Salary vs Dividends for Canadian Business Owners

For incorporated small business owners in Canada, deciding how to withdraw funds from the corporation has important tax and financial planning implications. Owners can choose to pay themselves through a salary, dividends, or a combination of both, each option will impact their financial strategy for personal tax liability and retirement savings.

Tax Implications for Salary vs. Dividends

While both salary and dividends serve as forms of compensation, they differ significantly in structure and tax treatment. Salary is treated as a business expense, making it deductible for the corporation and providing a more consistent basis for financial reporting purposes. In contrast, dividends are classified as investment income and are not eligible for a corporate tax deduction, resulting in different tax implications for both the company and the recipient.

What is a Salary

A salary is a regular payment your corporation provides to you as an employee in exchange for the work you perform. As a business owner, paying yourself a salary allows you to receive consistent income while also contributing to programs like the Canada Pension Plan (CPP) and qualifying for RRSP contribution room.

How to Pay Yourself a Salary

- You must register for a payroll account with the CRA.

- Deduct and remit source deductions (income tax, CPP, EI if applicable) on each pay period.

- Issue a T4 slip at year-end, showing total income and deductions.

Tax Implications for Salary Employees

- Personal Income: Your salary is taxed at the personal income rate.

- Remittance: Requires your corporation to deduct and remit CPP and income tax.

- Corporate Deductions: A salary is considered a business expense, which reduces your corporate taxable income.

- RRSP Eligibility: Access to RRSP contribution room of 18% of your earned income.

Do Dividends Count as Income?

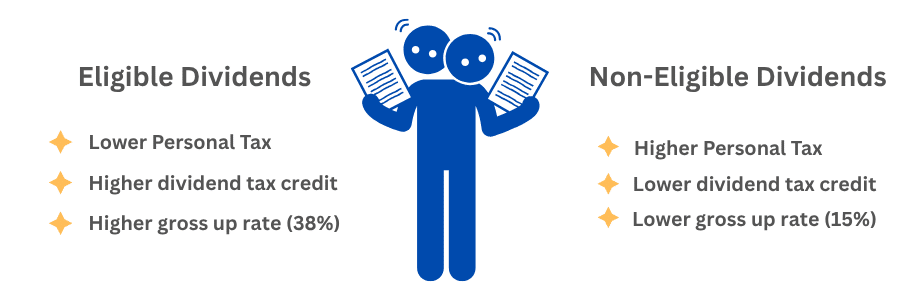

A dividend is a distribution of a corporation’s after-tax profits to its shareholders. Unlike salary, it is not considered employment income and does not create RRSP contribution room or require payroll deductions. Instead, dividends are considered investment income and are required to be reported annually on your T5 slips (Statement of Investment Income). In Canada, dividends are generally categorized into two types:

- Eligible dividends: Paid from income taxed at the general corporate tax rate.

- Non-eligible dividends: Paid from income taxed at the small business rate.

To pay yourself dividends, you’ll need:

- Because dividends are paid out after retained earnings, your business should have sufficient profits.

- A corporate resolution declaring the dividend, even if you are the only shareholder

- To issue a T5 slip to report dividend income at the end of each tax year

Advantages of Paying Yourself Dividends

- Lower Personal Tax Rate: Dividends benefit from the dividend tax credit, reducing the effective tax rate compared to salary income.

- No Payroll Deductions: Unlike salary, dividends are not subject to CPP contributions, EI premiums, or other payroll withholdings.

- Flexible Payment: Dividends can be issued at the discretion of the business, offering flexibility based on corporate profits and cash flow.

- Simplified Administration: Paying dividends avoids payroll-related paperwork, such as remittances and T4 slips (though T5 slips are still required).

- Retained Corporate Savings: By avoiding salary deductions, businesses can retain more cash flow internally, which can be used for reinvestment or operations.

How to Report Dividends on a Tax Return

As a shareholder receiving dividends, you must report them on your T1 tax return:

- All dividends are grossed up by a certain percentage (15% for non-eligible and 38% for eligible dividends).

- You receive a dividend tax credit to offset the double taxation.

- Report dividend income on Line 12000 (taxable amount) and Line 12100 (actual amount received).

- A T5 slip must be issued by the corporation and included with your tax return.

Because of the gross-up and tax credit mechanism, dividend income often results in lower personal taxes, but the savings depend on your total income level and other deductions.

The Dividend Trap

While dividends can offer short-term tax savings, relying solely on them can create long-term issues:

- No CPP Contributions: You may miss out on future Canada Pension Plan benefits, especially if you don’t invest the savings elsewhere.

- No RRSP Room: Dividends don’t generate RRSP room, limiting future tax-sheltered investing.

- Income Volatility: Irregular payments may make it harder to qualify for credit, obtain a mortgage, or manage personal finances.

- Higher Taxes for Low Income: If your income is very low, a salary may offer a refund or credit that dividends cannot..

The Benefits of Blended Compensation

A combined compensation approach, using both salary and dividends, offers a strategic balance between tax efficiency and financial planning flexibility.

From a tax standpoint, salaries are deductible for the corporation, lowering its taxable income and helping the business save on corporate taxes. They also build RRSP contribution room and ensure contributions to programs like the Canada Pension Plan (CPP), offering a long-term benefit for retirement planning.

Dividends, on the other hand, are taxed more favourably at the personal level due to the dividend tax credit. While they aren’t deductible to the corporation and don’t generate RRSP room or CPP contributions, they can still help reduce overall tax burdens when used strategically.

From a financial planning perspective, a blended model provides predictability and adaptability. Salary offers a steady income stream ideal for personal budgeting and loan qualification, while dividends provide flexibility by being adjustable based on the company’s profitability. This dual approach allows business owners to maintain stability while also leveraging tax planning opportunities that support their broader financial goals.

Conclusion

While choosing between salary and dividends isn’t a one-size-fits-all decision. A careful consideration of your income goals, tax planning strategy, retirement savings, and eligibility for loans will impact your business cash flow and tax liability. Often, a mix provides a flexible and tax-efficient solution that balances the pros and cons of salary and dividend compensation. To get personalized advice tailored to your business and financial goals, consult with a CPA today.