Automobile Deductions in 2022:

On December 23, 2021 – the Department of Finance Canada announced some changes to the automobile income tax deduction limits as well as expense benefit rates that apply in 2022.

Here’s a breakdown of the changes to limits and rates which were effective as of January 1, 2022:

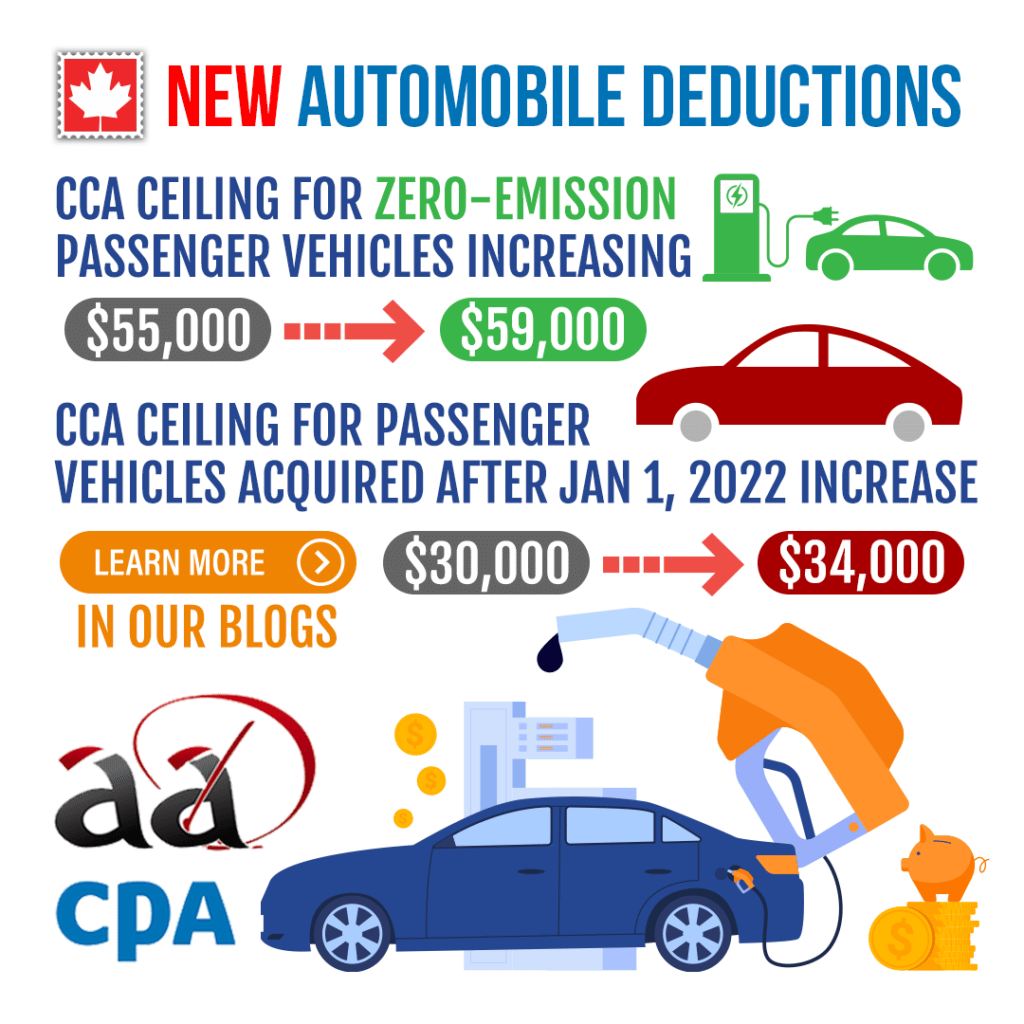

- The Capital Cost Allowances (CCA) ceiling for zero-emission* passenger vehicles has increased from $55,000 to $59,000 before tax.

- The CCA ceiling for passenger vehicles in general has increased from $30,000 to $34,000 before tax.

- For both CCA ceiling changes, vehicles new or used must be acquired on or after January 1, 2022.

- New deductible leasing costs are now increased from $800 per month to $900 per month before tax for new leases.

- Limits on deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes in provinces has increased by $0.02. This brings it to $0.61 per km in the first 5,000 km and each additional km receives a deduction of $0.55.

- If you are in the territories the limit is increased by $0.02 as well but has increased to $0.65 for the first 5,000 km and $0.59 for all additional km driven.

- There was also an increase by $0.02 in the general prescribed rate for the taxable benefit of employees in regards to their personal portion of automobile expenses paid by employers, bringing it to $0.29 per km.

*Keep in mind that for a zero-emission passenger vehicle to be eligible, it can be a plug-in hybrid with a battery capacity of at least 7 kWh, are fully electric or fully powered by hydrogen.

Have any questions? Give us a call at (604) 227-1120 to find out more, email us at info@advancedtax.ca or visit Canada.ca.