Prepare for the RRSP Deadline in this Tax Season

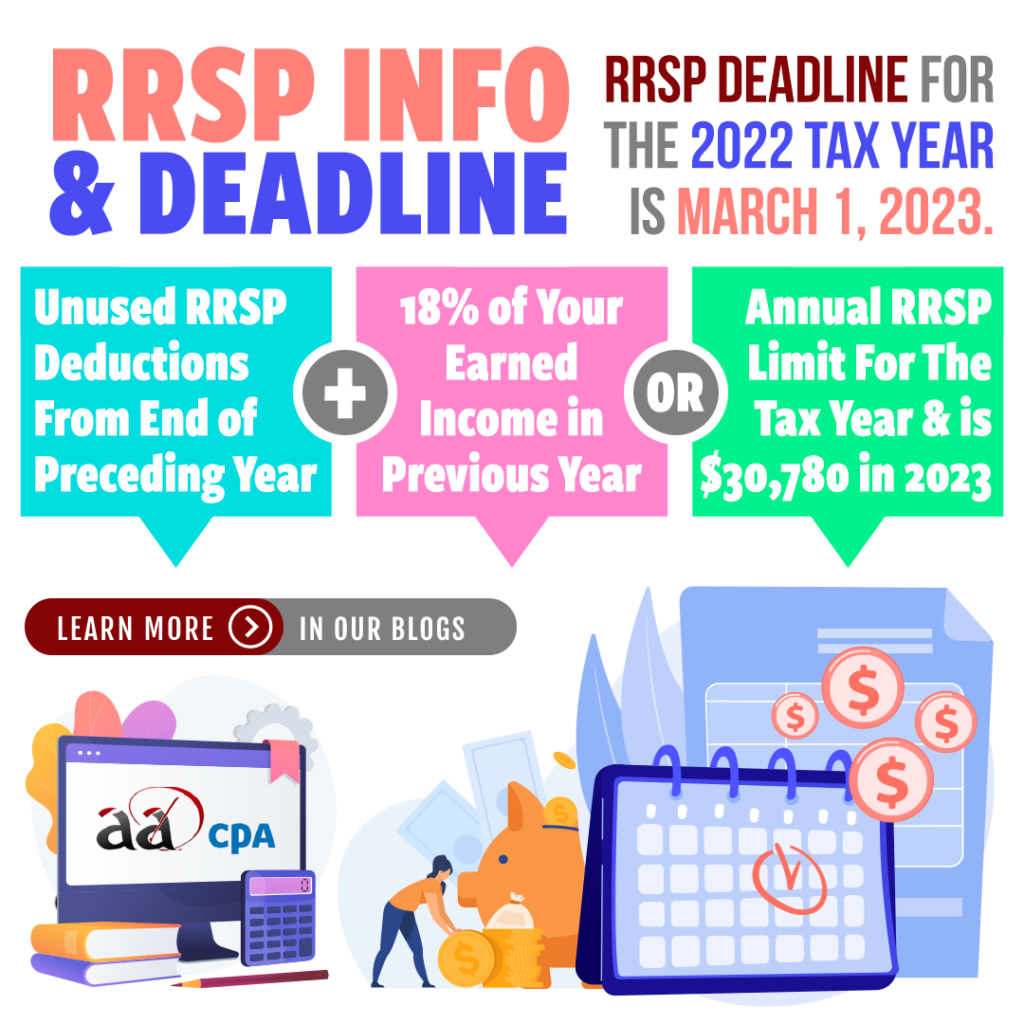

Throughout the year, you may have been contributing to your RRSP. To get the deduction for the 2022 tax year, the contributions must be done before the RRSP deadline of March 1, 2023. Ensure the contributions meet your registered retirement savings plan (RRSP) deduction limit which is the maximum amount you can deduct from contributions made to your RRSPs, PRPP, SPP and to your spouse’s or common-law partner’s RRSP or SPP for the year.

Calculating Your Deduction Limit for the RRSP Deadline

The RRSP deduction limit is calculated through:

- Your unused RRSP deduction room from the end of the preceding year.

- Plus:

- The lessor of:

- 18% of your earned income in the previous year.

- The annual RRSP limit which is $30,780 in 2023.

- The lessor of:

- Plus your pension adjustments reversal (PAR).

- Minus your net past service pension adjustment (PSPA).

Over Contributing Past Your RRSP Deduction Limit

If you contribute more than your RRSP deduction limit by more than $2,000, you have to pay a tax of 1 percent per month on them. This is the case unless you:

- withdrew the excess amounts before the end of the month in which the excess contribution was made

- contributed to a qualifying group plan

Items to Claim RRSP Deductions On

You Can Claim Deductions on:

- Contributions you made to your RRSP, PRPP or SPP.

- Contributions you made to your spouse’s or common-law partner’s RRSP or SPP.

- Your unused RRSP, PRPP or SPP contributions from the previous year.

You Cannot Claim Deductions on:

- Amounts paid for administration services on an RRSP.

- Brokerage fees charged to buy and sell within a trusteed RRSP.

- The interest you paid on the money borrowed to contribute to an RRSP, PRPP, or SPP.

- Capital losses within your RRSP.

- Employer contributions to your PRPP.

The RRSP deadline for contributions is approaching fast, so make sure you get yours in. To find out more information on where you can find your RRSP deduction limit, check out this link and review the list below.

- Form T1028, Your RRSP Information for 2022:

- CRA may send you Form T1028 if there are any changes to your RRSP deduction limit since your last notice of assessment or reassessment, or if the RRSP deduction limit statement was not included on your notice.

- My Account

- MyCRA mobile app

- Tax information Phone Service (TIPS)

- the RRSP Deduction Limit Statement, on your latest notice of assessment or notice of reassessment (see image below)

Contact us today to get started on your 2022 tax return to maximize your savings!