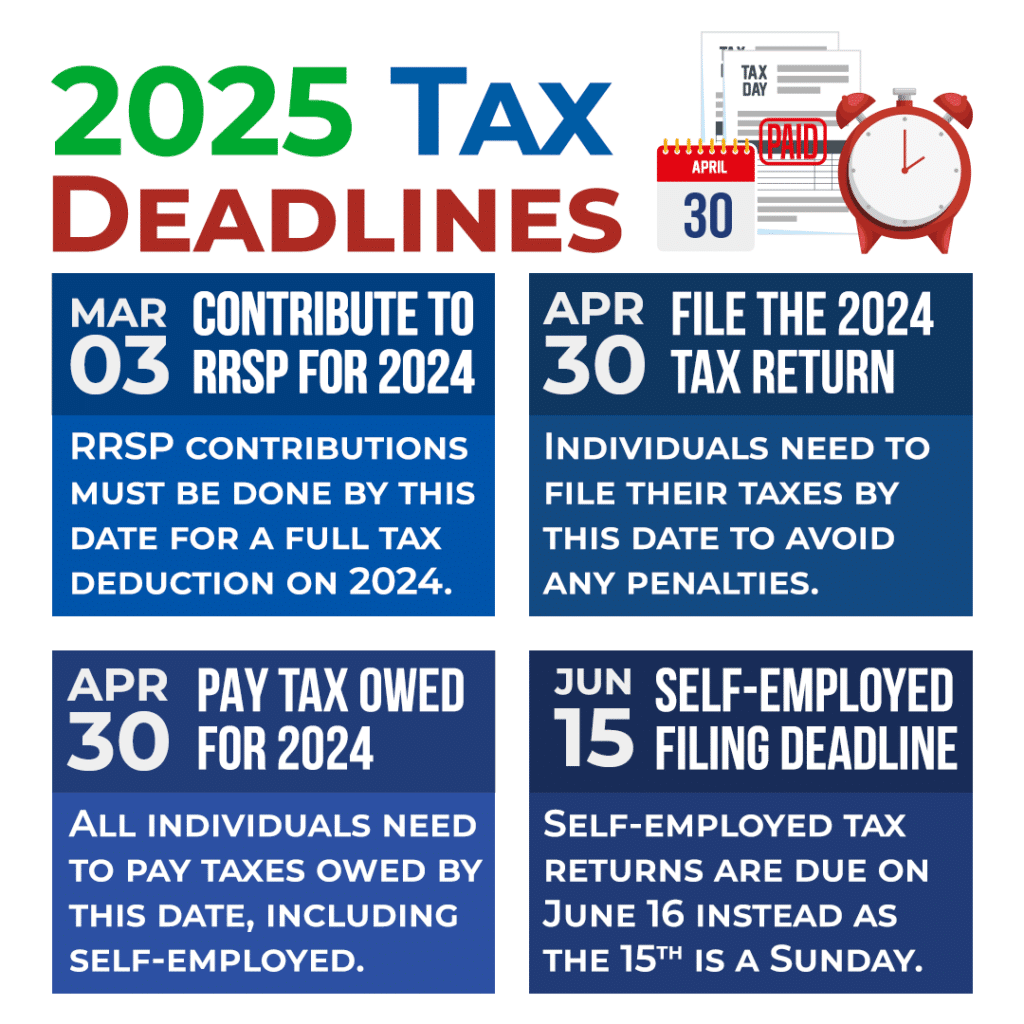

Canadian Personal Tax Filing Deadlines for 2025

There are 4 key dates that everyone needs to mark off on their calendars when it comes to Canadian personal tax filing deadlines in 2025. If you don’t and it’s missed, you could end up paying the CRA much more than you should due to late fees, penalties, and interest. Here are some of the main ones:

RRSP, PRPP, & SPP Contribution Deadline for the 2024 Tax Year

Monday, March 3, 2025

Contributions must be applied by this date to affect the 2024 tax return.

Personal Income Tax Filing Deadline for the 2024 Tax Year (Standard)

Wednesday, April 30, 2025

This does not include individuals claiming self-employment income.

Income Tax Payment Due Date for 2024 Tax Year (All Residents)

Wednesday, April 30, 2025

This also applies to individuals claiming self-employment income.

Self-Employed Income Tax Filing Deadline for the 2024 Tax Year

Monday, June 16, 2025

June 15 is the standard deadline but is on a Sunday in 2025 so it is pushed ahead.

Because the income tax payment deadline includes self-employed individuals, it is highly recommended that they have their income tax return prepared by this date, even though the deadline is not until June. This needs to be done to calculate the potential amount of tax owed and pay it by the deadline.

Preparing for your Personal Income Tax Deadlines

PRPP, SPP & RRSP Contribution Limit & Deadlines for 2025

If you want your PRPP, SPP & RRSP contribution to be a tax deduction on your 2024 income tax return, you have until March 3, 2025, to make it. The maximum contribution limit has been increased slightly for the year to $32,490. This deduction is an excellent opportunity to reduce your taxes owed since the contributions are fully tax-deductible, but it is important to connect with a tax accountant to plan how much to contribute and when. That way, you can utilize any unused contribution room carried forward from previous years and maximize your overall tax savings.

Income Tax Return Filing Deadline

For many Canadian taxpayers, tax season can be stressful, especially when the deadline for filing income tax returns for individuals is April 30, 2025. Even though self-employed individuals get an extended deadline until June 16, 2025 (due to the usual June 15 deadline falling on a Sunday), tax payments, including those for self-employed individuals, are due by April 30, 2025, as well.

Keep in mind that if you have rental income, business expenses, medical expenses, capital gains, or any other relevant income or expenses to Canadian taxes, you’ll need to make sure you’re already ahead of getting it organized. Keeping the documentation and proof at hand is critical to maximizing your tax savings when it comes to your tax return.

Deceased Taxpayers

For anyone who has passed away between January and the end of October 2024, the filing deadline for their year of death is April 30, 2025. If the death occurred in November or December 2024, the deadline is six months from the date of death. Outstanding taxes would be due on their respective filing dates.

RRSP Conversion

Turning 71 in 2025 requires converting your RRSP to a registered retirement income fund (RRIF) or a life annuity by December 31, 2025. Plan this conversion in early December to make sure your financial plans aren’t affected by it.

Underused Housing Tax Deadline

In 2022 a new legislation became law for non-resident or non-Canadian property owners with underused or vacant homes with certain exemptions on Canadian owners. This law requires owners to pay a 1% fee of the land value if it’s considered an underutilized property by April 30, 2025.

Northern Allowance

The deadline for filing any eligible tax deductions on Northern Allowances is April 30, 2025. This tax deduction is for Canadian residents living in designated regions that are isolated. Living costs are typically higher in these areas, qualifying the residents for additional tax savings. It allows eligible taxpayers to claim deductions for residency and travel expenses to offset costs while supporting residents in remote areas.

Crypto-Asset Gains

While crypto-assets like cryptocurrencies have grown in popularity, so has the need to track their income and losses effectively for tax purposes. This is because it has to be reported when preparing your income tax return. Like any other capital gains and investments, crypto follows a similar process where taxes are incurred when selling, trading, or using them to purchase goods. Keep in mind that losses from crypto investments can offset capital gains in other places so make sure to keep track of all your investments and any costs incurred.

Depending on the nature of the activities, businesses that use crypto assets for payments can incur complex tax situations in which a CPA might be required. Regardless, if you’ve invested in any crypto assets and have incurred a profit or loss in the 2024 tax year, it is important to show it to your accountant because if you don’t include it in your filing by April 30, 2025, it could result in excess taxes owing in addition to penalties, interest and late fees from the CRA.

Car Lease Tax Deductions

In Canada, businesses and individuals who lease a car to generate income are eligible for certain tax deductions on their vehicles. This deduction includes additional costs that are not included in the lease payment like insurance and maintenance. It is calculated into your tax return if you are eligible to write off your vehicle lease as a business expense. The deadline for claiming this tax deduction in your personal income tax return is April 30, 2025.

Business Tax Filing Deadlines for 2025

Employer Deadline for T4 Employment-Income Tax Slips

Businesses need to send out T4 employment-income slips by February 28, 2025. These slips are used for reporting different remuneration types, such as salary, wages, bonuses, and taxable benefits. Filing a T4 slip is mandatory if pension adjustments, CPP, QPP contributions, EI premiums, or income tax deductions were applied, or if the remuneration exceeds 0. Find out more information on filing the T4 slip and summary forms from the CRA’s website at this link.

Key GST/HST Filing and Payment Deadlines

Depending on your GST/HST filing period, your deadlines will vary. This is set up when you register for your GST account but can be changed with the CRA. If you made more than $30,000 in business income throughout the tax year, you’ll need to register for a GST number and file the return.

| Filing Period | Filing & Payment Deadline | Annual Taxable Supplies |

| Monthly | A month after the reporting period ends. | -$1,500,000 or less1 -Between $1,500,000 and $6,000,0001 -Higher than $6,000,000 -Charities1 -Listed Financial Institutions1 2 |

| Quarterly | A month after the reporting period ends. | -$1,500,000 or less1 -Between $1,500,000 and $6,000,0001 -Charities1 -Listed Financial Institutions1 2 |

| Annually (Fiscal Year-End other than December 31)3 | 3 months after the end of the fiscal year. | -$1,500,000 or less -Charities -Listed Financial Institutions2 |

| Annually (Fiscal Year-End of December 31)4 | April 30 is the payment deadline but the filing deadline is on June 15. | -$1,500,000 or less -Charities -Listed Financial Institutions2 |

- Optional Reporting Period

- This is in addition to corporations that have been determined to be a listed financial institution because they offer financial services.

- Does not include individuals that have a fiscal year-end of December 31 and business income relevant to income tax.

- For individuals that have a fiscal year-end of December 31 and business income relevant to income tax.

Finding Out Your GST/HST Reporting Period

Because the due date of your GST/HST tax return is decided by the reporting period, your GST/HST return form (GST34-2) will show the due date at the top and is specific to your business. Usually, reporting periods are decided based on the total revenue from taxable supplies you made in Canada in the previous fiscal year or per fiscal quarter coming up to it. Even if you have no business transactions or any net tax to remit, you still need to file the return if you have a GST number.

T4A Tax Forms

The T4A form is a statement of pension, retirement, annuity, or any other income slip that is a requirement for businesses to issue if they work with self-employed individuals or contractors. Businesses making payments like pensions, lump-sum payments, annuities, or other income, including fees or commissions for individuals who earned income above $500 or more before taxes during the 2024 tax year, should file T4A forms by February 28, 2025. Reporting taxable group term life insurance benefits on T4A slips is obligatory if the amount surpasses $50 in the calendar year.

T5 Tax Forms

To report investment incomes in Canada, T5 forms need to be filed. If your organization or institution makes investment income payments to Canadian residents, you need to prepare and file a T5 information return by February 28, 2025. It’s important to note that T5 slips should not be used for reporting investment income paid to non-residents.

Find Out More in Another Canada Tax Guide

- Learn how to calculate your eligible RRSP deductions.

- Read our comprehensive guide on calculating income tax as a sole proprietor or self-employed individual.

- Check out whether you qualify for the UHT tax exemption or owe the CRA for your UHT.

- Living up north or in an isolated/rural area? You could qualify for tax deductions that you can find out about here.

- Learn how to prepare and organize your taxes for your crypto investments.

- Discover if you’re eligible to apply for a car lease tax deduction here.

- Make sure you’re paying your employees as per CRA’s regulations or you could be due some extra tax fees. Read our guide on taxable benefits and employee allowances here.

Exceptions to Due Dates and Deadlines in the Canada Tax Guide

One main exception comes when a due date ends up being on a public holiday recognized by the CRA or weekend (Saturday or Sunday). In that case, payments and filings are considered on time if received on the next business day.

Reviewing Your Canadian Tax Filing Deadlines for 2025 with an Accountant

Preparing all the information and the different tax forms can be challenging, especially with each year’s changes to the Canadian tax system. We recommend getting in touch with and having a Chartered Professional Accountant’s firm plan, review, organize, prepare, and file your tax return. That way you can maximize tax credits and deductions to get the most savings possible on your filing. At the same time, a CPA will make sure it’s compliant with the CRA and doesn’t incur unnecessary penalties, late fees or interest.

What You Can Do with Our Canada Tax Guide

At Advanced Tax, we understand the importance of meeting these deadlines. Not only is this key for compliance with Canadian tax regulations, but it lets us help you save on your taxes. Our team is committed to assisting you with your tax, bookkeeping, and accounting needs. Feel free to reach out to us for personalized assistance on your tax journey. Remember, staying informed is the first step toward financial success.