Disability Tax Credit and Your Income Tax Return

The disability tax credit reduces income tax for people with physical or mental impairments. Alternatively, it can also be used by their supporting family members to reduce what they may have to pay in income tax to reduce costs related to the impairment. Keep in mind that if the disability tax credit, or the DTC, is more than what is owed on the tax return, none of the remaining credit will be refunded by the CRA.

Getting the Disability Tax Credit

1. Applying for the DTC

To apply for the disability tax credit, the impaired and a medical practitioner need to certify the effects of the impairment.

2. Claiming the DTC on Your Tax Return

Once the application for the DTC is approved, then the disability amount can be claimed on a tax return.

Applying for the Disability Tax Credit

The impaired needs to have a medical practitioner to certify the effects of the impairment in order to apply for the disability tax credit. Refer to the list below to find which medical practitioner can certify unique impairments.

| Medical Practitioner | Impairment |

| Medical Doctor | All Impairments |

| Nurse Practitioner | All Impairments |

| Optometrist | Vision |

| Audiologist | Hearing |

| Occupational Therapist | Walking, Feeding, Dressing |

| Physiotherapist | Walking |

| Psychologist | Mental Functions |

| Speech-Language Pathologist | Speaking |

An application can be completed via a digital or paper form. Each method includes a section for the medical practitioner and the impaired individual. This form is to be submitted to the CRA to begin the review of the application. The individual is then mailed a notice of determination within 8 weeks of receiving it. It can take longer if information is missing.

Claiming the Disability Tax Credit

Either the individual with the impairment can claim the DTC or it can be transferred. The full amount does not need to be transferred, rather just what is remaining. This can be to a supporting family member that was identified in the application for the disability tax credit. If they were not added into the initial application, a request to the CRA must be made. The request will be signed and includes details of the support the family member provides for the basic necessities of life to the impaired.

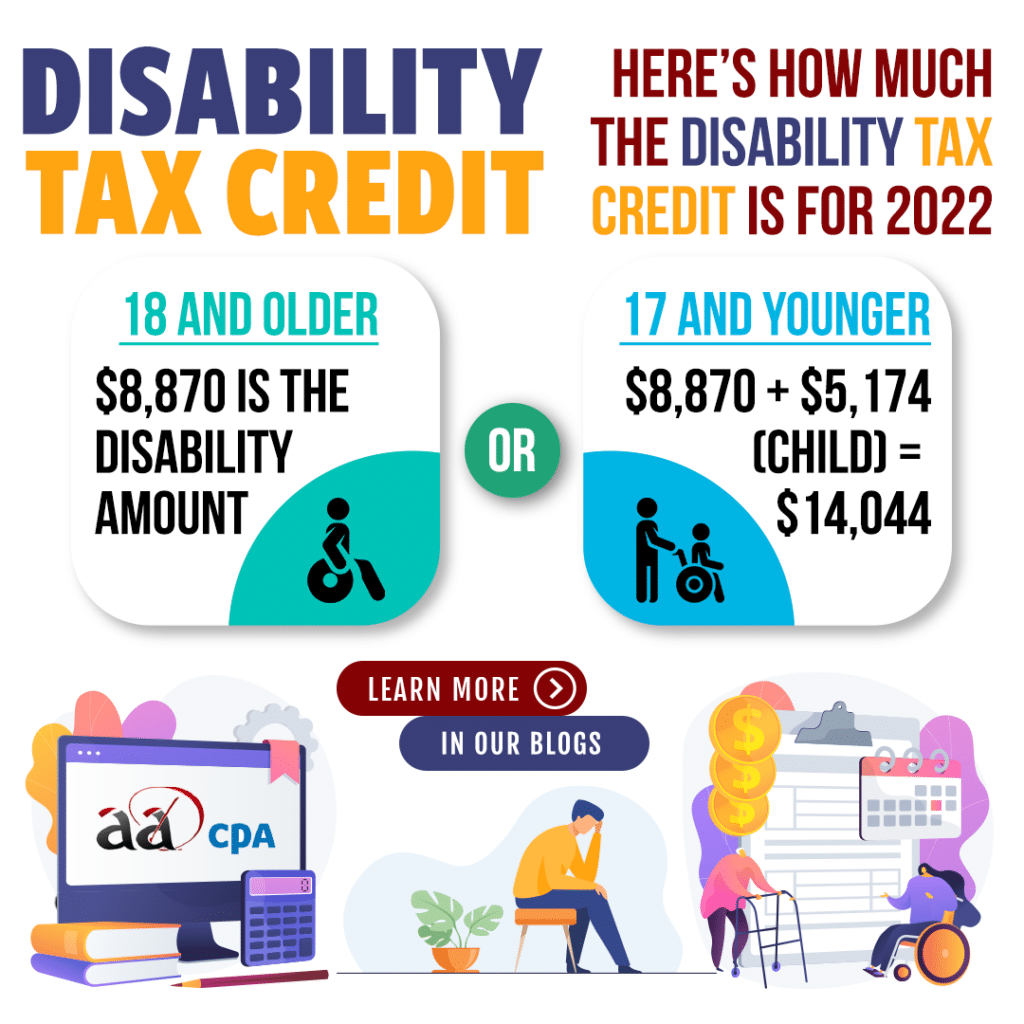

If the impaired individual is 18 or older on the last day of the year, the base disability amount can be claimed. For those 17 and younger on the last day of the year, there is an additional supplement for children.

Disability Amounts for the 2022 Tax Year

- 18 and Older

- $8,870 is the full disability amount.

- 17 and Younger

- $8,870 is the disability amount.

- Plus $5,174 supplement for children.

- Total is $14,044.

Keep in mind that if you were eligible for the DTC in past years but did not claim it, you still can. An impaired individual can claim the disability tax credit going back up to 10 years. They can either ask the CRA in writing to adjust them or work with an accountant to do it themselves. Find out more info by visiting the CRA’s section on the disability tax credit by clicking here.