Simplifying Taxation for Sole Proprietors in Canada: A Comprehensive Guide

An unincorporated business owned by a single individual is a sole proprietorship. The sole proprietor has a very simple business structure compared to partnerships and corporations. Sole proprietors are liable for all the business risks and can effect your personal property and assets. They are responsible for making business decisions, receiving all the profits or claiming all the losses, and do not have a separate legal status from the business.

Tax for this business structure is paid through personal income tax returns on the net income from the business. The business can be registered under a business name, operated under the owner’s name, or both options. If the business has a name that isn’t the owner’s, a separate bank account is needed to process cheques payable to the business.

Tax Requirements for Sole Proprietorships

Sole proprietorships are obligated to calculate and pay income tax in addition to:

- Goods and Services Tax (GST) or Harmonized Sales Tax (HST): If your revenue exceeds the $30,000 annual threshold, you are required to register and charge the GST or HST to your customers and file regular GST/HST returns with the CRA. Find out when to register for and start charging GST or HST on the CRA’s website by clicking here.

- Payroll Deductions: For sole proprietorships that have employees, income tax, Canada Pension Plan (CPP), and Employment Insurance (EI) premiums need to be deducted and remitted from their wages. This is in addition to filing necessary payroll reports which need a payroll account with the CRA.

- Record-Keeping: Sole proprietors need to make sure they maintain accurate records of business transactions, receipts and invoices. They support deductions, act as references during tax audits, and help the owner understand their business’ financial position.

How much tax does a sole proprietor pay in Canada?

To find out how much tax a sole proprietor pays, all of the owner’s taxable income needs to be calculated. Then it is applied to the appropriate federal and provincial income tax rate. The individual is taxed on business income but it is considered to be personal income for tax purposes. Determining how much tax is owed can be done using an online tax calculator. You will need records of your business income, expenses, deductions, and credits for it to be effective.

Calculating Income Tax as a Sole Proprietor

- Determine Business Income: Calculate your total revenue by adding up all the income generated by the business in the year. The income includes any sales, fees, and other forms of revenue.

- Deduct Eligible Business Expenses: Next, tally up your allowable business expenses incurred in the year. These expenses include rent, utilities, office supplies, professional fees, and any other costs directly related to running the business. All expenses need supporting records through documentation of invoices, receipts, and other relevant information.

- Calculate Net Business Income: Subtract the eligible business expenses from your total revenue to get your net business income.

- Complete the T2125 Form: On your personal income tax return, fill out this form labelled the Statement of Business or Professional Activities. This adds your net business income to taxable income you may have from other sources on the T1 General Income Tax and Benefit Return.

- Determine Income Tax Payable: Your income tax liability is calculated based on federal and provincial tax rates. They are applied to your taxable income after deductions and credits.

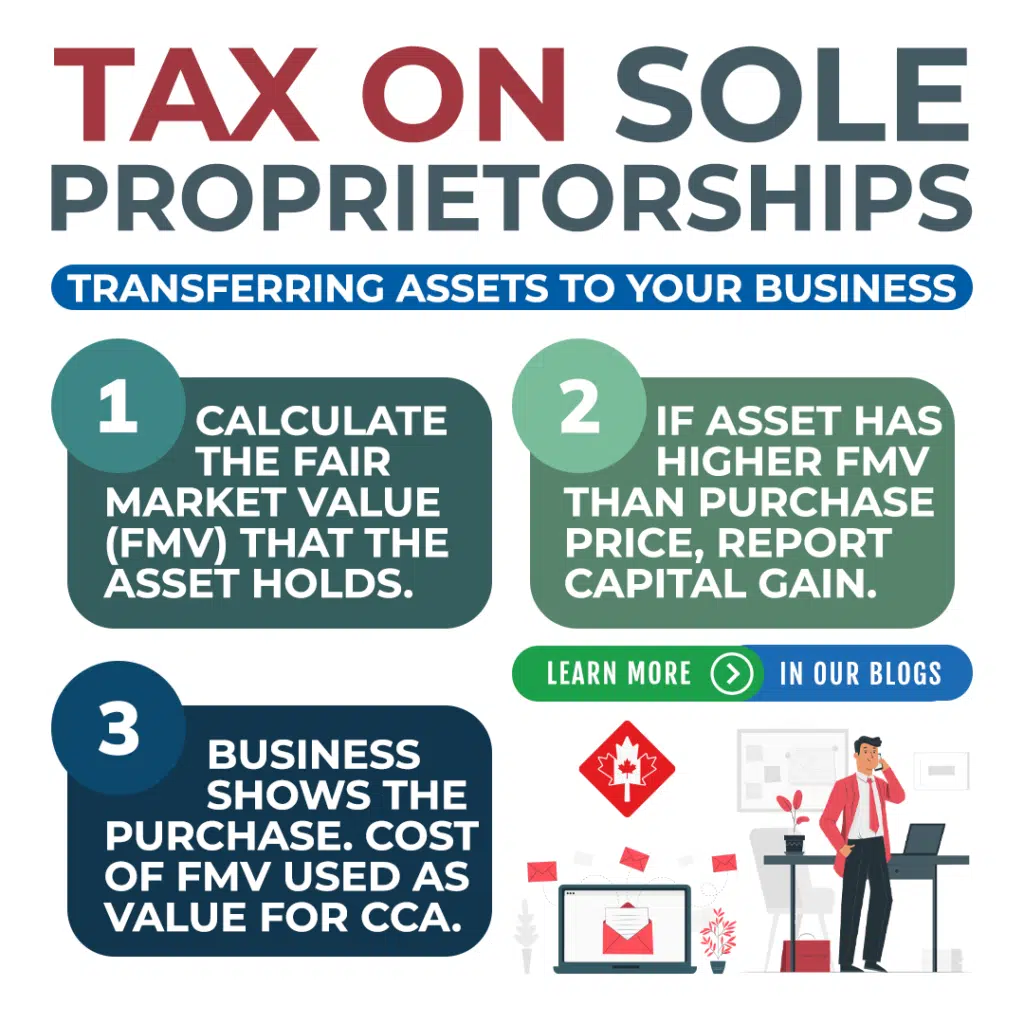

Transferring Assets to a Sole Proprietorship Business

To transfer personal assets to a sole proprietorship, a few steps need to be taken. As per the Income Tax Act, the assets are considered to be sold to the business at their Fair Market Value (FMV). If the FMV is more than the original purchase price, the individual needs to report a capital gain on the sale of the asset to the business. Then, the business needs to record the purchasing of the asset which is based on the FMV from the transfer. The FMV is then used as the value that is added to the capital cost allowance (CCA) schedule for the business’ income tax return filing.

As a sole proprietor, understanding your tax obligations is critical and may seem intimidating. Professional accountants are here to make them easy to deal with and understand. Contact our team at Advanced Tax to simplify the process and get you the resources you need to meet your tax requirements and calculate your income tax. We help you make the most out of your income tax return. Making sure you get the tax deductions and credits you are owed maximizes your return.