Small & Medium Business Audits in Canada

With the changes to our economy from the COVID-19 pandemic, parties involved with the subsidies that were provided may be susceptible to audits, on top of the regular risk-assessment system from the CRA. The risk-assessment system analyzes tax returns and subsidy claims to judge whether they are at a high risk of being non-compliant. If there are a lot of errors or signals of non-compliance, these returns and claims will be flagged and the CRA will initialize the process for business audits. Make sure your tax return or subsidy claims are as accurate as possible to avoid being chosen for an audit.

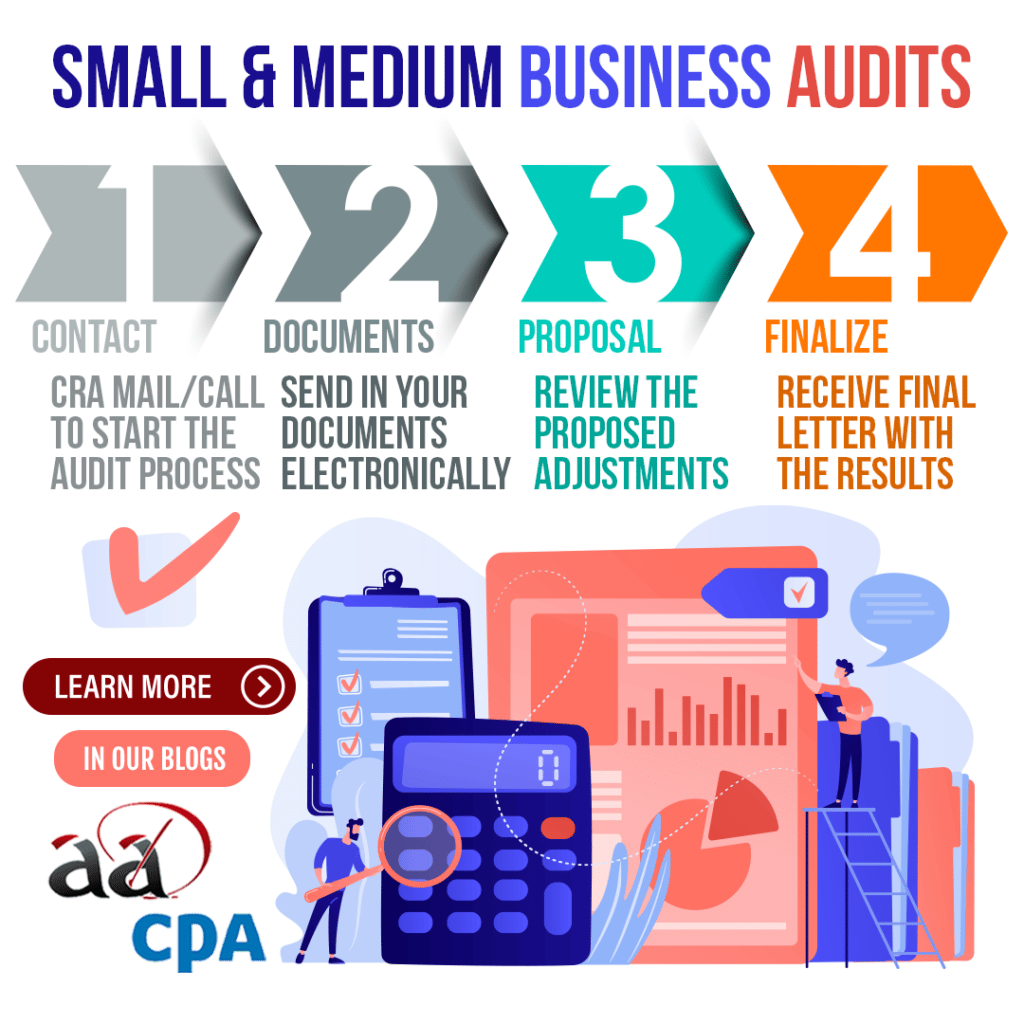

The Audit Process

- If you are selected for an audit, an auditor from the CRA will get in touch with you to start the audit process through mail or a phone call. You will be informed exactly which time periods are being audited and how to provide the relevant documents.

- Audits are currently virtual and require you to send any relevant documents electronically to the auditor. They will provide the instructions on how to do so and will review the submitted documentation.

- After reviewing the documents, the auditor will let you know if there are any adjustments. They will issue a proposal letter that includes the adjustments and you have 30 days to review them and provide representations, then the audit will be finalized. In this time, you can communicate the auditor and provide resolutions.

- After 30 days from the proposal has been completed, a final letter will be sent over with the results of the audit. This letter will notify you of one of the following results.

- No adjustments will be made to the previous assessment or subsidy claims.

- An adjustment will be made that means you will owe more tax from the reassessment. You will have to pay the balance. If it was done on a subsidy claim, a notice of redetermination will be issued and adjusts your claim.

- There can also be an adjustment that results in less tax being owed via reassessment and you will be eligible for a refund.

Please note that auditors can make copies of your records and online document submission will be done via the CRA’s secure services.

What the CRA Looks for in Business Audits

The CRA and its auditors examine your business’ books, records, documents and information. This primarily includes:

- Business Records like ledgers, journals, payroll records, invoices, receipts, contracts and bank statements.

- Personal Records of the business owner such as bank statements for personal accounts, mortgage documents and credit card statements.

- Personal or Business Records of any other individuals or entities that are related to the business owner. This includes a spouse, family member, corporation, partnership or a trust.

Disputing the Result of a Business Audit

If you don’t agree with the CRA’s assessment or reassessment, you may object. If you do so, the additional taxes owed will not be due until the objection is resolved. You may also file a complaint on the service from the CRA.

To find out more information on how business audits are conducted in Canada along with relevant links to important audit resources, visit the CRA’s webpage on Small and Medium Business Audits by clicking the link below.

Click Here to Access the CRA’s Business Audit Resources