Car Lease Tax Deduction Rules for Employees and Businesses in Canada

In Canada, there is a car lease tax deduction in specific situations. This comes with various rules and regulations that are set out by the CRA. Its purpose is to provide the tax deduction for employees and businesses using a vehicle for work. This could involve either a vehicle used for transportation in business activities or even a fleet used operationally. Maximizing the deduction gets you more tax savings if it adheres to the following criteria we describe in the blog below.

Understanding the Car Lease Tax Deduction in Canada

Basically, the Canada Revenue Agency (CRA) allows deductions for car lease payments when used for income-earning purposes. This helps employees using a leased vehicle for employment and business owners save on taxes. There are different rules for employees and business owners, but they follow the same general guidelines.

Car Lease Tax Deduction for Employees

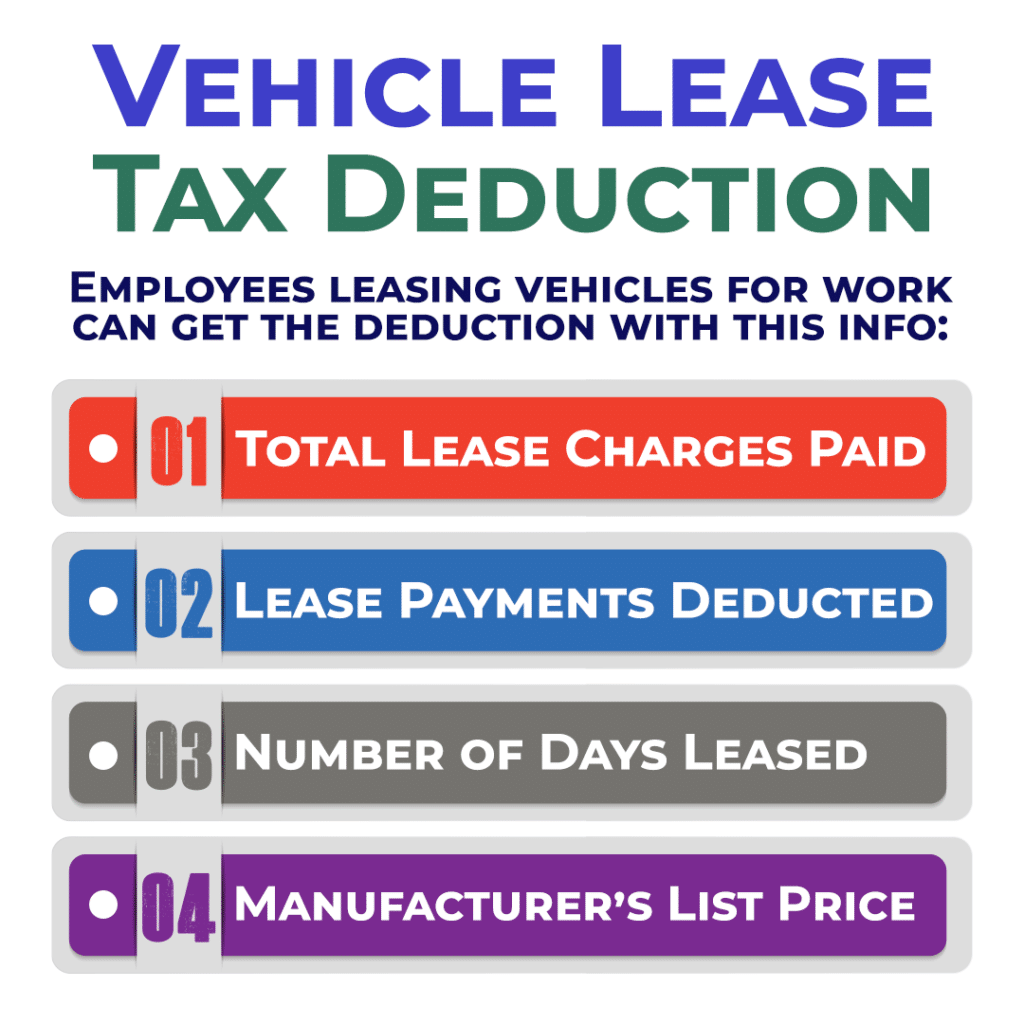

As an employee leasing a vehicle for work, they can deduct the amounts paid towards the vehicle lease. They vehicle must be used to earn employment income and comes with the following rules:

- Leasing Costs Deduction Limit: On passenger vehicle leases, there are limits to the amount of lease costs that can be deducted. If the vehicle was leased after December 31, 2000, use the CRA’s “Chart, Eligible leasing costs for passenger vehicles”. This helps calculate your eligible cost for the deduction. It is based on the following amounts:

- Total lease charges paid in the year.

- Total lease payments already deducted.

- The total number of days it was leased.

- Manufacturer’s list price.

- Inclusions and Exclusions: Usually, lease agreements don’t include insurance, maintenance, and taxes. These costs need to be considered separately from the lease cost on Form T777, Statement of Employment Expenses. In the case that the lease agreement does include these costs, then they can be factored into the lease charges for your calculations.

- Zero-Emission Vehicles: The same restrictions on leasing cost deductions apply to zero-emission vehicles as they do to other passenger vehicles.

Car Lease Tax Deduction for Businesses

Businesses can also deduct costs incurred from leasing vehicles used to earn income. These deductions are claimed under different lines depending on the type of income earned:

- Leasing Costs for Business Income: Report these on line 9281 for business and professional expenses, line 9819 for farming expenses, and line 9281 for fishing expenses.

- Leasing Cost Calculation: Use “Chart C – Eligible leasing cost for passenger vehicles” on your form to calculate the deductible amount. Ensure that if your lease includes taxes (GST/HST or PST), they are included in the lease charges.

- Prescribed Limits: The prescribed deductible leasing cost limit and capital cost allowance (CCA) limits are major factors in the deductible amount. For example, the CCA capital cost limit for a passenger vehicle might be set at $34,000, impacting the calculation of eligible leasing costs.

Special Considerations

- Repayments and Imputed Interest: If your lease agreement involves repayments owing to you or imputed interest, you cannot use the standard chart for calculating eligible leasing costs. Imputed interest occurs when interest would be owing to you if you were paid interest on money deposited to lease a vehicle. Contact the CRA directly for guidance if this applies to your situation.

- GST/HST and PST Rates: The applicable GST or HST rate varies by province, and it’s essential to use the correct rate for your region when calculating leasing costs.

Unsure If Car Lease Tax Deduction Applies to You?

Just talk to one of our tax experts. That’s what we’re here for.

How We Can Help You Save on Your Car Lease

If you’re looking to get a new vehicle, this deduction should be something to consider. If you use a vehicle to earn income, your tax savings could increase when the deduction is used right. The guidelines above are a highlight of the CRA rules to consider when doing so, but they are an opportunity to maximize your allowable deductions by reporting expenses accurately.

You might still be unsure of how to use this deduction best, but that’s why we’re here. Working with our CPA accounting firm and tax experts gets you personalized assistance. This is the best way to ensure compliance with all tax regulations. At the same time, they can make sure you’re getting the most out of your tax returns. Contact our team at Advanced Tax to get the advice you need to start making the most of your tax return filing.