Breaking Down Canada’s Tax Brackets

When going through tax planning for the year, it is important to understand Canada’s Tax Brackets so you are able to budget accurately. Keep in mind that your income tax considers income from all sources that are taxable.

Once you know what your total income is, it is time to reference how much you will pay in income taxes. This is done by verifying the tax bracket you fall into federally and provincially. In Canada, we have a graduated income tax system which means that people with a lower income pay a lower tax rate than those with a higher income.

Your taxable income is the total income you earn minus allowable deductions and exemptions such as education and medical. For self-employed individuals, expenses reduce your taxable income as well.

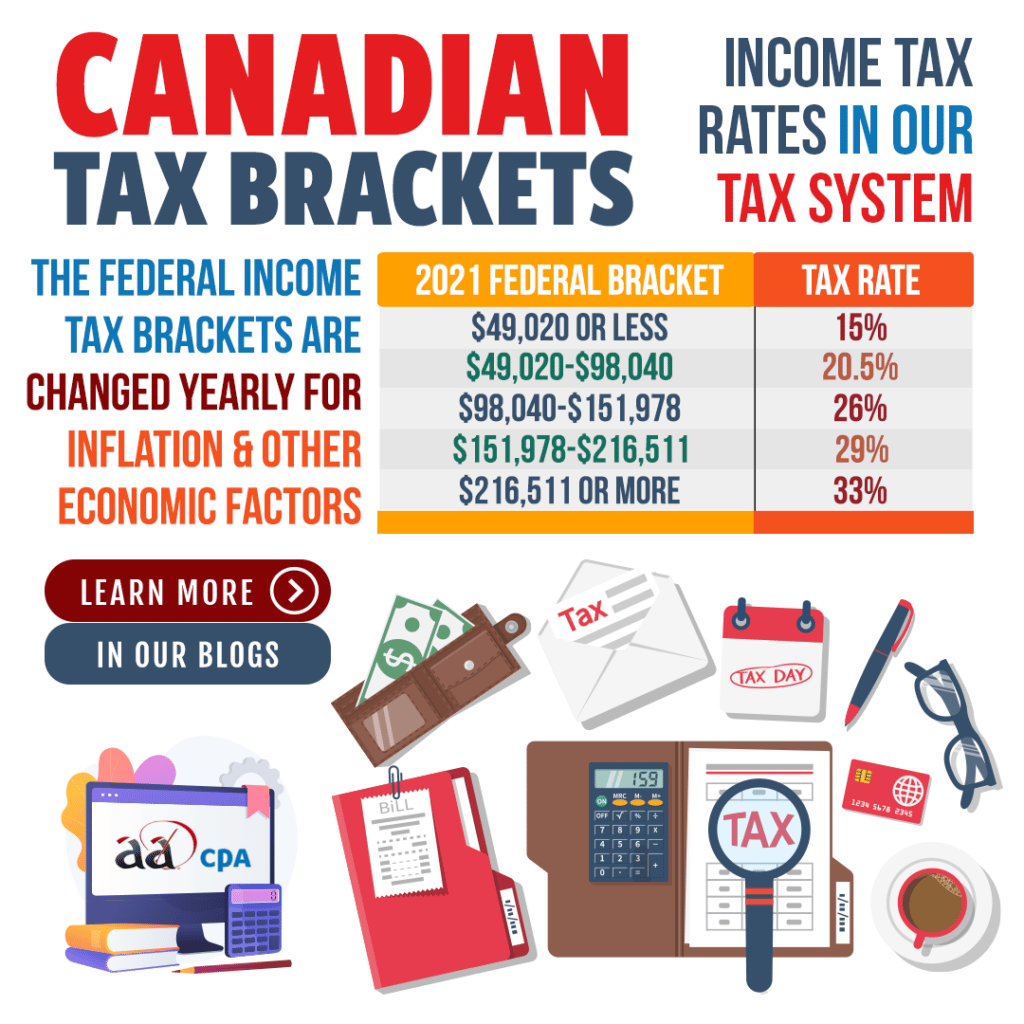

Canada’s Tax Brackets for Federal Income Tax

| 2021 Federal Income Tax Brackets | 2021 Federal Income Tax Rates |

| $49,020 or less | 15% |

| $49,020 to $98,040 | 20.5% |

| $98,040 to $151,978 | 26% |

| $151,978 to $216,511 | 29% |

| $216,511 or more | 33% |

Keep in mind that this is in addition to your provincial income tax bracket. The calculation of your income tax keeps the rate per amount of income you earn. In other words, you pay each tax rate for each bracket you surpass. For example, if your taxable income in 2021 was 0,000:

- You pay 15% on the first $49,020.

- Then, you would pay 20.5% on the amount between $49,020 to $98,040.

- Finally, you would also pay 26% on the amount from $98,040 to $110,000.

To summarize, your federal income tax would be calculated as:

- The first $49,020 would incur $7,353.00 in federal income tax.

- From $49,020 to $98,040 of your taxable income, you would pay $10,049.10.

- The final $11,960 of your taxable income would result in $3,109.60 of federal income tax.

- This ends up with $20,511.70 in federal tax.

Your employer may have already deducted most, all or less than this amount which is why you may have to pay when filing or get a refund. If you haven’t already paid tax on the income, expect to pay it when you file your return based on your total taxable income.

Canada’s Tax Brackets & Other Rates to Consider

Now you may be wondering, what is the actual rate of federal income tax being paid if it is broken out like this?

Average Federal Tax Rate

Well, one measure can be your average federal tax rate. To get this rate, divide your total income by the total tax you pay. Going back to the example above, here’s what your average tax rate would be in 2021 based on a taxable income of 0,000:

- $20,511.70 / $110,000 = 0.18647 or 18.647%

- Total Federal Income Taxes Paid / Total Taxable Income = Average Tax Rate

- Thus, 18.647% would be your average tax rate.

Marginal Federal Tax Rate

Your marginal federal tax rate is the tax rate you will pay on anything earned above your current total income. If you take the example above again and your taxable income is 0,000, then your marginal federal tax rate is 26% until you earn more than 1,978. This changes when you earn more than $216,511 to 33%. Another way to explain this is that for every dollar above your taxable income of $110,000, you will pay 26% in federal income tax.

If you still want more information or want to understand how this applies to you, contact us. For reference you can always check out CRA’s website and their article on federal income tax here.