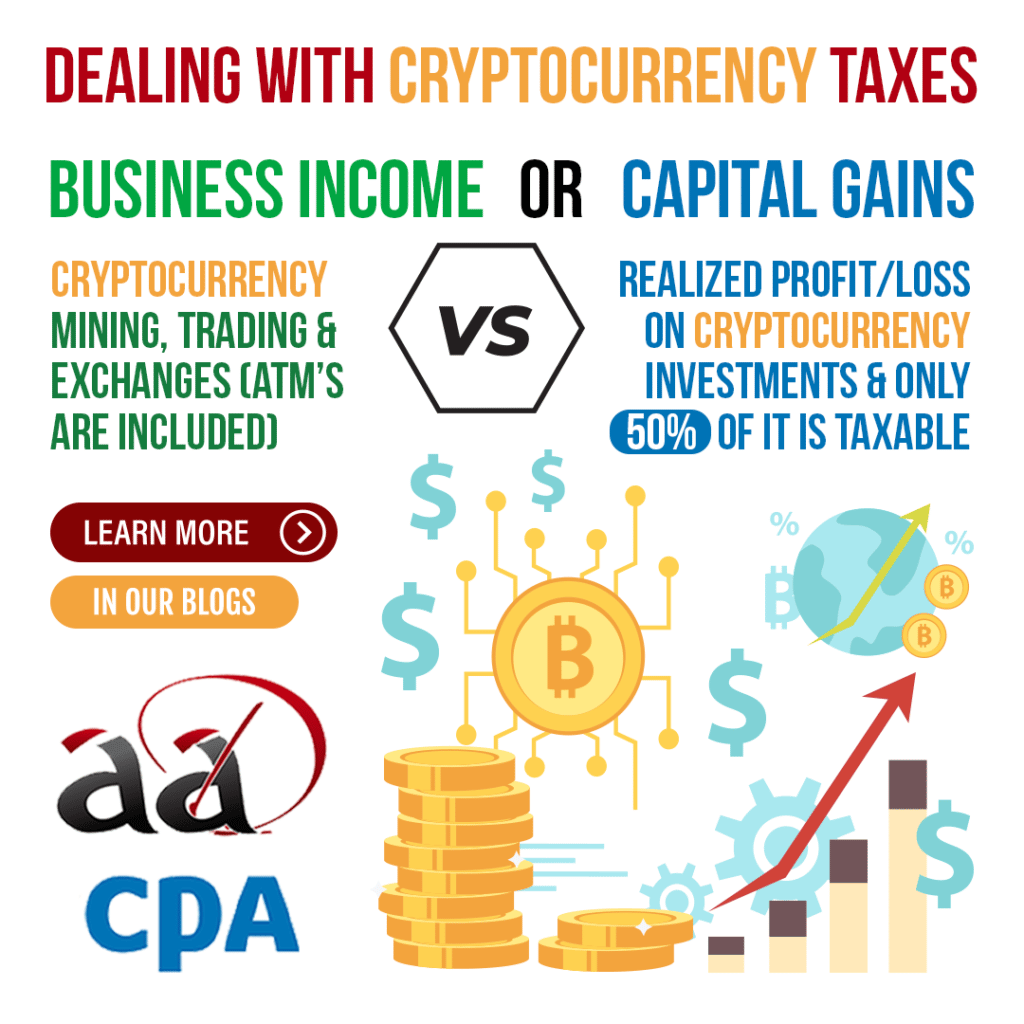

Have you been trading cryptocurrency or other digital assets and are wondering how to apply this to your tax return? Your cryptocurrency dealings may be considered either a business income or capital gain and depending on your situation, you’ll be applying it to your tax return differently.

When is this a concern for your taxes?

Once you have gone through a disposition and have gotten rid of your digital assets by giving, selling or transferring it, then you need to worry about your tax implications. Here’s a breakdown on the situations that a disposition refers to:

- Selling or gifting cryptocurrency

- Trading or exchanging cryptocurrency (this includes disposing of one for another)

- Converting cryptocurrency to government-issued currency such as CAD

- Using cryptocurrency to buy goods or services

Cryptocurrency as a Capital Gain

Selling cryptocurrency without the nature of carrying on a business may result in a capital gain or capital loss. When the amount that the cryptocurrency sells for is more than the original purchase price or its adjusted cost base, then there is a realized capital gain. Half of this gain is subject to tax but for any losses in this venture that result in a capital loss, it can only be applied to reduce income from other capital gains rather than other sources like employment income. Your capital losses can also be carried forward or offset the gains of any of the preceding three years.

Trading Cryptocurrency for Another Type of Cryptocurrency

- When disposing one cryptocurrency for another, you must follow barter transaction rules.

- Convert the value of the cryptocurrency you received and disposed into Canadian dollars.

- Obtain the difference between the two and now you have your gain or loss for your capital income or business income.

Evaluating Cryptocurrency as Capital Property or Inventory

- Capital Property

- Record and track the adjusted cost base to accurately report any capital gains.

- Inventory

- Compare the cost and fair market value of each item and resolve which number is lower. Then, use this amount for each item to calculate the total inventory value at the end of the year.

- The cost refers to the original price paid for the item of inventory including all reasonable costs that incurred to purchase it.

- Another method is to value the entire inventory at its fair market value at the end of the year.

- Once an inventory evaluation method has been used, you must use the same inventory method from year to year.

Keeping Track of Your Transactions

Make sure you keep records of all instances where you acquire or dispose of cryptocurrency. You are expected to keep all required records and supporting documents for at least six years from the end of the last tax year that they relate to. These transactions and details include:

- Dates of the Transactions

- Receipts of Purchases and Trasnfers

- Value of Cryptocurrency in CAD at Time of Transaction

- Digital Wallet Records and Cryptocurrency Addresses

- Description of the Transaction and the Other Party

- Exchange Records

- Accounting and Legal Costs

- Software Costs Relating to Managing Tax Affairs

Treating it as Business Income

Whether you are involved in a business with cryptocurrency or not is based on the following criteria and includes cryptocurrency mining, trading and exchanges which include ATM’s.

- Carrying on activity for commercial reasons and is commercially viable.

- Undertaking activities in a business manner which includes preparing a business plan and obtaining capital assets or inventory.

- Promoting products or services.

- Showing that you plan on making a profit even if it is unlikely in the short term.

- You have undertaken significant activity that is part of your income-earning process.

At the end of the day, this decision on whether to class your cyrptocurrency activites as a business or capital investment is still determined on a case by case basis so make sure to touch base with your accountant when making this decision.

Mining Cryptocurrency

If you are mining cryptocurrencies, you can class it as a business or a hobby which means that it’s for pleasure, entertainment or enjoyment. Even though payment comes in the form of the newly created cryptocurrency block, they are still paid in the cryptocurrency itself and must identify this as income.

As a miner, make sure you keep these records:

- Receipts for purchasing cryptocurrency mining hardware.

- Receipts supporting expenses and other records with the operation.

- Power costs

- Mining pool fees

- Hardware specifications

- Maintenance costs

- Hardware operation time

- Mining pool details and records

Find out more information about dealing with your digital assets on the Canadian Government’s Website under the Cryptocurrency Compliance Section.