How the Canadian Luxury Items Tax Affects You

There is a new tax called the Luxury Items Tax that came into effect on September 1, 2022. This luxury tax applies to the sale or import of certain vehicles, aircraft, and vessels. Vehicles and aircraft priced or valued over $100,000 along with vessels over $250,000 will incur the tax.

Vehicles That Are Subject to the Luxury Items Tax

If a motor vehicle is priced or valued at more than $100,000 and meets the criteria listed below, the luxury items tax will be applied on its sale or import.

- The vehicle is designed or adapted to carry people on highways and streets.

- It’s seating capacity is not more than 10.

- The gross vehicle weight rating is 3,856 kg or less.

- It’s manufacturing date is after 2018.

- The motor vehicle is designed to travel with four or more wheels in contact with the ground.

Basically, this includes sedans, coupes, hatchbacks, convertibles, SUV’s, and light-duty pickup trucks.

Exclusions to the Definition of a Subject Vehicle

Here is the list of motor vehicles that are not subject to the luxury tax:

Recreational vehicles designed or adapted to provide temporary residential accomodations and have at least four of the following features:

- Cooking Facilities

- Refrigerator or Ice Box

- Self-Contained Toilet

- Heating/AC that Functions Independently from the Engine

- Potable Water Supply System Including a Faucet and a Sink

- 110-V to 125-V Electric Power Supply or Liquified Petroleum Gas Supply that Functions Independently from the Engine

Other exempted vehicles:

- Ambulances

- Hearses

- Motor Vehicles Marked for Policing Activities

- Motor Vehicles Marked & Equipped for Emergency Medical or Fire Response Activities

- Motor Vehicles Registered with a Government Before September 2022

How to Calculate the Tax Amount

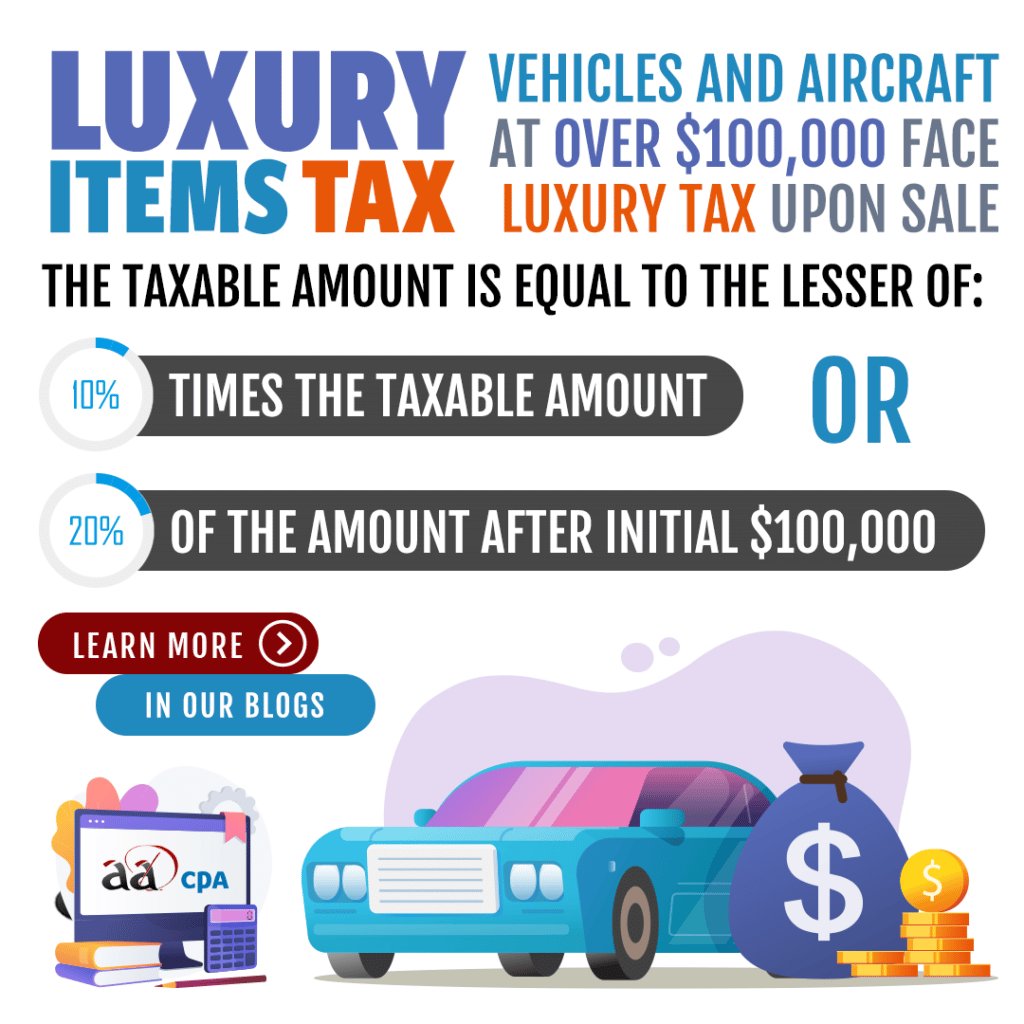

To calculate the amount of luxury tax owed on a purchase or import, the taxable amount of the purchase is used. The amount owed is equal to the lesser of 10% of the taxable amount or 20% of the amount above the price threshold. Here are the two calculations needed and only the lower result is used to calculate the luxury tax:

- Multiply the taxable amount by 10%.

- Subtract $100,000 from the taxable amount and multiply the difference by 20%.

Keep in mind that this applies to certain motor vehicle leases as well.

To find out more information, please visit the CRA’s website and their information section on the Select Luxury Items Tax Act. Primarily, it will go into further details about subject (motor) vehicles and how the tax is applied. Click here to visit the page.