How Much Capital Gains Tax Do You Pay?

A capital gain occurs when you sell or are considered to have sold a capital property for more than its cost. This cost includes the adjusted cost base (ACB) and any outlays or expenses incurred to make the sale. Capital gains tax applies to these sales and if you make a loss on the sale, it can be used to offset any other capital gains.

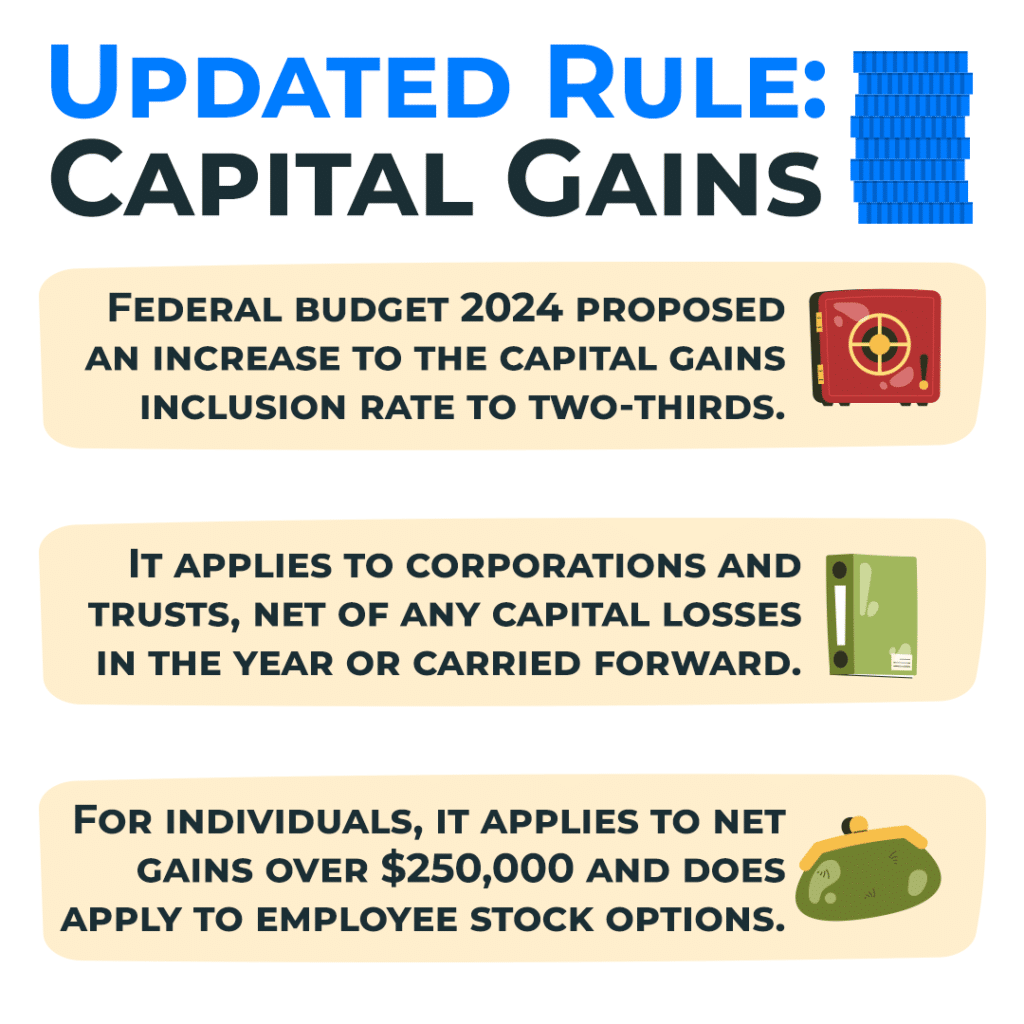

Update to Capital Gains Tax in 2024

The current capital gains tax rule on disposing capital property results in only 50% of the capital gain being included in taxable income. This is known as the inclusion rate, or how much is included in your taxable income. With the 2024 federal budget propsal, the inclusion rate is to go up to two-thirds (66.67%). While it affects all corporations and trusts, individuals are only affected for capital gains realized for the year on or after June 25, 2024 when exceeding $250,000. Keep in mind that your principal residence is excluded from this increase.

With the $250,000 threshold, individuals incurring capital gains up to the amount only pay to the inclusion rate of 50%. This is the net of capital losses in the year or carried forward from previous years. Another point of consideration is for any employees exercising employee stock options. Any capital gains from stock options exercised over $250,000 face the inclusion rate of 66.67%. Any gains that amount under the threshold remain at the 50% rate.

Capital losses are to remain at the 50% allowable rate. There is no change but any losses previously realized and carried forward can offset any gains that are to be at the new inclusion rate. In summary, for individuals with capital gains of over $250,000, net of losses, corporations, and trusts, there are two inclusion rates to consider. That is the 50% inclusion rate for gains up to the threshold and 66.67% for gains over the threshold.

Confused on the Changes to Capital Gains Tax?

Call our tax experts today. We can help you save on your taxes.

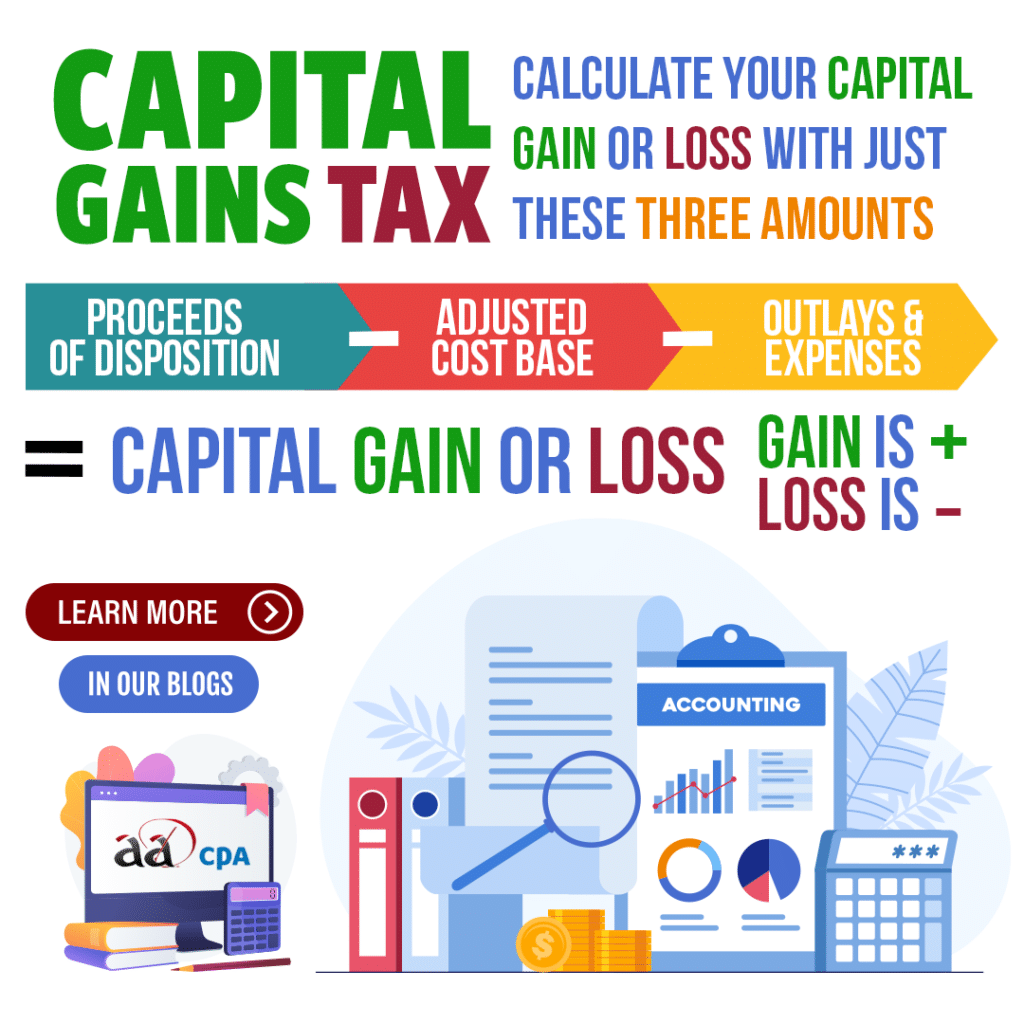

Calculating Capital Gain or Loss

To calculate your capital gains or losses, prepare the following information.

- The Proceeds of the Disposition

- The Adjusted Cost Base (ACB)

- The Outlays and Expenses that Incurred in the Sale of the Property

Subtract the total Adjusted Cost Base and any Outlays and Expenses from the Proceeds of the Disposition. The amount you get is your capital gain or loss and is needed on your tax return.

Calculating Capital Gains or Losses in Foreign Currency

- First, convert the proceeds of the disposition to Canadian dollars using either the Exchange Rates or Annual Average Exchange Rates (2007 to 2017) in effect at the time of the sale.

- Then, convert the ACB (Adjusted Cost Base) of the property to Canadian dollars. This is done using the exchange rate that was in effect at the time of the acquisition of the property.

- Finally, convert the outlays and expenses to Canadian dollars. This uses the exchange rate in effect at the time in which they occurred.

Zero-Rated Capital Gains Tax

Any capital gain that incurs as a result of a donation to a qualified donee may be eligible to an inclusion rate of zerio. This occurs if it is also one of the following properties:

- Shares of a Capital Stock of a Mutual Fund Corporation

- Unit of a Mutual Trust Fund

- Interest in a Related Segregated Fund Trust

- Prescribed Debt Obligation (Not a Linked Note)

- Ecologically Sensitive Land

- Including a Covenant or Easement

- In Quebec this can be a Personal Servitude or Real Servitude Donated to Certain Qualified Donees Other than a Private Foundation

Capital Losses in Capital Gains Tax

If the Adjusted Cost Base (ACB) and the Outlays & Expenses are higher than the Proceeds of the Disposition, this is a capital loss. Half of this capital loss can be used against any taxable gains in the tax year. Additionally, if your loss is higher than all taxable capital gains for the year, it becomes part of the calculation used for your net capital loss for the year. The net capital loss can be used to reduce your taxable capital gain in any of the 3 preceding years, or in any future year.

If you would like to read more about how your capital gains are dealt with during your tax return, visit the CRA’s website and find information on Line 12700 – Taxable Capital Gains by clicking here.