The Penalty for Late Tax Filing in Canada Adds Up to Impactful Consequences

The personal income tax filing due date for this year was at the end of April, leaving those who haven’t filed wondering what happens now. A penalty for late tax filing in Canada can result in fees, interest, and other consequences to those responsible. There are other factors to consider like how much tax is owed, and which type of tax return it is.

For example, self-employed individuals have until June 15 to file, but they are still expected to pay their tax owing by April 30. Not paying by the date incurs interest until it is paid off, even it if it is filed on time. Keep reading to find out what the penalty for late tax filing and payments are for their respective returns.

Penalties for Late Tax Filing for Personal Income Tax Returns

Paying for your tax owing late results in interest being accumulated on the amount owed. In addition, if there’s a balance owing and you file the return late, you’ll get charged with a late-filing penalty. Interest is compounded daily from April 30, the date at which the payment is owed. It collects until the balance is cleared.

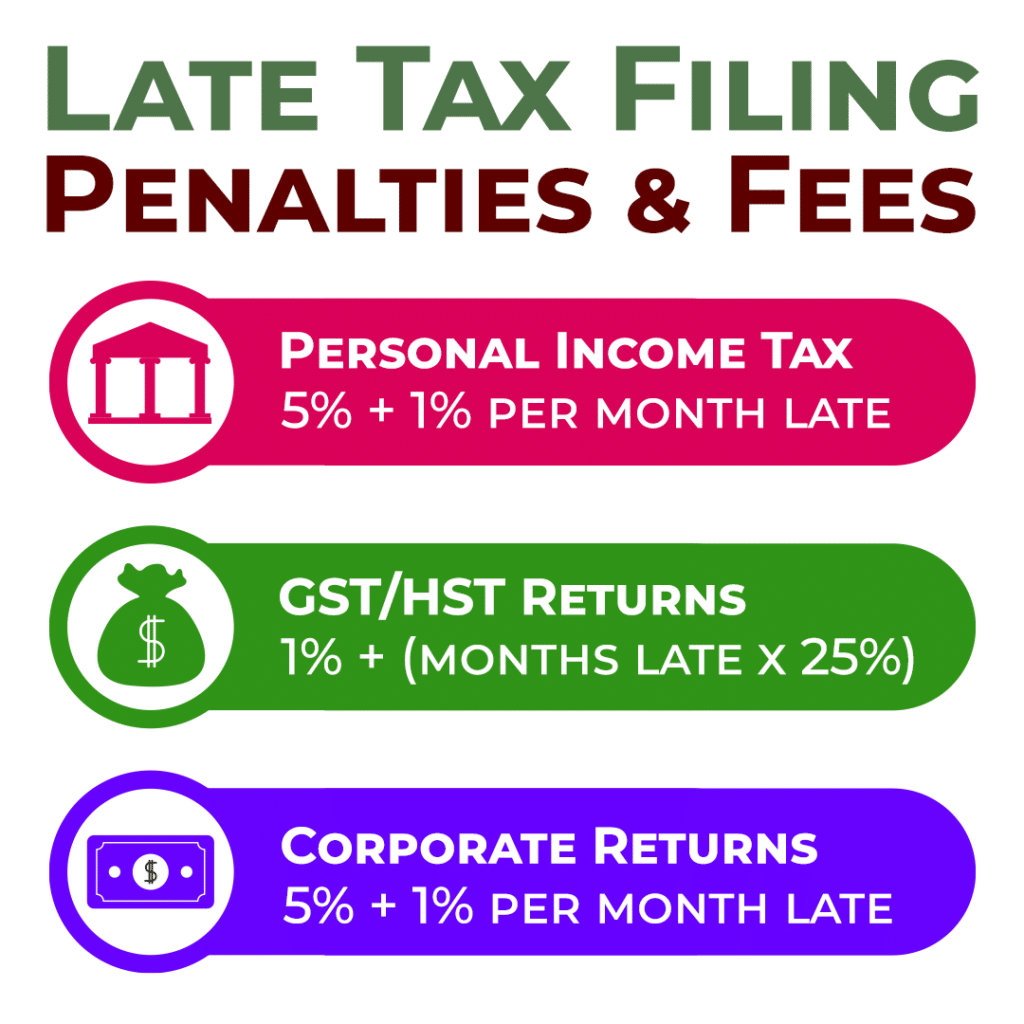

Late filing can also cause delays to any of your benefit and credit payments. Even if you can’t pay the full amount on time, make sure you file anyways to avoid the late-filing penalty. The late filing penalty for personal income tax returns for 2023 is 5% of the tax owing from the 2023 tax filing. On top of that, there is an extra 1% late fee charged per month after the due date it was filed. This can increase to a maximum of 12 months.

In the case where you had a late-filing penalty charged for any of the previous 3 years, like 2020, 2021, or 2022, and the CRA requested a formal demand for a return, your penalty increases significantly. The penalty becomes 10% of the balance owing. On top of that, there’s an additional 2% additional per full month that you filed after the due date. This can increase until the maximum of 20 months.

Penalties for Late Instalment Payments

This penalty applies to tax instalments as well. If you are required to pay instalments, the payment due date of the instalment that is missed starts the compounding of interest. If your tax instalments are under $1,000, then you will not face the penalty for late fees, but interest will still be charged.

Penalty for Late Tax Filing of GST/HST Returns

If you didn’t file on time, but there is no GST/HST owed to the CRA or they owe you a refund, there is no late filing penalty. If you have an amount owing for the GST/HST return, the late filing fee is 1% of the amount owing plus 25% times the number of full months the return is overdue. This accumulates up to the maximum of 12 months.

In the case where the CRA demands that you file and you don’t, the late filing fee is $250. If you are required to file electronically but don’t do it, there is a $100 penalty for the initial return and $250 for each subsequent return not filed electronically. For cases where the return was filed inaccurately, the penalty is 5% plus 1% for each month of the difference between what was reported and what should have been reported. The maximum penalty in this case is 10%.

Interest on Late GST/HST Tax Payments

For returns that have overdue balances owing, interest is compounded daily based on the prescribed interest rates. When the CRA owes a refund for an overpayment or refund of net tax claimed on a GST/HST return, the interest is also compounded daily. This begins from the option that is latest of the following:

- 30 days from the day the return was filed in which the refund was claimed.

- 30 days from the day after the end of the reporting period of which the return covers.

- The date when the payment was done that resulted in the overpayment.

For instalments, if they match the expected payments from the previous year, you will not have interest owing. This is the case even if your total tax owed is higher than the previous year. In the situation where you paid less than what was owed for the required instalment payments, you can eliminate or reduce the instalment interest by overpaying the next instalment or paying early. Interest on instalment payments is charged at the end of the fiscal year. It is calculated starting the day after the instalment payment was due until the earlier of the day the amount and interest is paid or the day the net tax owed for the year is due.

Penalty for Late Tax Filing of Corporate Tax Returns

Late filing of corporate tax returns results in a penalty for late tax filing of 5% of the unpaid tax due on the filing deadline. In addition to the 5%, 1% of it is owed for each full month that it is late, up to 12 months. If the CRA issued a demand to file, the percentages are doubled. The penalty becomes 10% of the unpaid tax when it was due. An additional 2% per full month that the return is late is also owed. The maximum in this case is 20 months.

In instalment penalties in which the interest is more than $1,000, the penalty is calculated by subtracting the instalment interest from the larger of either $1,000 or 25% of the instalment interest which is calculated if no instalment payment was made for the year. Half of this difference is what the amount of the penalty would be.

Non-resident corporations face a different set of penalty calculations. This is a penalty that is equal to the larger of either $100 or $25 per full day the return is late. The maximum is 100 days.

Late Payroll Remittance Penalties

When you make deductions that meet the following criteria and are past the due dates, there are consequences. The CRA applies significant penalties and interest that is compounded daily. The criteria for remittance amounts include:

- Those over $500 but aren’t sent to the CRA.

- Are over $500 and sent to the CRA late.

- Amounts are under $500 but intentionally not sent to the CRA or sent late.

Depending on your remitter type, due dates vary. The penalty would be:

- 3% of the amount owing when it is late by 1 to 3 days.

- 5% of the amount owing when it is late by 4 or 5 days.

- 7% of the amount owing when it is late by 6 or 7 days.

- 10% of the amount owing if it is above 7 days late or not remitted.

- 20% if it is the second or succeeding time you received the penalty in a calendar year and was intentional.

The CRA’s Prescribed Interest Rates

Every quarter, the CRA updates their prescribed interest rates. Each set of interest rates applies to the relevant calendar quarter. The interest rates apply to any amounts owed to the CRA and vice versa. The key interest rates to keep in mind include:

- Overdue taxes, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums have an interest rate of 10%.

- Corporate taxpayer overpayments result in an interest rate of 6%.

- Non-corporate taxpayer overpayments result in an interest rate of 8%.

- Taxable benefits for shareholders and employees from interest free and low-interest loans have an interest rate of 6%.

How to Avoid the Penalty for Late Tax Filing

The best way to not incur penalties for late filing and payments is to file and pay on time. Make sure you leave a few days before the deadlines just to be safe. Working with a professional accountant gets you the advice you need to maximize your payment deadlines in accordance with the CRA’s expectations.

A tax professional can also help you by requesting the CRA to cancel or waive penalties and interest. When in this kind of situation, it is best to speak to an expert as it can impact 10 years of taxes. Again, make sure you’re ahead of your deadlines but if you aren’t, get in touch with us for the best approach to complying with Canada’s tax regulations. We’ll do our best to make sure you avoid the penalty for late tax filing.