The Canada Child Benefit and Eligibility

The Canada Child Benefit or CCB is a non-taxable amount that is paid monthly for families with children under the age of 18. On top of that, there is a Child Disability Benefit which you may be eligible for.

When you apply for the Canada Child Benefit, your children are also registered for the goods and services tax or harmonized sales tax (GST/HST) credit, climate action incentive payment (CAIP), and any other related federal, provincial and territorial programs that the CRA offers alongside it.

Eligibility for the Canada Child Benefit

- You must be living with the child.

- They must be under 18 years of age.

- You must be primarily responsible for the child’s care and upbringing.

- You must be a resident of Canada regarding tax purposes.

- You or your spouse (or common-law partner) must be:

- A Canadian Citizen

- A Permanent Resident

- A Protected Person

- A Temporary Resident

- This means you have lived in Canada throughout the last 18 months and have a valid permit in the 19th month.

- Registered or Entitled to Register Under the Indian Act

Ideally you should apply when your child is born, lives with you or when a new shared custody arrangement begins.

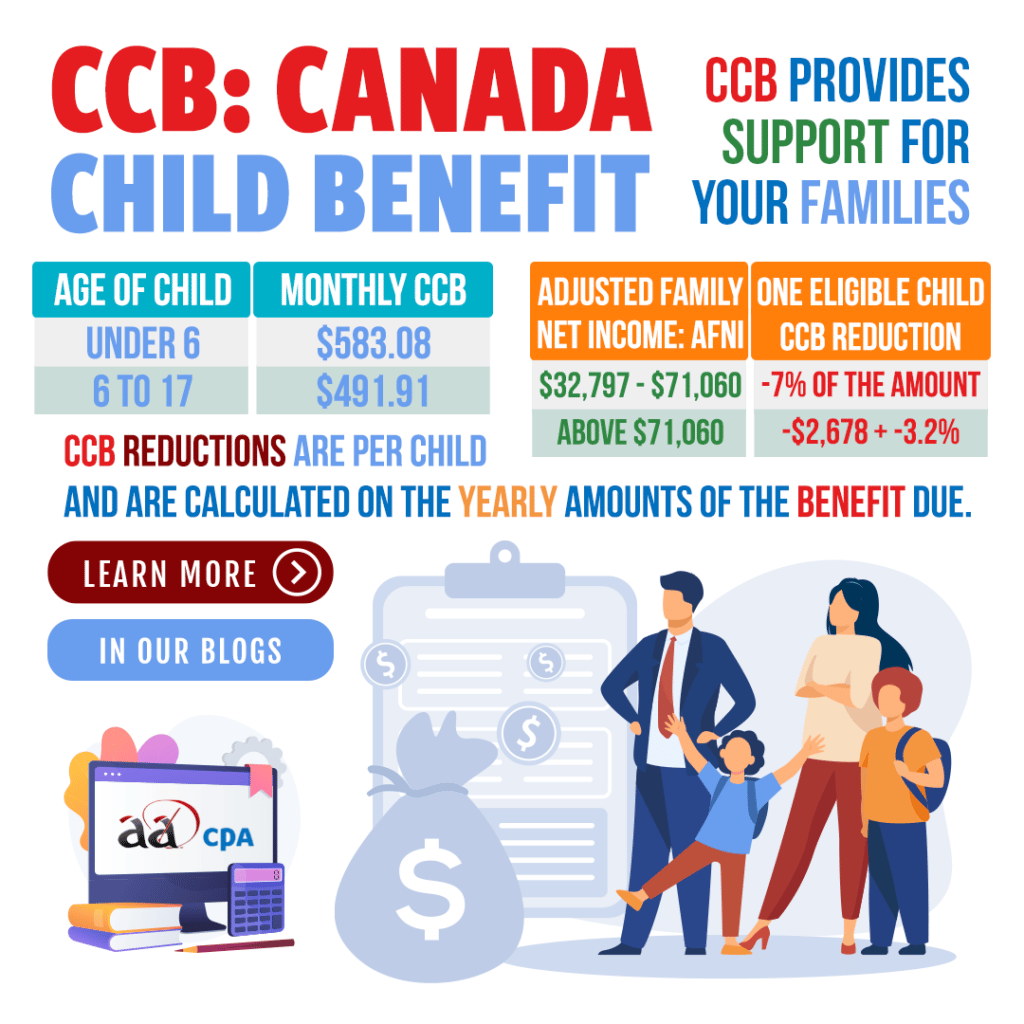

Calculating the CCB Amount

The calculation of your CCB amount is based on:

- Number of Eligible Children

- Ages of Eligible Children

- Adjust Family Net Income (AFNI) for the Last Tax Year

- Eligibility for the Disability Tax Credit (DTC)

The CCB is currently calculated as:

- $6,997 per year for each eligible child under the age of 6.

- This translates to $583.08 per month.

- $5,903 per year for each eligible child aged 6 to 17.

- This comes to $491.91 per month.

One Eligible Child

- Reduction is 7% of the amount of the Adjusted Family Net Income (AFNI) greater than $32,797 up to $71,060

- If income is greater than $71,060 then the reduction is $2,678 plus 3.2% of the AFNI greater than $71,060

Two Eligible Children

- Reduction is 13.5% of the amount of the Adjusted Family Net Income (AFNI) greater than $32,797 up to $71,060

- If income is greater than $71,060 then the reduction is $5,166 plus 5.7% of the AFNI greater than $71,060

Three Eligible Children

- Reduction is 19% of the amount of the Adjusted Family Net Income (AFNI) greater than $32,797 up to $71,060

- If income is greater than $71,060 then the reduction is $7,270 plus 8.0% of the AFNI greater than $71,060

Four or More Eligible Children

- Reduction is 23% of the amount of the Adjusted Family Net Income (AFNI) greater than $32,797 up to $71,060

- If income is greater than $71,060 then the reduction is $8,801 plus 9.5% of the AFNI greater than $71,060

To find out more information on the Canada Child Benefit or CCB, visit the CRA’s website for a CCB calculator and more information via this link: Canada Child Benefit Overview by the CRA