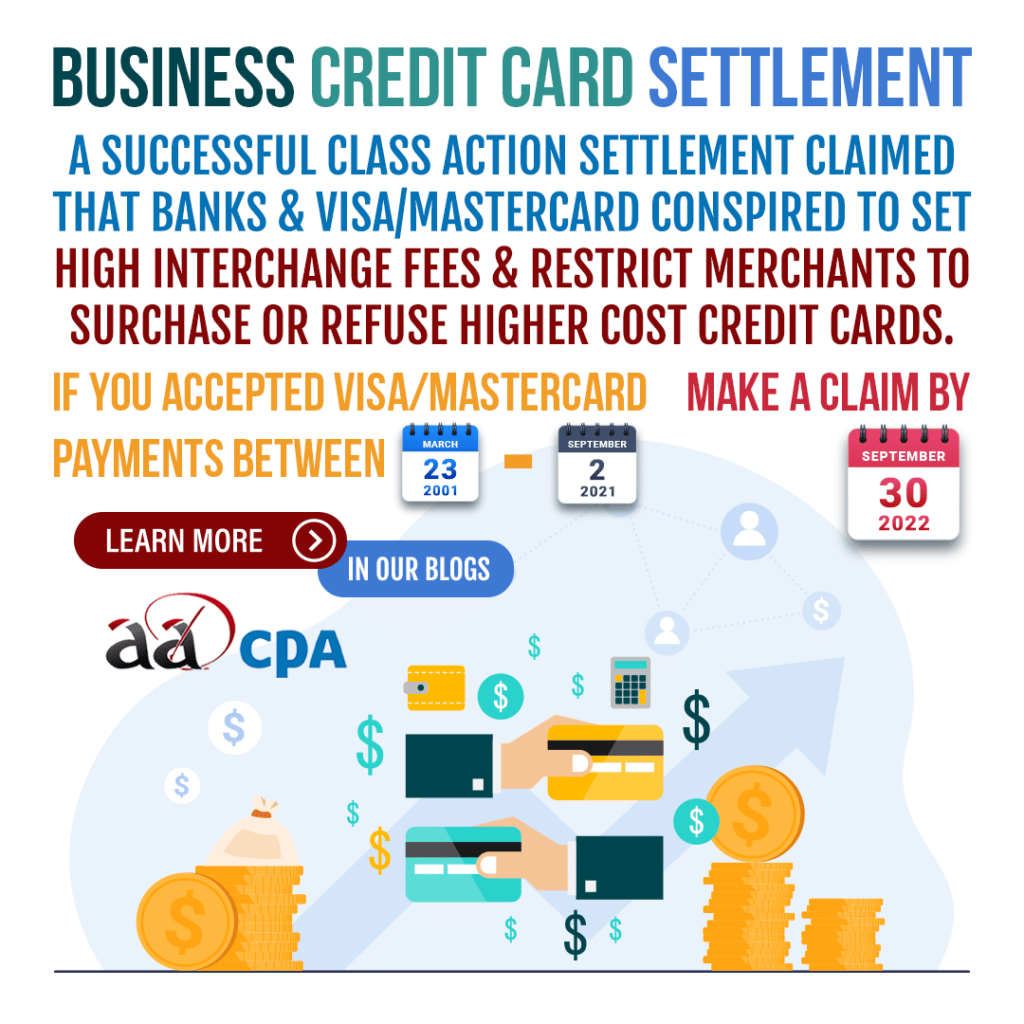

The VISA / Mastercard Class Action Settlement

In Canada, there were several class actions against a multitude of banks along with Visa and Mastercard. This credit card class action claimed that they conspired in order to set higher interchange fees and imposed rules that restricted merchants’ capacity in adding surcharges or to refuse higher cost Visa and Mastercard credit cards.

Interchange Fees

“Interchange Fees” are fees paid by merchants and collected by banks for transactions involving Visa and/or Mastercard credit cards in Canada.

Retrieved from https://creditcardsettlements.ca/

The Settlement from the Credit Card Class Action

The total settlement was $188 million Canadian dollars and made Visa and Mastercard to agree to modifying their no-surchage rules. This way, merchange can add a surchage up to a camp for the next five years minimum. Court approval has been received and $131 million Canadian dollars is ready to be distributed to class members after deductions even though the “Defendants” (Visa and Mastercard) have not admitted to any wrongdoing or liability. The settlement resolved this action and involved the following financial institutions:

- Capital One

- Citigroup

- Bank of America

- Desjardins

- National Bank

- Visa

- Mastercard

- CIBC

- Royal Bank

- Bank of Montreal

- TD Bank

- Bank of Nova Scotia

Eligibility for the Credit Card Class Action Settlement

If you accepted Visa or Mastercard payments for payments towards goods or services in Canada between March 23, 2001 and September 2, 2021, you are eligible for a part of the settlement.

Claims must be submitted before September 30, 2022 to participate. To submit a claim, click here for more information or visit the website at creditcardsettlements.ca.

Here’s How the Settlement Will Be Distributed

Small Merchants

- 40% of the settlement will be distributed for Small Merchant Settlement Class Members.

- These members collect less than $5 million Canadian dollars in average yearly revenue throughout the Class Action period.

- The claim may be undocumented but will provide $30 Canadian dollars per year of the claim period applicable.

Medium Merchants

- 10% of the settlement will be distributed for Medium Merchant Settlement Class Members.

- These members collect between $5 million and $20 million Canadian dollars in average yearly revenue throughout the Class Action period.

- The claim will be simplified but will provide $250 Canadian dollars per year of the claim period applicable.

Large Merchants

- 50% of the settlement will be distributed for Large Merchant Settlement Class Members.

- These members collect more than $20 million Canadian dollars in average yearly revenue throughout the Class Action period.

- The claim may be undocumented but will provide $250 Canadian dollars per year of the claim period applicable.

Start your claim by clicking the link below and submitting a claim for by September 30, 2022:

Start Your Canadian Credit Card Class Action Settlement Claim Here

To find out more information, check out the following link to the Credit Card Settlement website:

Click Here to Read More About the Canadian Credit Card Class Action Settlement