Demystifying Financial Statements: A Guide by Your Trusted CPA Accounting Firm

Being able to understand financial statements is vital when making informed financial decisions that affect your business. Accurate financial statements provide an understanding of your organization’s financial health. They also provide insights into your profitability, liquidity, and overall financial performance. Continue reading our guide to understand the different types of financial statements that you get when working with an accountant and how you can read them.

What Are Financial Statements?

Financial statements are reports that show your organization’s financial position, performance, and cash flow activities. The information they contain is invaluable as they illustrate your company’s assets, liabilities, revenues, expenses, and equity. This lets your shareholders, executives, and any other relevant shareholders assess its financial viability to make decisions.

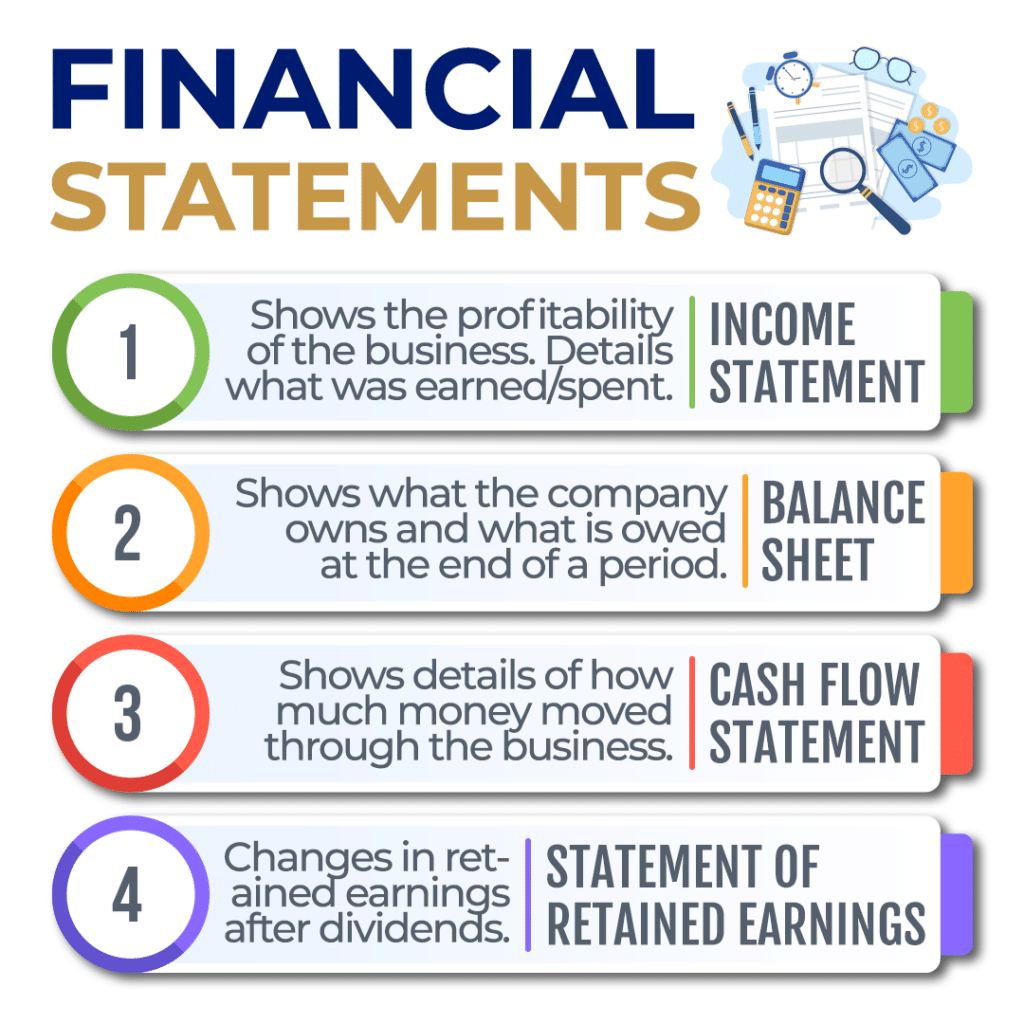

Types of Financial Statements

Balance Sheet

The balance sheet is a snapshot of your organization’s finances at a specific point in time. It includes your company’s assets, liabilities, and equity. Assets represent what your company owns, such as cash, inventory, and property.

On the other hand, liabilities show your company’s debts and obligations. Equity reflects the residual interest in the assets after deducting liabilities that represent the shareholders’ or other owners’ stake in your company.

Income Statement

Also known as the profit and loss statement or statement of earnings, the income statement reflects your company’s revenues, expenses, gains, and losses over a specific period. It helps assess your company’s profitability by calculating net income. Your net income is the difference between total revenue and total expenses and shows your true profitability.

Statement of Retained Earnings

The statement of retained earnings highlights the changes in your company’s retained earnings over a specific period. Retained earnings are the accumulated profits or losses that have been retained within the company and have not been distributed to shareholders as dividends. This statement shows how net income, dividends, and other adjustments impact the retained earnings balance.

Statement of Cash Flows

The statement of cash flows reports on your cash inflows and outflows from the operating, investing, and financing activities during a specific period. The information is key in getting insights on your company’s liquidity, as it shows how it generates and uses cash. This statement helps assess your company’s ability to meet short-term obligations, invest in growth, and distribute dividends.

How to Read Financial Statements

Understanding financial statements can seem overwhelming. Without the knowledge on how to read them, it becomes difficult to make confident financial decisions for your business. Here’s our recommended process when reading through your financial statements:

First Start with the Balance Sheet

Review your balance sheet to understand your company’s overall financial position. Pay close attention to the assets, liabilities, and equity sections to gain insights into your company’s solvency, liquidity, and general financial health. Excess liabilities can impact your long-term growth and they need to be considered when making further investments.

Then Analyze the Income Statement

Examine the income statement to assess your company’s profitability by focusing on your revenues, expenses, gains, and losses. Calculate your net income to find out if your company is generating profits or losses. Once all your operating expenses are considered, the net income identified is the true profit that your business is making. A negative net income can identify areas to cut costs or new focuses for revenue to make sure your business is financially sustainable.

Next, Dive into the Statement of Retained Earnings

The statement of retained earnings reveals how your company’s profits or losses are retained within the business. Analyze the adjustments made to retained earnings and understand how they impact the company’s overall financial picture. Understanding how dividends paid out to investors are impacting your company helps align your goals with shareholder interests.

Finally, Evaluate the Statement of Cash Flows

The statement of cash flows provides valuable insights into the company’s cash inflows and outflows. Assess the operating, investing, and financing activities to understand how the company generates and utilizes its cash resources.

Now That You Know About Financial Statements, What’s Next?

Most modern accounting software like Quickbooks can spit out financial statements with the click of a button, but to really understand your financial performance and stability, a CPA’s expert opinion may be needed. In addition, working with a professional accounting firm ensures your reports are accurate. Misrepresented information in these reports leads to making decisions that may not be what your business needs. When making investments, lending, and planning finances, informed decision-making becomes critical to ensure your business’ success. As your trusted CPA accounting firm, we are here to help you navigate the complexities of financial statements and provide expert insights to support your financial success. Contact us today to get the assistance your business needs.