Understanding the Tax Implications of Foreign Income for Canadian Residents

In today’s globalized world, many Canadians find themselves generating income from overseas ventures. This includes foreign employment, business activities, rental properties, and other sources. However, it’s crucial to comprehend the complexities of reporting and fulfilling tax obligations on foreign income as Canadian residents. In this comprehensive guide, we’ll delve into the intricacies of taxation of income from foreign sources and how to ensure adherence to Canadian tax laws.

Defining Foreign Income

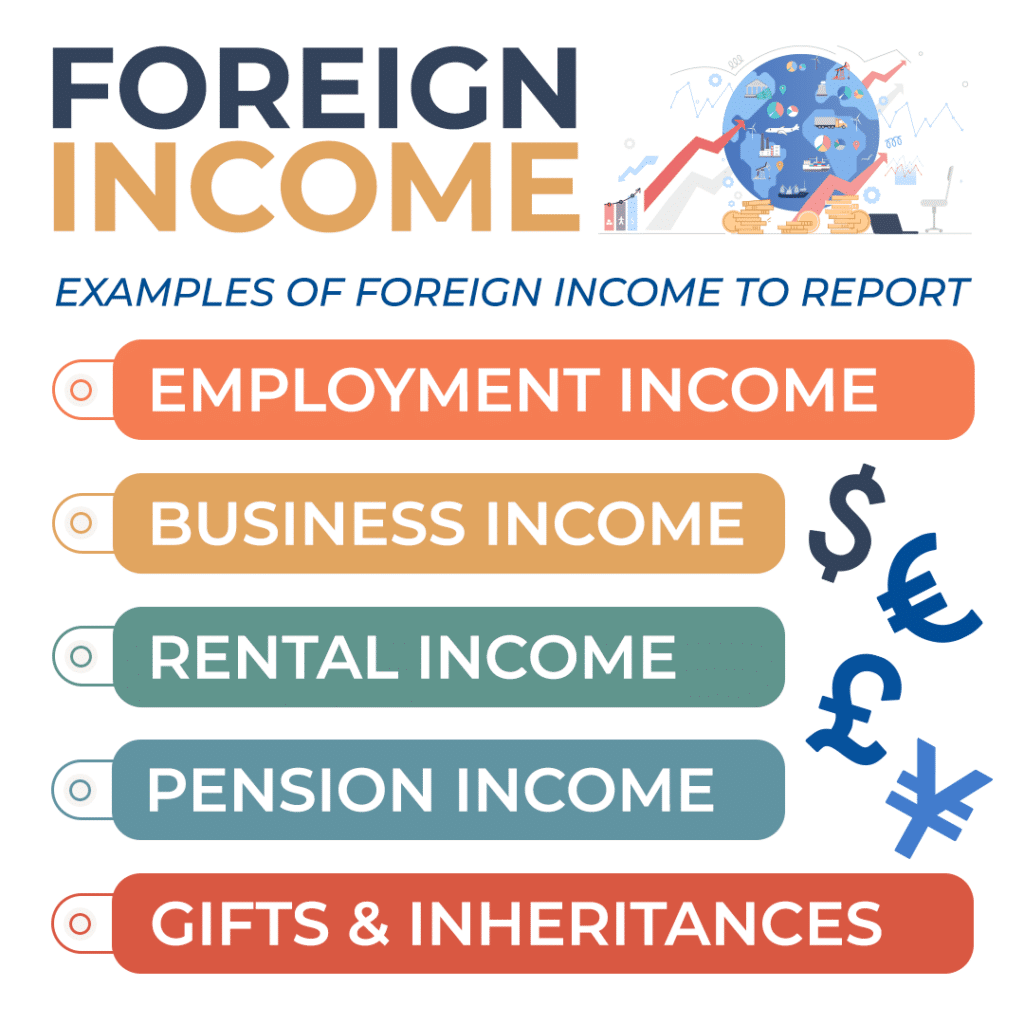

Foreign income encompasses all earnings derived from sources outside of Canada. This umbrella term encompasses various forms of income:

- Foreign Employment Income: Canadians working abroad may earn income subject to taxation in both their foreign host country and Canada.

- Foreign Business Income: Operating a business overseas can generate foreign income, potentially subject to Canadian taxation.

- Rental Income from Foreign Property: Income generated from rental properties abroad is considered foreign income and must be reported to the Canada Revenue Agency (CRA).

- Foreign Pension Income: Receiving pension payments from a foreign country is classified as foreign income and necessitates reporting.

- Foreign Self-Employment Income: Self-employed individuals conducting business abroad must report their foreign self-employment income.

- Receipt of Funds from Abroad: Any funds received from abroad, whether as gifts, inheritances, or from other sources, may be subject to taxation in Canada.

Reporting Your Foreign Income

To ensure compliance with Canadian tax laws, it is necessary to accurately report all income from foreign sources. If you’ve received income from abroad, make sure to consult with a professional accountant to ensure compliance with the CRA.

Global Income Reporting

Canadian residents are obligated to report their worldwide income to the CRA. This entails disclosing all income from foreign sources, irrespective of whether it has already been taxed in the source country.

Foreign Income Tax Credit

To prevent double taxation, Canada has tax treaties with numerous nations. You may be eligible for a foreign income tax credit, which enables you to offset foreign taxes paid against your Canadian tax liability.

Foreign Income Exemption

There are exemptions for some types of worldwide income, like foreign pension income. This is because it may qualify for partial or full exemption from Canadian taxation under specific circumstances. Consultation with a tax professional is recommended to determine eligibility.

Comprehensive Record Keeping

Maintain meticulous records of all transactions for income from foreign sources. This includes supporting documents like receipts and bank statements.

How to Report Foreign Income in Canada

Reporting worldwide income in Canada involves completing relevant sections of your income tax return. Depending on your situation, you may also need to submit additional forms, such as the Foreign Income Verification Statement (T1135), which furnishes detailed information about your foreign assets and income.

Canadian Taxation on Foreign Income

The tax implications of international income in Canada depend on several factors. This includes the nature of the income, applicable tax treaties, and your overall income. Usually, income from foreign sources is taxed at your marginal tax rate. Nonetheless, the foreign tax credit and foreign income exemption can substantially mitigate your Canadian tax liability on income from foreign sources.

Seek Expert Guidance

Navigating the intricate landscape of taxation on income from foreign sources in Canada can be challenging. To ensure compliance and optimize your tax position, it’s prudent to seek the counsel of a qualified CPA or tax professional. They can provide insights into reporting on income from foreign sources, leverage available tax credits, and offer expert guidance tailored to your unique circumstances.

At Advanced Tax, we specialize in providing tax and accounting services to people and organizations receiving income from foreign sources. Our team has a comprehensive understanding of foreign income tax regulations in Canada, foreign tax credits, and reporting requirements. Don’t hesitate to get in touch with us today to ensure efficient management of your foreign income, in full adherence to Canadian tax laws.

In conclusion, while earning income from abroad as a Canadian resident can be financially rewarding, it also comes with tax obligations. Understanding how to report and fulfill tax responsibilities on income from foreign sources is essential to avoid potential legal and financial complications. By staying informed and seeking professional guidance, you can make the most of your international financial endeavors while ensuring compliance with tax regulations.