Why File Your Tax Return with a CPA?

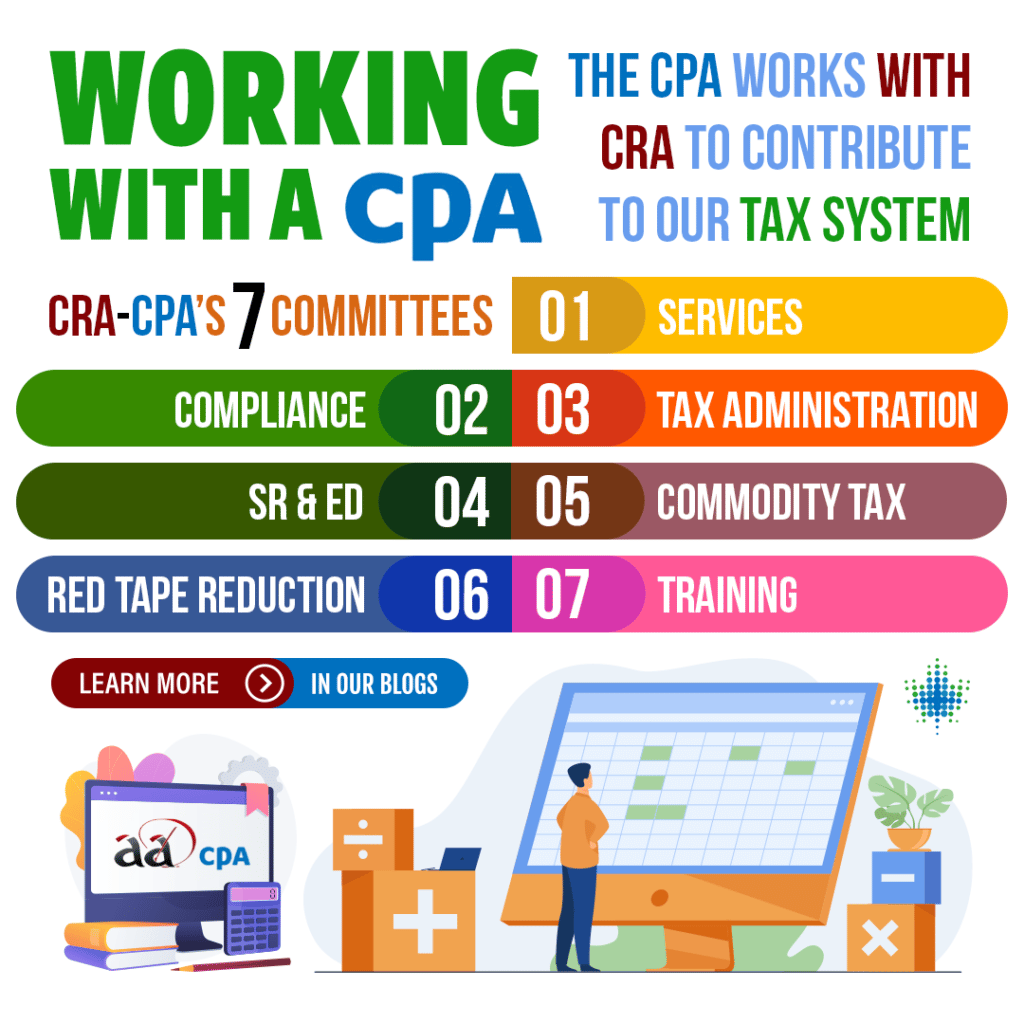

The governance of the CRA-CPA Canada Framework is done by an overarching steering committee. They manage they relationship between the CRA and CPA Canada to provide high level guidance and direction to tax related committees. Thus filing a tax return with a CPA is the safest and most accurate way to do so.

There are seven committees in total and consist of the following headings:

- Services

- Compliance

- Tax Administration

- Scientific Research & Experimental Development

- Commodity Tax

- Red Tape Reduction

- Training

Service Committee

- Provide enhancements to the existing CRA services and operations

- Receives input on forms, publications and programs that are still early in the development cycle

- Provide continuous feedback on tax administration for the CRA

Scientific Research & Experimental Development

- The SRED committee enhances existing Scientific Research & Experimental Development services and operations

- They also receive input of SRED forms and publications still early in development

Red Tape Reduction Committee

- The Red Tape Reduction refers to the committee that identifies red tape burdens for taxpayers and provides solutions

- They also provide feedback on CRA’s red tape reduction deliverables

Compliance Committee

- They provide feedback on the audit process

- Additionally, they receive input on how the process for taxpayers to comply can be easier

- Work with each other in regards to issues that are of national interest

- This includes the underground economy, aggressive tax planning, offshore activities and CPA Canada’s “privilege” request

Tax Administration Committee

- This committee identifies situations where administrative provisions are considered to get to tax policy objectives

- Produce possible solutions to obtain tax policy objectives

Commodity Tax Committee

- Identify possible enhancements to existing commodity tax services and operations

- To receive input on commodity tax forms, publications and programs still early in development

- This is also a source of feedback on commodity tax administration for the CRA

Training Committee

The training committee is there to consider and identify synergies related to training programs offered by the CRA and CPA Canada. They also recognize CRA experience for the CPA Canada professional designation accreditation. In addition, they offer the tax audit training to university curriculums.

Filing Your Return with a CPA

Considering how closely the CRA works with CPA Canada, it is clear that a recognized CPA representative will be able to offer the highest level of service in the market. Filing a tax return with these professionals will provide much more confidence that the information you are conveying to the CRA is an accurate representation of your tax situation. Speak to us today to start filing your business, personal or trust taxes with our certified CPA’s. Learn more about the CPA’s who work with the CRA via this link: Click Here to Find Out More About CPA-CRA Committees for Tax Governance