Eligible Medical Expenses for Tax Returns

That time of the year is coming up again and this is the best opportunity to get ready to file your tax return. Start collecting all the proof of any medical expenses you’ve incurred that haven’t been claimed. They must be paid for in any 12-month period ending in 2022 and have not been claimed in 2021. Even if the expense didn’t incur in Canada, you can still claim it on your return.

Only the part of the expense that you or someone else have not been or will not be reimbursed for can be claimed. There is an exception to this and if the reimbursement is included in your income like as a benefit showed on your T4, and was not deducted anywhere else, it can be claimed.

Common Medical Expenses

| Medical Expense | Prescription? | Certification in Writing? | Form T2201? |

| Air Conditioner | Yes | No | No |

| Air Filter, Cleaner, or Purifier | Yes | No | No |

| Altered Auditory Feedback Devices | Yes | No | No |

| Ambulance Service | No | No | No |

| Artificial Eye or Limb | No | No | No |

| Audible Signal Devices (Bells, Horns, etc) | Yes | No | No |

| Baby Breathing Monitor | Yes | Yes | No |

| Bone Marrow Transplant | No | No | No |

| Braces for a Limb | No | No | No |

| Braille Note-Taker Devices | Yes | No | No |

| Cancer Treatment | No | No | No |

| Catheters, Catheter Trays, Tubing, etc. | No | No | No |

| Computer Peripherals | Yes | No | No |

| Crutches | No | No | No |

| Deaf-Blind Intervening Services | No | No | No |

| Dental Services | No | No | No |

| Dentures and Dental Implants | No | No | No |

| Devices or Software | Yes | No | No |

| Diapers or Disposable Briefs | No | No | No |

| Driveway Access | No | No | No |

| Electronic Speech Synthesizers | Yes | No | No |

| Furnace | Yes | No | No |

| Hearing Aids (Personal Assistive Listening Devices) | No | No | No |

| Heart Monitoring Devices | Yes | No | No |

For a full list of eligible medical expenses, see the CRA’s section on the Medical Expense Tax Credit by clicking the link here.

How to Claim Eligible Medical Expenses

You can claim medical expenses for yourself, spouse or common-law partner, and your dependant children under 18.

Eligible medical expenses that you or your spouse/common-law partner paid for if they fall under the following criteria can also be claimed:

- You, your spouse, or common-law partner’s children who were 18 years of age or older at the end of the tax year, or grandchildren.

- You, your spouse, or common-law partner’s parents, grand-parents, brothers, sisters, aunts, uncles, nieces, or nephews who were residents of Canada at any time during the tax year.

How Much Can You Claim?

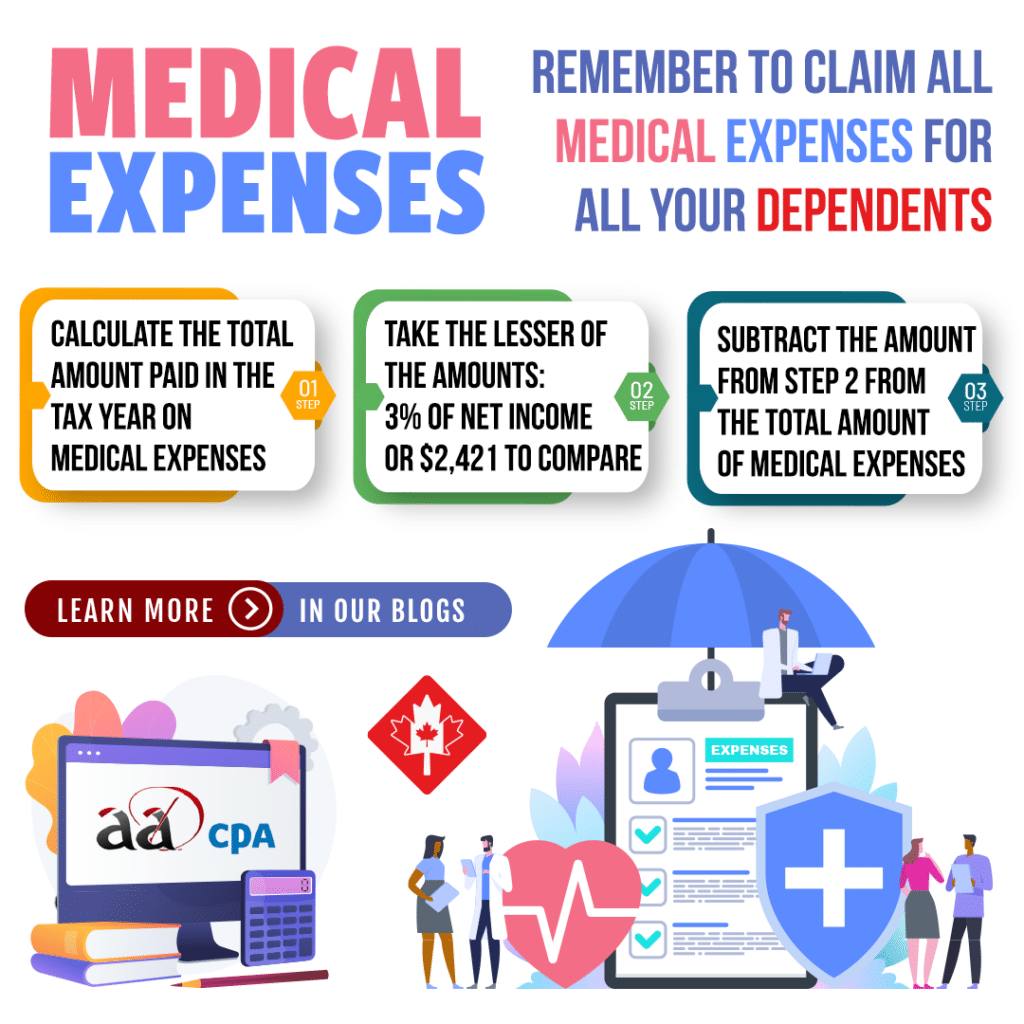

For each dependent as well as yourself, complete the following to find out how much you can claim:

- Calculate the total amount that you, your spouse, or common-law partner paid in 2021 in medical expenses.

- Take the lesser of either 3% of your net income or $2,421.

- Subtract the amount in step 2 from the amount in step one and you now have your tax credit.

This can also be claimed in the line on your provincial or territorial non-refundable tax credit form.

What Proof Do You Need for Medical Expenses?

In case the CRA asks to see proof of your medical expenses, make sure you keep the following if applicable:

- Receipts – That show the name of the company or individual to whom the expense was paid.

- Prescription – Certain medical expenses need a prescription to support the claim and can be provided by a medical practitioner.

- Certification in Writing – Some medical expenses need a certification in writing to support your claim and can be provided by a medical practitioner.

- Form T2201, Disability Tax Credit Certificate – Other medical expenses may need to have this form approved by the CRA for your claim.

For more information, visit the CRA’s guide and list of common medical expenses by clicking here.