Unlocking Financial Benefits: The Essential Guide to Newcomer Tax Filing in Canada

Are you a recent immigrant to Canada, ready to explore new opportunities? This blog aims to provide crucial insights into Newcomer Tax Filing in Canada, making the transition to the Canadian tax system easy and stress free. The information lets you make informed decisions for maximizing tax benefits and credits while complying with Canadian tax laws.

Residency and Social Insurance Number (SIN): Building a Solid Foundation for Newcomer Tax

Whether you hold permanent residency, refugee status, or a temporary permit, determining your residency status for income tax purposes is pivotal. It is essential to distinguish between your immigration and residency status. Residency status is established based on your residential ties in Canada. Acquiring a Social Insurance Number (SIN) is a critical step in this process, serving as a confidential 9-digit identifier necessary for various purposes.

In situations where obtaining a SIN poses challenges, the Canada Revenue Agency (CRA) may issue a temporary tax number (TTN) to facilitate access to benefits, credits, tax filing, and online services.

Benefits and Credits: Financial Support for Newcomers

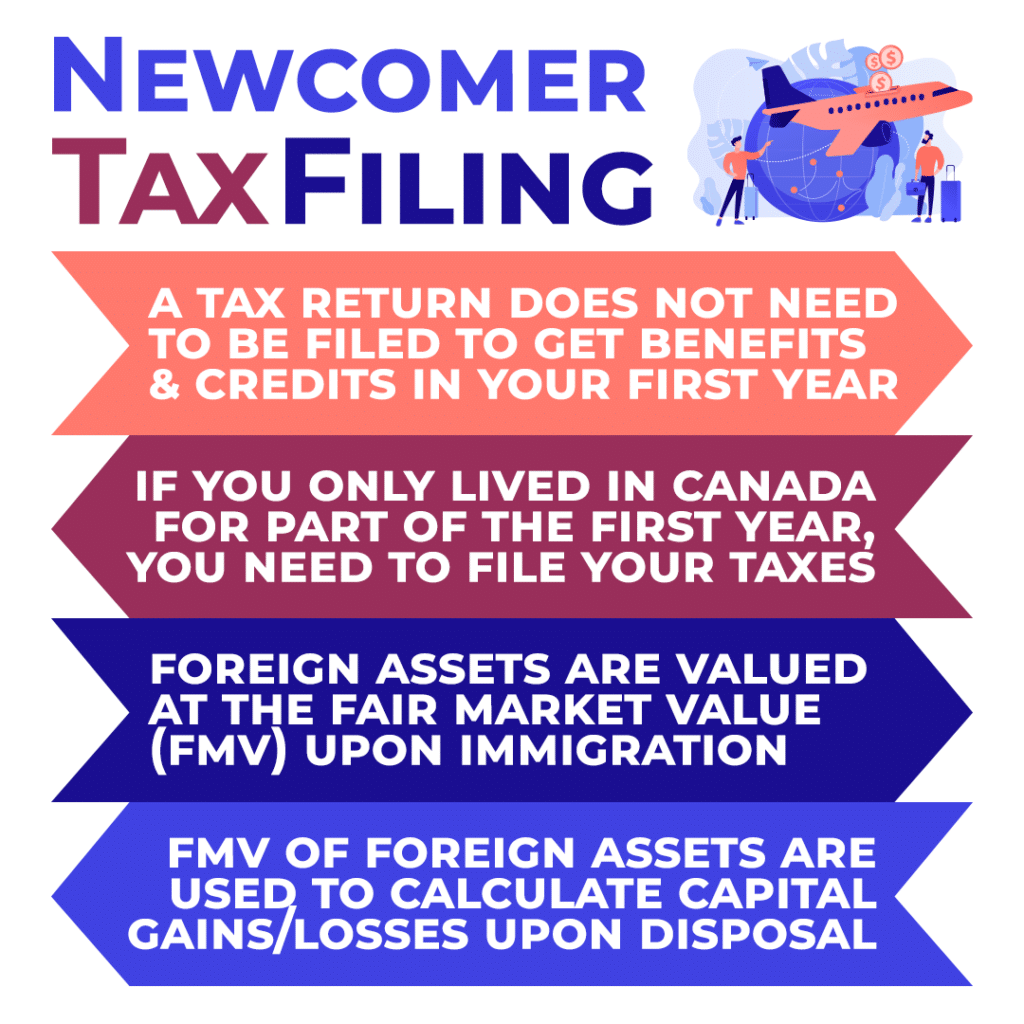

Canada provides a variety of benefits and credits designed to support newcomers financially. To qualify for these, either you or your spouse/common-law partner must be a resident for income tax purposes. Obtaining a SIN from Service Canada and applying for eligible benefits and credits allows you to start receiving payments. It is important to note that filing your first tax return is not a prerequisite for accessing these benefits and credits in your initial year in Canada.

To qualify for certain benefits and credits, temporary residents on visas must live in Canada for 18 months straight. On the 19th month, they need to have a valid permit before applying.

If you have children, fill out and sign Form RC66, Canada Child Benefits Application to apply for all child and family benefits. This includes the GST/HST credit. In the case you don’t have children, fill out and sign Form RC151. This is for the GST/HST Credit and Climate Action Incentive Payment Application for Individuals Who Become Residents of Canada.

Even if your residency is only partial for the year, filing a tax return becomes essential if tax payment or refund claims are necessary. Consistent tax return filing is crucial to maintaining eligibility for benefits and credits, regardless of your income level.

World Income Reporting: A Holistic Approach to Newcomer Tax Compliance

When filing your tax return, it is imperative to report your world income (in Canadian dollars) for the part of the year you were considered a resident of Canada. This encompasses income from all sources within and outside Canada. While certain types of income may be exempt under a tax treaty, accurate reporting remains mandatory.

For the period when you were not a resident, specific types of income earned in Canada must be reported. This includes employment income, taxable capital gains, and certain benefits. The reporting ensures adherence to Canadian tax regulations.

Deemed Disposition and Foreign Income: Key Considerations for Newcomers

If you owned properties (other than taxable Canadian properties) upon immigrating to Canada, the CRA deems it a disposition. This involves selling and immediately reacquiring the properties at fair market value. Maintaining a record of the fair market value is crucial for future calculations of gains or losses. If you dispose of the property, meaning you sell, give, or it is destroyed or stolen, the capital gain or loss is calculated based on the value at immigration. You do not need to pay Canadian taxes on these previously owned foreign properties unless they are disposed of post-immigration.

As a resident of Canada, you may receive income from your previous country or region. This subjects you to tax obligations in both locations. Exploring tax treaties and claiming a federal foreign tax credit for taxes paid in the other country or region can optimize your tax situation.

Foreign Property Reporting: Meeting Obligations with Form T1135

If you own foreign property exceeding $100,000, filing Form T1135 is mandatory. The reporting is mainly based on the cost amount, not the fair market value. In cases of acquisition through gifts, bequests, or inheritances, the fair market value at the time of receipt is used instead.

New to Canada u0026amp; Unsure on How to File Your Taxes?

Get in touch with our tax experts today and get ahead of your tax return.

Our tax experts are committed to ensuring newcomers a seamless transition into the Canadian tax system. If you have questions or need any help, feel free to reach out to our expert team. Welcome to Canada. Get personalized assistance to build your financial success together!