Bookkeeping Tips for a Small Business in 2023

Bookkeeping refers to recording financial transactions and is a vital part of the accounting process for any organization. Preparing source documents for transactions, operations, and other events involving finances are all part of it. Transactions could include purchases, sales, receipts, and payments made by the business or organization.

A bookkeeper is the person or third-party responsible for performing bookkeeping functions. They document every record of sales, purchases, receipts, and payments. The documentation of each financial transaction is then classified by the payment method, cash, credit, or cheque and then into its appropriate ledger. Some common ledgers used by businesses include petty cash, suppliers, customer, and general ledgers.

Accountants take the information recorded by bookkeepers to create financial reports and conduct further analysis. The bookkeeper gets the business’ books ready for a trial balance, but the accountant puts together the income statement and balance sheet.

The Two Main Bookkeeping Systems

With single-entry bookkeeping, the main record is the cash book which is also known as the cheque account or current account. All entries are allocated through different categories of income and expense accounts. Seperate records are created for petty cash, accounts payable, and accounts receivable. Other important transactions can include inventory and travel expenses. Most modern bookkeeping softwares take care of single-entry bookkeeping to save time and avoid miscalculations.

The double-entry system involves having every transaction or event changing at least two different nominal ledger accounts. Ledgers are a permanent summary of all amounts entered in supporting journals, listing individual transaction by date. They show the balances of the accounts in chronological order through daily recording of financial transactions. This information is used by the balance sheet and income statement. The primary uses of ledgers include the sales ledger for accounts receivable and the purchase ledger for accounts payable.

What is a CPA’s Role in this Process?

Chartered Public Accountants or CPAs are responsible for supervising the controls and systems for bookkeeping, minimizing errors in the many financial transactions being recorded in a business or organization.

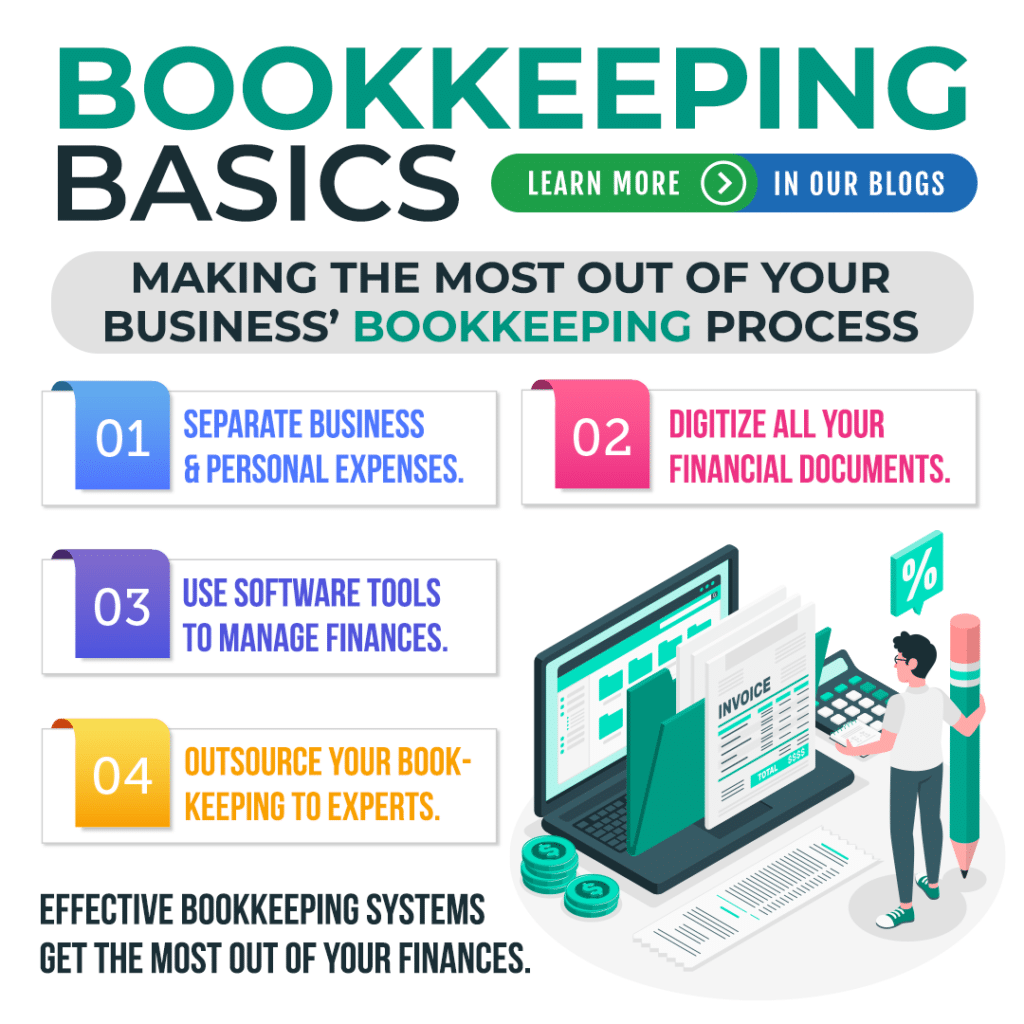

Tips and Tricks for Effective Bookkeeping Systems

When working with your finances, it is vital that the records are kept accurately and effectively. Data entry may seem tedious, but it is key to creating an accurate financial overview of a business and what is a business but it’s finances.

Some basic bookkeeping tips for a small business include:

- Separating personal and business finances.

- Digitizing all your financial documents.

- Using bookkeeping and accounting softwares and tools.

- Working with professionals to make sure your bookkeeping is on point.

With the amount of financial transactions any business owner goes through, it’s clear that it’ll take time to keep the business’ bookkeeping system on track. Assigning transactions to the right accounts, scanning all relevant documents and uploading them to the right places, and managing the softwares and tools needed is a lot to deal with. Your time is better used at running your business and a professional accounting firm is there to make sure you have an accurate picture of your finances.

Having a clear financial picture of your business helps you save on taxes and make better decisions. Contact us today to help you get your bookkeeping streamlined and make the most out of your money.