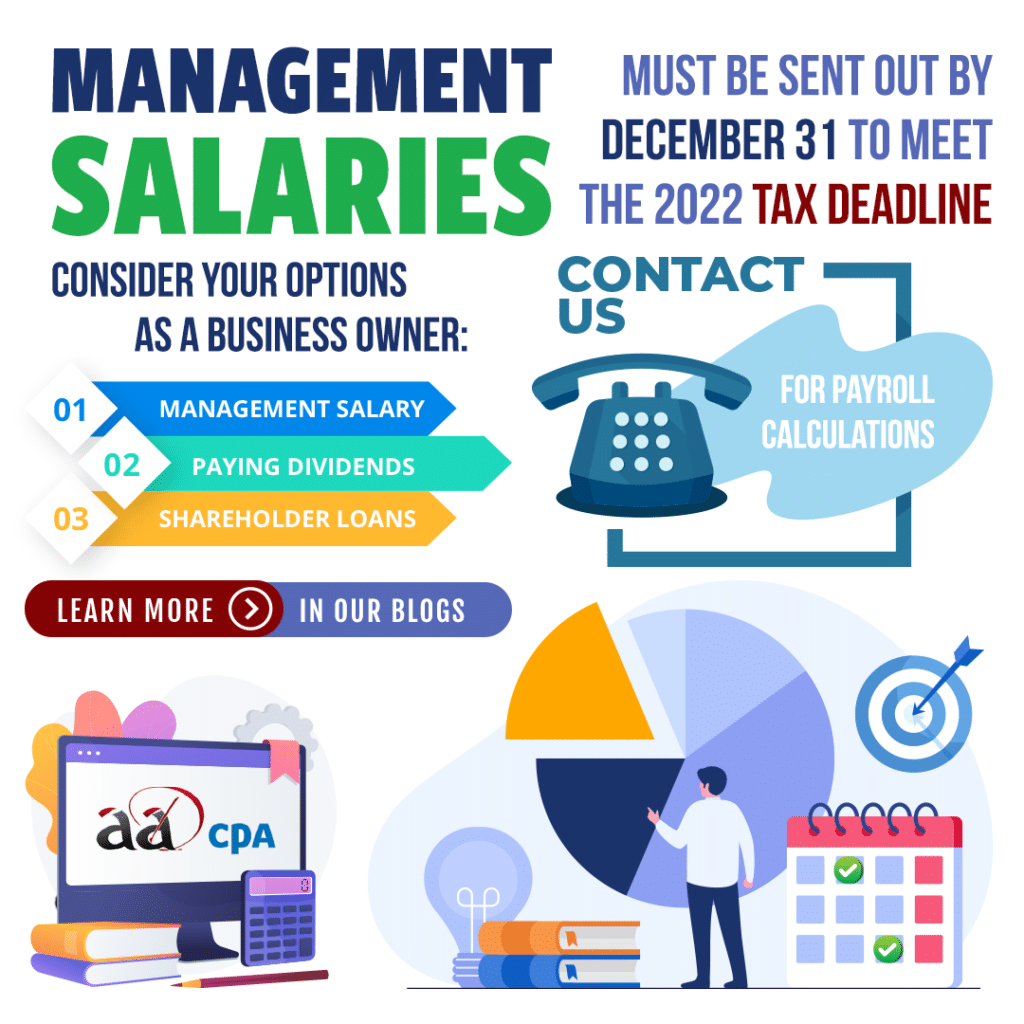

The Management Salary Deadline is Almost Here!

It’s that time of the year where business owners need to finalize how they’ll be paid and can be done in a few different ways. Management salary is one way to do so and involves paying remittance on the salary paid. The deadline for paying management salaries is December 31 and will be counted as a deduction that will reduce your corporate net income. It will be taxed on your personal tax return instead.

Advantages of Paying Yourself a Management Salary

Some benefits of using this method include:

- Paying into your CPP or the Canada Pension Plan which you will collect upon retirement.

- Some of the taxes will be already paid in advance of filing your personal tax return.

- Using an RRSP or Registered Retirement Pension Plan or a TFSA, Tax-Free Savings Account can be leveraged for investments reducing tax owed.

- Having a T4 slip makes processes for mortgages, loans, and planning for your expenses easier.

Some Disadvantages of Paying Yourself the Salary

- Personal income is 100% taxable and can increase your tax load.

- You pay two portions of CPP from your roles as an employer and employee.

- Due to the process of payroll, it will be processed through CRA.

Paying Yourself in Dividends Instead of a Management Salary

There are some benefits of paying yourself in dividends instead, and include:

- Paying dividends is a simpler process. You take cash from the company and record it as a dividend while there is no requirement to remit tax on the payment.

- These do not count as ‘earned income’ so they do not affect programs such as maternity leave. If a salary is paid to someone on maternity, it may risk their access to the maternity benefits program.

Key Aspects of Dividends to Take Note Of

Using the dividend method to assist in cash flow management while accepting the penalties and interest instead can prove to be quite costly. The Q1 2023 interest rate on late tax payments is currently 8%, and installment interest is an additional 8%. Penalties can also be charged on top of the amount making it even tougher to manage cash flow.

While it is technically simpler to just let the accountant deal with preparing your taxes after taking cash out of the company, it does lead to some consequences. Due to the strict nature of remittance and calculating withholding taxes and CPP on salaries, many business owners seek to avoid the process. With the way technology and accounting services have evolved, preparing T4 slips for employment income versus T5 slips has reduced in difficulty. Of course there are penalties for late remittance, but if you get yours in before the end of this year, it won’t be something to worry about.

Find out more about the different methods of paying yourself as a business owner by checking out these links to other articles like on FilingTaxes.ca and ConnectCPA.ca