Harnessing Canadian Clean Energy Tax Benefits for Your Business

Environmental sustainability is a growing concern globally, and Canadian business owners are not exempt from it. The Canadian government has implemented different tax credits to push the country towards its net-zero emissions goal, including the Clean Energy Tax Credit. Additionally, recent updates in Budget 2023 have introduced several measures to bolster green innovation and job creation. As a respected CPA accounting firm, we’re here to help you make the most of these tax credits, both existing and new, while enhancing your financial outlook and contributing to a cleaner future.

Clean Energy Tax Credits in Canada

Clean Energy Tax Credit

The Clean Energy Tax Credit in Canada is there to incentivize businesses in reducing their carbon footprint. It involves substantial clean energy initiatives that range from clean technology investments and carbon capture to clean electricity, hydrogen, and more. Taking advantage of this credit can reduce your tax liability. It also assists your business in moving towards potential environmental sustainability goals (ESGs).

Budget 2023: New Tax Credit Updates

Budget 2023 brings promising news for businesses aiming to bolster sustainability and clean energy initiatives. The Honourable Steven Guilbeault, Minister of Environment and Climate Change, highlighted the introduction of the “big five Clean Investment Tax Credits.” These credits are intended to ignite green innovation and job growth, propelling the development of a sustainable, made-in-Canada clean economy. Let’s explore these new tax credits:

Clean Electricity Investment Tax Credit

Budget 2023 introduces a 15 percent refundable Clean Electricity Investment Tax Credit. It supports eligible investments in technologies essential for clean electricity generation, storage, and transmission across provinces and territories. This credit is available to both taxable and tax-exempt entities, broadening its accessibility.

Clean Technology Manufacturing Tax Credit

Another significant addition is the refundable Clean Technology Manufacturing Tax Credit. It covers 30 percent of the costs related to new machinery and equipment used for the manufacturing and processing of clean technologies. It also applies to the extraction, processing, or recycling of critical minerals.

Clean Hydrogen Investment Tax Credit

Budget 2023 extends support for the Clean Hydrogen Investment Tax Credit, initially introduced in the 2022 Fall Economic Statement. This credit now offers assistance that ranges from 15 to 40 percent of eligible project costs for producing clean hydrogen domestically.

Carbon Capture, Utilization, and Storage Investment Tax Credit

The budget also expands the Carbon Capture, Utilization, and Storage Investment Tax Credit to encompass a wider range of equipment. Any equipment used for capturing and storing carbon dioxide emissions or employing them in industrial processes is now included.

Clean Technology Investment Tax Credit Expansion

The eligibility for the refundable Clean Technology Investment Tax Credit has been expanded. It now encompasses geothermal energy systems, further nurturing Canada’s clean technology sector.

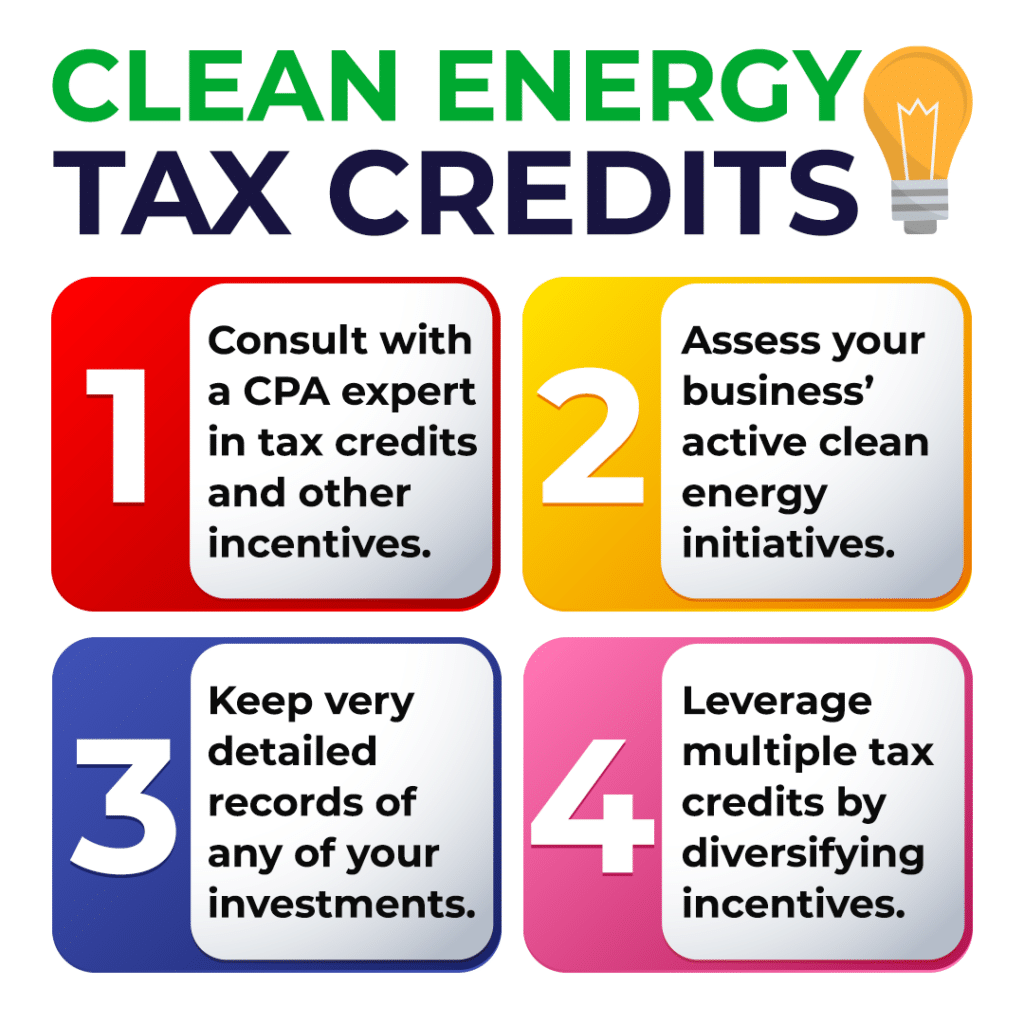

Maximizing Your Clean Energy Tax Benefits

To ensure you maximize the benefits of these clean energy tax credits, it’s crucial to comprehend the eligibility criteria and specific requirements for each credit. Here are some key steps to consider:

1. Consult with a Professional:

Collaborating with a CPA firm experienced in clean energy tax credits, including the new Budget 2023 credits. This can provide invaluable insights into the tax code’s intricacies, help you identify eligible projects, and optimize available incentives.

2. Assess Your Clean Energy Initiatives:

Identify the clean energy initiatives that align with your business objectives, considering the new Budget 2023 credits. Whether you’re investing in solar panels, clean hydrogen production, CCUS projects, or any other clean technology, ensure your projects meet the eligibility criteria for the credits you’re pursuing.

3. Keep Detailed Records:

Maintaining meticulous records of your clean energy investments, including those supported by the new Budget 2023 credits, is crucial. Proper documentation is vital when claiming tax credits. Be sure to keep records of expenses, project timelines, and supporting documents.

4. Leverage Multiple Credits:

Diversifying your approach and combining various incentives, such as the Clean Energy Tax Credit, Renewable Energy Tax Credit, and the new Budget 2023 credits, can significantly enhance your potential savings.

Budget 2023’s Impact on Clean Energy

In addition to the new tax credits, Budget 2023 allocates billion to the Canada Infrastructure Bank to support major clean-electricity and clean-growth infrastructure projects. The investments that the budget brings forward are needed to expand and improve the clean electricity grid. It contains an additional $3 billion committed to the Smart Renewables and Electrification Pathways Program along with the Smart Grid program. These initiatives are here to support further advancement in innovation of the electricity grid.

These strategic investments in abundant and cost-effective clean electricity lay the foundation for other initiatives, which are expected to create thousands of middle-class jobs, power the Canadian economy, and make energy more affordable for millions of Canadian households.

What Do Clean Energy Tax Credits Mean for Your Business?

In the ever-evolving realm of clean energy tax credits in Canada, business owners have a unique opportunity to lead the way in adopting sustainable practices and promoting green innovation. By working with a reputable CPA accounting firm like ours, you can confidently explore the opportunities presented by the Clean Energy Tax Credit, the new Budget 2023 tax credits, and other related incentives.

Remember, these credits are not just about reducing your tax burden. They’re meant to build a cleaner and brighter future for all Canadians. If you have questions or need assistance in learning how to take advantage of any clean energy incentives, don’t hesitate to reach out to us—your trusted tax experts. Let’s collaborate to harness the full potential of clean energy tax credits in Canada.

By strategically incorporating these tax credits into your business plans, you can make a significant impact on your business’s sustainability and contribute to a cleaner, more prosperous future for all.