Tax Return Filing Deadlines for Your 2022 Return

It’s that time of the year again and that means gathering all your documents, receipts, and information for your tax filing. This guide will go over some important tax return filing deadlines you need to know for this year. It is important to file your return early or at least before the due date. This way, you can avoid being charged interest and penalties along with disruptions to your benefit and credit payments.

Some benefit and credit payments that can be affected by late or not filing include:

- GST/HST credit which includes any related provincial or territorial credits

- Canada Child Benefit (CCB) which also includes related provincial or territorial payments

- Old Age Security (OAS) benefits

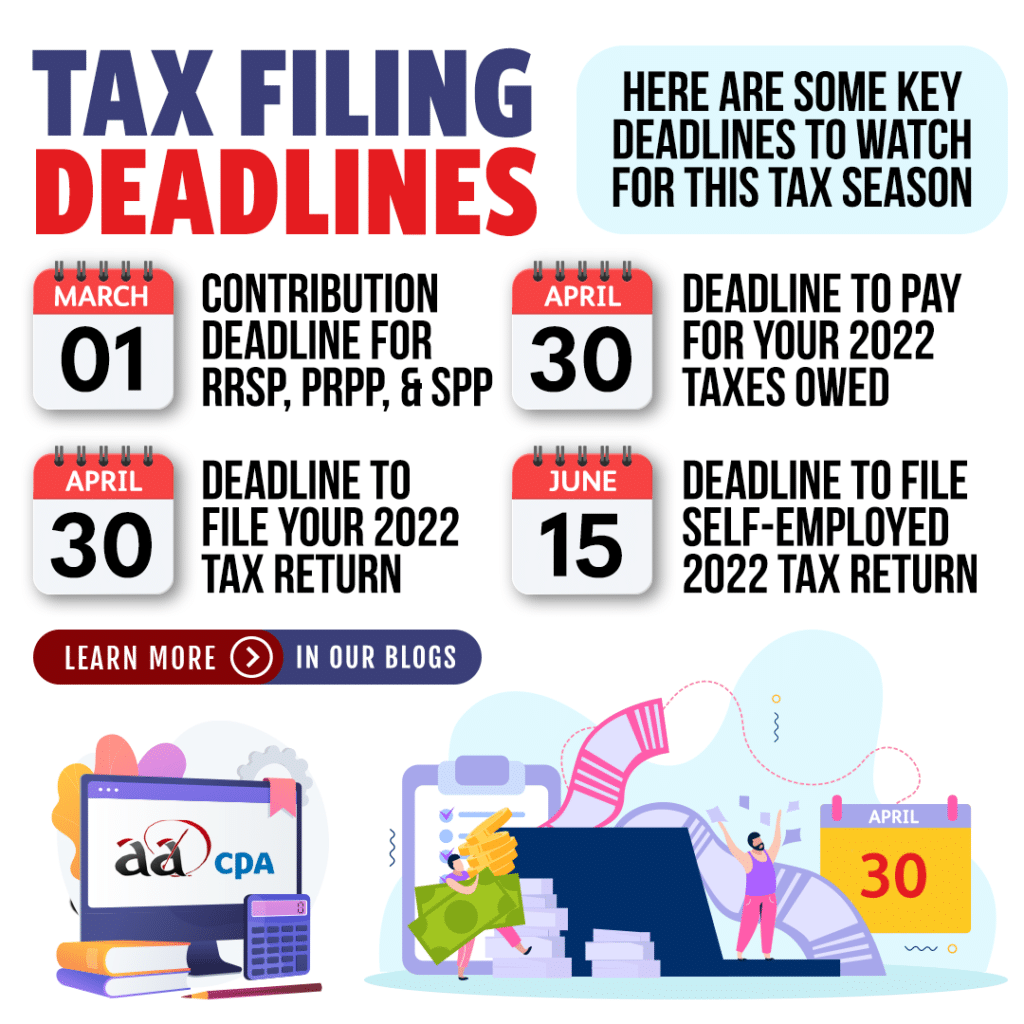

Key Tax Return Filing Deadlines

Here are some tax return filing deadlines that you should keep in mind:

| Date | Deadline |

| March 1, 2023 | RRSP, PRPP, & SPP contribution deadline. |

| April 30, 2023 | Deadline to pay your taxes if any amounts are owed for 2022. |

| April 30, 2023 | Deadline to file your personal tax return. |

| June 15, 2023 | The self-employed tax return filing deadline. |

*If a due date is on a Saturday, Sunday, or public holiday that is recognized by the CRA, the return or payment is on time if the CRA receives it or it is postmarked on or before the next business day.

For tax shelter investments, the tax return filing deadline is on April 30, 2023 instead of June 15, 2023.

Getting Prepared for the Tax Return Filing Deadlines

To get ready for your 2022 tax return filing, start gathering your documents that relate to any income you’ve earned and those relating to deductions you can claim. Consider how you want to file your return, whether it will be digital or paper.

Income to report includes COVID-19 benefits, self-employment income, foreign investment income, income from assets, or other earnings. Income from assets includes rental income but if you have any other business income coming in to your person, they should be identified on your report as well.

Some key documents regarding deductions include RRSP, PRPP, and RPP deductions. On top of that, documents regarding pension adjustments, annual union or professional dues, child care expenses, employment expenses, capital gains, disability tax credit amounts, student loan interest, tuition, education, and textbook amounts. The CRA has a full list of any deductions, credits or specific documents you may need here.

Tax slips are also key for filing your tax return and will be mailed or emailed to you. They can also be found online through your My CRA account. Here are some of the more common tax slips you may receive:

T4 Slips

- T4 – Statement of Remuneration Paid

- T4A – Statement of Pension, Retirement, Annuity, and Other Income

- T4A(OAS) – Statement of Old Age Security

- T4A(P) – Statement of Canada Pension Plan Benefits

- T4E – Statement of Income from an Registered Retirement Income Fund

- T4RIF – Statement of Income from a Registered Retirement Income Fund

- T4RSP – Statement of RRSP Income

T5 Slips

- T5 – Statement of Investment Income

- T5007 – Statement of Benefits

- T5008 – Statement of Securities Transactions

- T5013 – Statement of Partnership Income

- T5018 – Statement of Contract Payments

Other Tax Slips

- T3 Statement of Trust Income Allocations and Designations

- T2202 Tuition Enrolment Certificate

- T1204 – Government Services Contract Payments

- RC62 – Universal Child Care Benefit Statement

- RC210 – Working Income Tax Benefit Advance Payments Statement

- RRSP Contribution Receipt

- PRPP Contribution Receipt

Get started on filing your tax return with us by contacting us or visiting our office in Richmond, BC. Use the buttons below to call us, get in touch through email by filling out a simple form, or drop in to our tax office in Richmond, British Columbia.