Federal Budget 2024 Canada Summary: Key Highlights for Businesses and Individuals

The Canadian Federal Budget 2024 announcement was recently made, and we’ve highlighted the key areas in this article. It affects anyone residing or operating a business in Canada, along with other areas of foreign impact. When working with expert accountants, you can trust that they’re up to date with what’s happening across the country. This makes sure than any financial and tax planning done always considers the full scope of your situation and upcoming changes. The Federal Budget brings economic changes which can really affect your livelihood; that’s why we’re here to break it down.

Federal Budget Housing Initiatives: Building for the Future

One key focus area of the 2024 Federal Budget is around the Canadian housing crisis. The proposals come with a vision to construct around 3.9 million new homes by 2031. To do so, the following measures have been introduced:

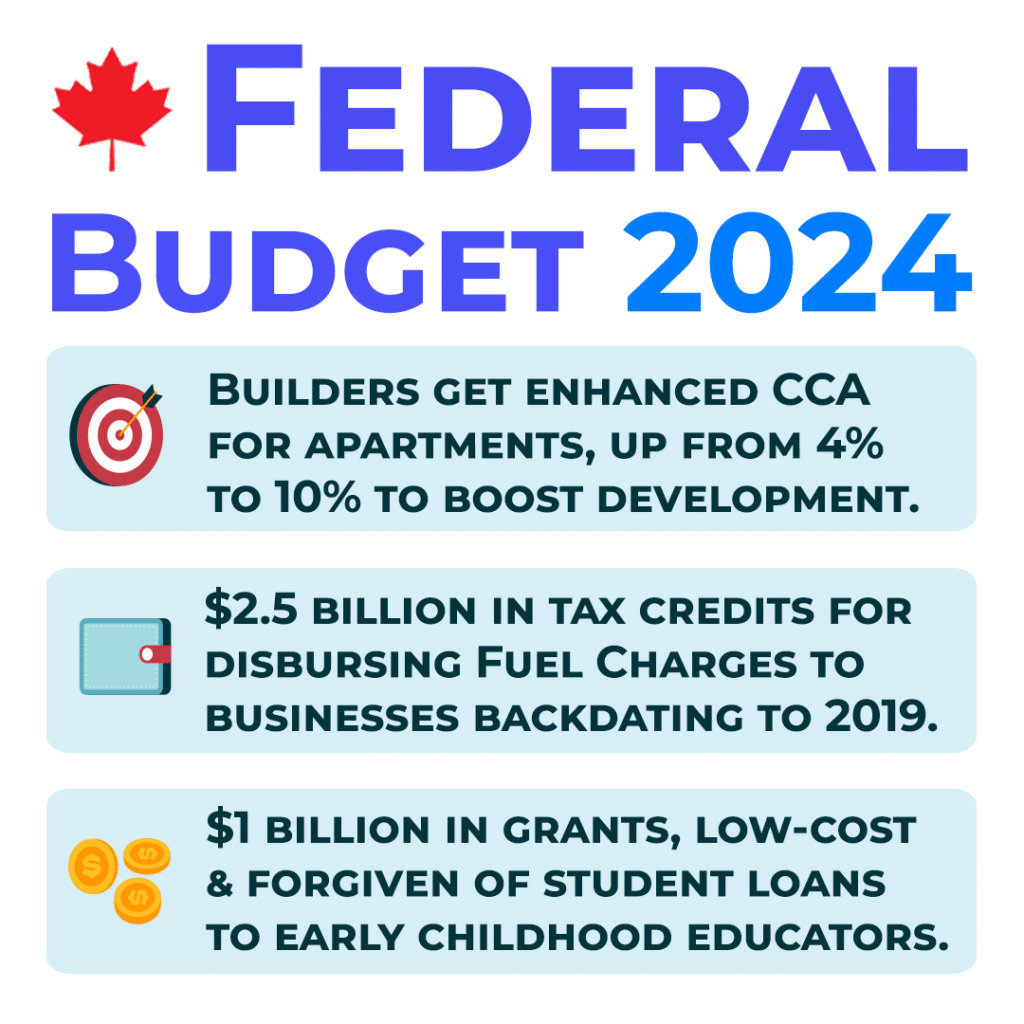

- Increased Tax Incentives: Builders will benefit from an enhanced capital cost allowance rate for apartments, rising from 4 to 10 percent. This adjustment provides more substantial tax write-offs, encouraging investment in housing development.

- Extended Mortgage Amortization: First-time homebuyers purchasing new builds can now take advantage of a longer mortgage amortization period of up to 30 years. This change aims to enhance affordability for home ownership.

- Land Availability: Public lands, including Canada Post and National Defence properties, will be opened for home construction. Leasing land to developers will help expand the housing supply.

- Addressing Homelessness: $250 million over two years is allocated to encampments and shelter shortages for homeless individuals.

Tax Reforms: Impacts on High-Worth Individuals and Corporations

Taxes in the coming years will be significantly changed by the 2024 budget. It targets high-net-worth individuals, corporations, and trusts primarily with these changes:

- Capital Gains Taxes: The inclusion rate for capital gains above $250,000 (for individuals) and all capital gains (for corporations and trusts) increases to 66.67 percent, up from 50 percent. This change will bring in an additional $19.4 billion in revenue over the next four years.

- Excise Taxes: Taxes on tobacco and vaping products are set to rise, with a $4 increase on a carton of cigarettes and a 12 percent hike on vape supplies, generating nearly $1.7 billion in revenue over five years.

Federal Budget Support for Students and Healthcare Professionals

The federal budget prioritizes support for education and healthcare sectors:

- Student Loan Forgiveness: Early childhood educators and various health and education workers, including hygienists, pharmacists, teachers, and social workers, will benefit from loan forgiveness programs totaling hundreds of millions of dollars.

- Early Childhood Educators are receiving $48 million over four years and $15.8 million after for loan forgiveness. More than $1 billion total will be provided for low-cost loans, grants, and student loan forgiveness to expand childcare services as well.

- Health and Education Workers are getting $253.8 million over four years and $84.3 million per year after towards loan forgiveness.

- Pharmacare and Mental Health: The budget allocates funds to cover contraceptives, diabetes medication, and supplies under the new Pharmacare plan. This will cost $1.5 billion over five years. The Canada Disability Benefit and related costs come with a budget of $6.1 billion over six years and $1.4 billion per year after. Additionally, significant investments are directed towards mental health services including:

- A $500 million fund to help community health organizations provide mental-health care to younger individuals.

- Bring a “right to disconnect” to legislation for federally regulated workplaces.

Environmental Initiatives and Business Incentives

Environmental sustainability and business growth are focal points of the budget:

- Green Initiatives: Over $900 million will be invested in greener homes and energy efficiency programs. On top of that, a national flood insurance program will be developed by 2025. This provides $15 million in support through the Canada Mortgage and Housing Corp.

- Business Tax Credits: Businesses involved in the electric-vehicle supply chain and clean electricity sectors will benefit from new tax credits of 10% over the next 10 years. In the same time frame, a 15% tax credit is offered for investments in new equipment or refurbishments for clean electricity. They are also offering Credits for Disbursing Fuel Charge Proceeds to around 600,000 small and medium-sized businesses worth .5 billion. These credits backdate to 2019, increasing their impact for the businesses.

Want to Take Advantage of the New Credits?

Get a consultation from on of our accountants today.

Indigenous Communities and Foreign Policy

The budget outlines substantial support for Indigenous communities and foreign policy endeavors:

- Indigenous Support: Indigenous communities undertaking resource projects will receive up to $5 billion in sector-agnostic loan guarantees. Funding is also allocated for education, housing, and infrastructure improvements. $150 million over three years is allocated to an Emergency Treatment Fund to help deal with the opioid crisis. There is an additional 0 million being put towards increasing access for Indigenous Peoples for mental-health services. Another $1.2 billion is to be used for primary and secondary education infrastructure on First Nations reserves with $918 million for housing and other infrastructure.

- Global Aid: Canada will provide lethal and non-lethal military aid to Ukraine of 41.6 billion over five years. Investments in global humanitarian responses and foreign credential recognition programs come to $350 million over two years and $159 million over five years to support changes to Global Affairs Canada. Additionally, the budget boosts military spending by 1.76% of GDP by 2030, involving $8.1 billion over the next five years and $73 billion by 2044.

Artificial Intelligence and Future Readiness

The government is investing heavily in artificial intelligence (AI) to enhance technological capabilities and prepare for the future:

- AI Investments: The budget sets aside $2.4 billion to bolster AI capacity, with a focus on improving computing capabilities and technical infrastructure. Funds will also support workers affected by AI, including those in the creative industries. Part of this is to set up and fund a new AI Safety Institute of Canada and Transport.

- Foreign Credentials: Over the next two years, $50 million is to be used to enhance the foreign credential recognition program for workers in construction and health care. They also have a plan to spend $77.1 million to integrate internationally educated health-care professionals in new training positions.

Navigating the Changes of the Federal Budget 2024 Canada

With the Federal Budget 2024 in Canada announced, this summary highlighted key areas that may affect your situation. Whether you’re in business, or just concerned with how it affects you as an individual, there are changes coming up to consider. Housing initiatives, tax reforms, investments in healthcare, education, and AI bring new opportunities across the board. The budget is a detailed roadmap for where Canada’s growing economically and socially.

At the end of the day, you need an expert to give the right advice based on the upcoming changes. This helps with tax planning, financial reporting, and strategic consulting. That’s why the team at Advanced Tax is just a message or a phone call away to get you to your goals. Book a consultation with us today to get ahead of the upcoming changes from the 2024 Federal Budget in Canada. It’s better to be proactive and informed over scrambling when you feel the effect of the changes. We’ll get you the personalized guidance you need.