Optimizing Business Cash Flow Management: A Vital Aspect for Canadian Business Owners

In the contemporary business landscape, Canadian entrepreneurs encounter numerous challenges. From grappling with tax regulations to maintaining financial records, managing a company’s fiscal well-being is a multifaceted endeavor. Within this intricate mosaic, one piece stands out – “business cash flow management.” As a prominent CPA accounting firm based in Canada, providing a comprehensive array of services, we recognize the pivotal importance of efficient cash flow management for businesses. In this article, we will explore the significance of cash flow management, the techniques involved, and how our services can bolster your company’s efforts in this regard.

Why Cash Flow Management is Essential

Efficient cash flow management stands as the life force of any business, with relevance to Canadian enterprises. It involves the vigilant scrutiny, assessment, and enhancement of the funds entering and exiting your organization. Here’s why it holds immense significance:

Safeguarding Business Continuity: A steady and robust cash flow ensures you have the financial wherewithal to meet your financial obligations. This includes bills, payroll, and supplier payments. This is vital for business continuity.

Informed Decision-Making: By closely monitoring your cash flow, you can make informed decisions regarding investments, expansion plans, and cost-efficiency measures.

Meeting Financial Obligations: Effective cash flow management enables your business to meet its tax obligations and maintain compliance with Canadian tax regulations.

Cash Flow in Project Management: In project management, understanding and controlling cash flow is indispensable. It is used for resource allocation, cost management, and avoiding budget overruns.

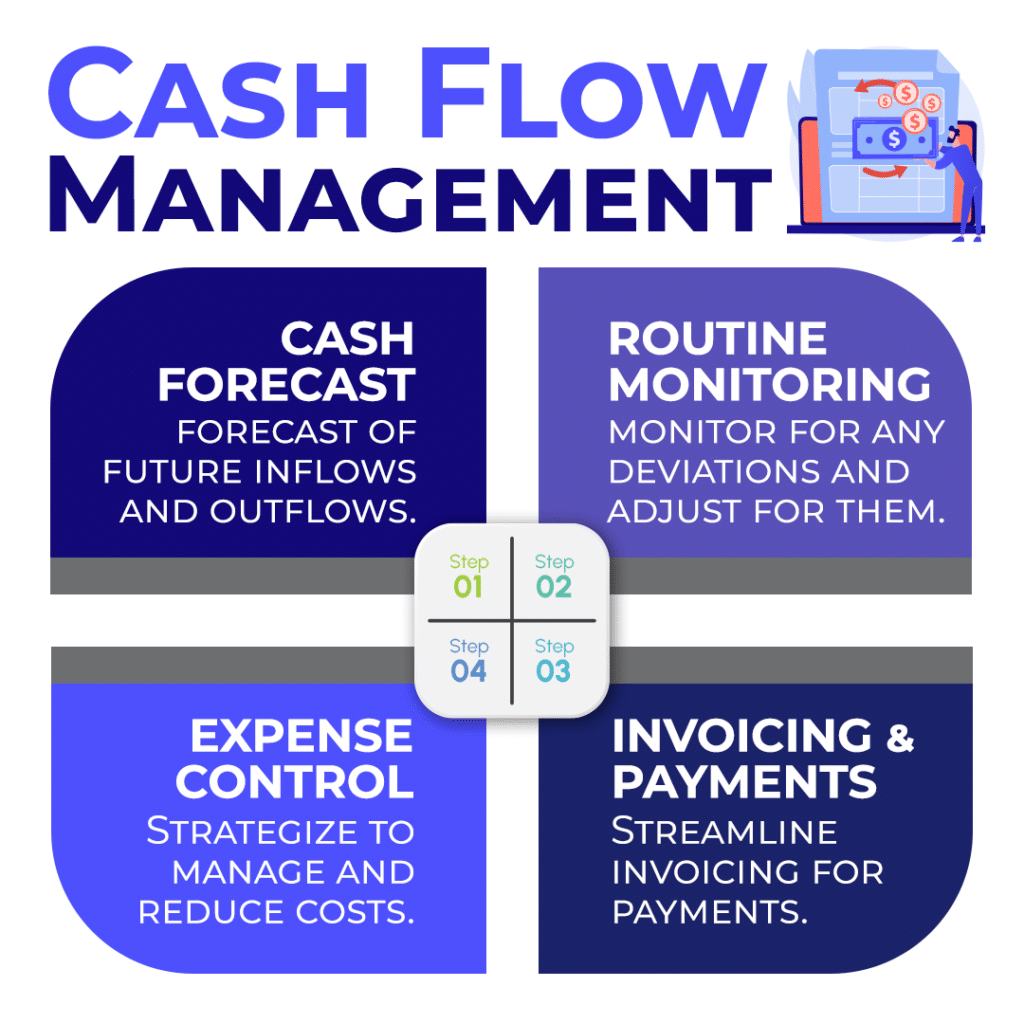

Implementing a Cash Flow Management System

To excel in cash flow management, a well-structured system is imperative. Key components include:

- Detailed Cash Flow Forecast: Develop a comprehensive cash flow forecast that anticipates future inflows and outflows. This aids in identifying potential shortfalls and surpluses.

- Routine Monitoring: Consistently monitor your cash flow to detect any deviations from your forecast, enabling prompt adjustments and proactive risk mitigation.

- Expense Control: Employ strategies to manage and reduce expenses, which may entail renegotiating supplier contracts, optimizing inventory levels, and trimming unnecessary costs.

- Effective Invoicing and Payment Collection: Streamline your invoicing process and ensure the timely collection of payments to bolster your cash inflow.

Techniques for Company Cash Flow Management

Effective cash flow management encompasses various techniques, such as:

Cash Reserves: Maintain cash reserves for unforeseen emergencies, ensuring your business can weather unexpected challenges without disruptions.

Debt Management: Optimize your debt structure and interest rates to minimize interest expenses and improve cash flow.

Inventory Management: Keep inventory levels lean to avoid tying up excessive funds in unsold products.

Cash Flow Risk Management: Identify potential cash flow risks and establish contingency plans to mitigate their impact.

Services to Help Manage Your Cash Flow

At Advanced Tax, we comprehend that proficient cash flow management is indispensable for your business’s prosperity. Our team of dedicated professionals offers a gamut of services to bolster your company’s efforts in this domain. Here’s how we can provide support:

- Cash Flow Analysis: We furnish in-depth cash flow analysis, pinpointing areas for improvement and potential risks.

- Tax Optimization: Our tax experts assist you in navigating the intricate Canadian tax landscape, ensuring compliance with obligations while minimizing your tax burden.

- Bookkeeping and Accounting: Our comprehensive bookkeeping and accounting services ensure your financial records remain accurate and up to date.

- Financial Consulting: We extend financial consulting services to guide your strategic decisions, positively impacting your cash flow and overall business performance.

In conclusion, mastering the art of business cash flow management is a pivotal element in the success of your Canadian enterprise. Armed with the right cash flow management system, techniques, and professional services, you can navigate the intricacies of cash flow. This lets you concentrate on your core operations. Advanced Tax is here to support you at every juncture, ensuring the robustness and resilience of your financial health.

If you’re prepared to elevate your company’s cash flow management, please do not hesitate to contact us today for personalized and expert assistance.