Guide to Payroll Tax Deductions and Remittances

Any employer, including non-residents, are required to withhold amounts of the income tax liability of an employee in Canada even if they will be exempted in other forms such as tax treaties. If an employer doesn’t want to withhold the payroll tax amounts, they would have to apply for and get an income tax waiver from CRA.

Eligibility for a Payroll Program Account

If you meet any of the following criteria, you need to register for a payroll program account:

- You pay:

- Salaries or Wages

- Tips or Gratuities

- Bonuses or Vacation Pay

- Provide benefits or allowances to employees.

- You need to report, deduct, and remit amounts from other types of remuneration like pension.

If you already have a business number, you just need to add a payroll program account to it. Otherwise, if you don’t have a BN, it needs to be setup and registered for a payroll program account before the date your first remittance is due.

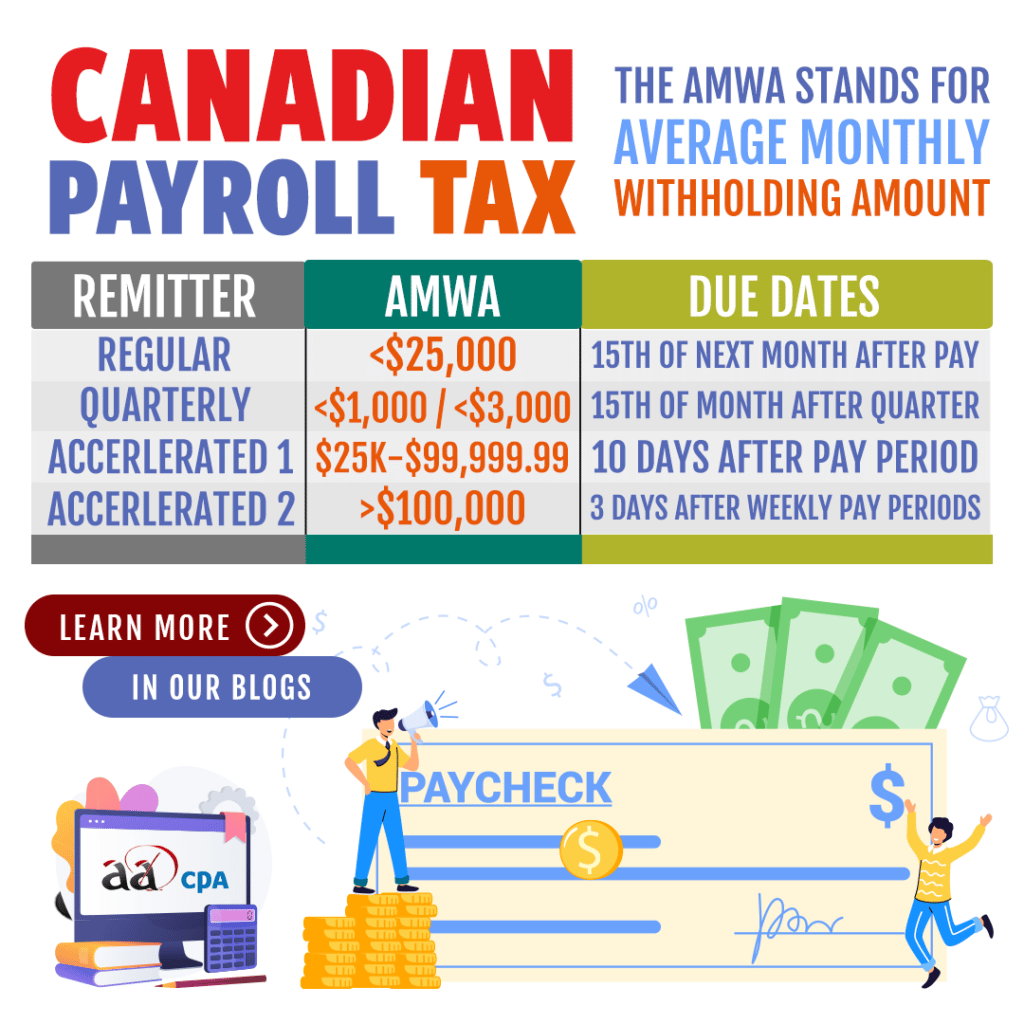

Payroll Tax Remittance Due Dates

Depending on the withholding amount for your remittance, there are different due dates assigned by the CRA to receive the payments. If the due date is on a Saturday, Sunday, or public holiday that is recognized by the Canada Revenue Agency, it is then due on the next business day.

The four types of remitters are:

- Regular Remitter

- AMWA of less than $25,000

- Quarterly Remitter

- AMWA of less than $1,000 and less than $3,000

- Accelerated Remitter Threshold 1

- AMWA of $25,000 to $99,999.99

- Accelerated Remitter Threshold 2

- AMWA of $100,000 or more

| Remitter Type | Due Dates |

| Regular Remitter | The deductions must be received on or before the 15th day of the month after the month you pay your employees. |

| Quarterly Remitter | The deductions must be received on or before the 15th day of the month following the end of each quarter. These dates are April 15, July 15, October 15, and January 15 and are based on quarters in a calendar year. |

| Accelerated Remitter Threshold 1 | The deductions for this remitter type must be received by the 25th day of the month in which payroll is completed in the first 15 days. For payroll completed from the 16th to the end of the month, remittances are due by the 10th day of the following month. |

| Accelerated Remitter Threshold 2 | The remittances must be received within three working days after the last day of the following pay periods: – 1st to the 7th day of the month – 8th to the 14th day of the month – 15th to the 21st day of the month – 22nd to the last day of the month |

Have Questions on Managing Your Payroll Tax?

Managing payroll in Canada can seem complicated, but it is important that you consult with a tax specialist when doing so. Contact us if you have any questions or visit the CRA’s guide to payroll deductions and remittances by clicking here.