Preparing Your Small Business for Taxes

If you have a sole proprietorship, are in a partnership, or are self-employed, that means you have business income. Money earned from a profession, trade, manufacture, or any other undertaking is considered business income. Any activity of trade or for profit and has evidence to support it is also business income. Wages and salaries from an employer are not business income. Continue reading to learn key information in preparing for your business tax in Canada.

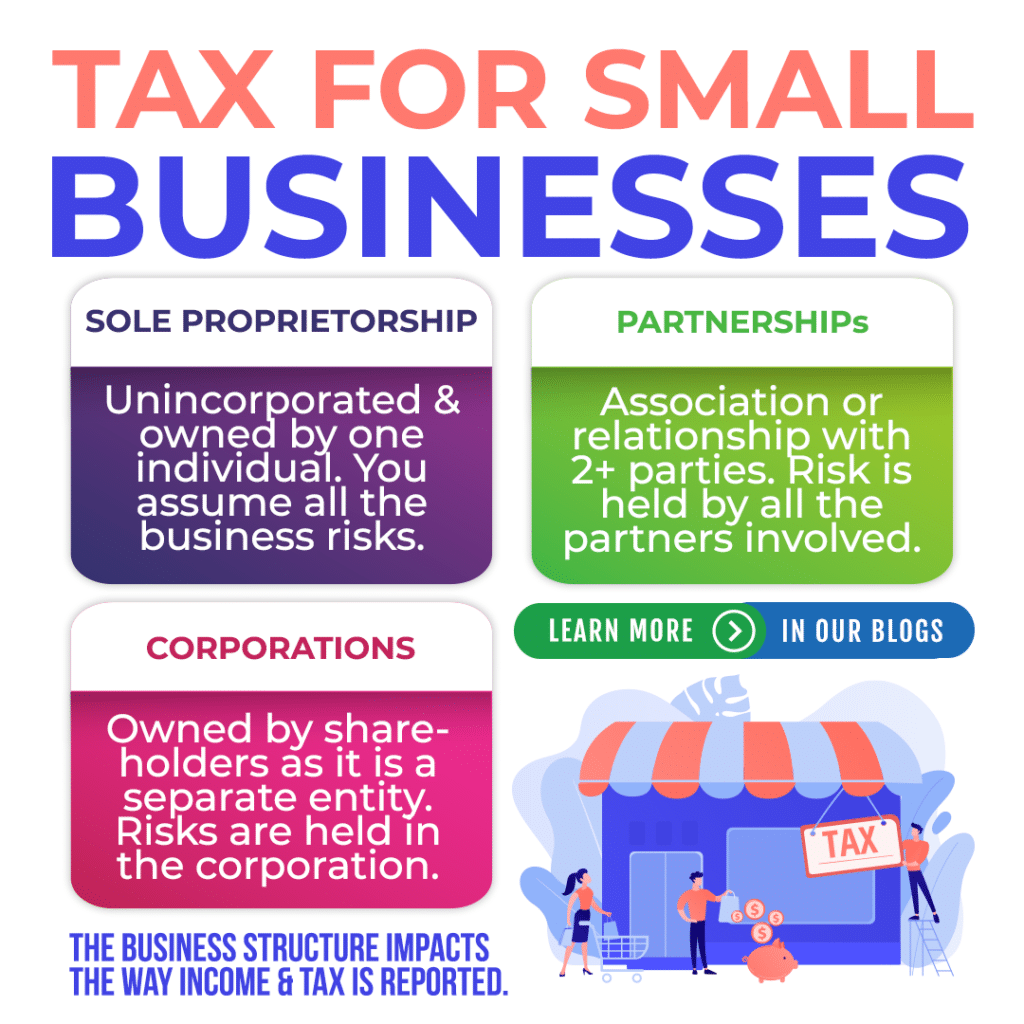

Setting Up Your Business Structure for Business Tax

There are three primary types of business structures. Each one comes with different personal risks, rules, and regulation. Regardless of the structure, all income entries in the records need original documents which include sales invoices, cash register tapes, receipts, receipts, bank deposit slips, fee statements, and contracts. We’ve broken them down with the key information from each here.

Sole Proprietorship

This is an unincorporated businesses owned by on individual. It is a very simple structure and the owner has full responsibility of any obligations. This includes making decisions, receiving profits, claiming losses, and not having a separate legal status from the business. The owner assumes all risks and can affect personal property and assets. A business name can be chosen and registered but it can also be operated under the owner’s own name. Sole proprietors pay business tax through their T1 income tax and benefit return. You have to file a T1 return to pay tax, pay capital gains, make CPP (or QPP) payments on earnings, get EI benefits, or if the CRA has requested it.

Partnerships

Partnerships involve an association or relationship between two or more individuals, corporations, trusts, or partnerships that join together for trade or business. Each partner contributes money, labour, property, or skills but is also entitled to part of the profits or losses. This is another simple business structure and a verbal agreement is enough for its formation. Each partner maintains liability for business activities and can affect personal property and assets.

Corporations

This is a legal entity separate from its owners. The corporation itself has most of the same rights and responsibilities as an individual. It can enter contracts, loan or borrow money, sue or be sued, hire employees, own assets, and pay taxes. Regardless, it keeps the risk away from its shareholders’ personal property and assets.

Determining the Fiscal Period for Your Business Tax

Business income needs to be reported annually. For sole proprietorships and partnerships, this needs to be done on a calendar-year basis. There is an exception to this for partnerships in which all members are individuals. In that case, a non-calendar-year fiscal period can be elected.

For corporations, the tax year is its fiscal period and cannot be longer than 53 weeks (371 days). New corporations can choose any tax year-end provided it isn’t more than 53 weeks from the date the corporation was incorporated or formed. The income tax return has to be filed within six months of the end of its fiscal period. When the fiscal year ends on the last day of the month, the return is due on or before the last day of the sixth month after the tax year ends. Otherwise, it is due on the same day of the sixth month after the end of the tax year.

Transferring Personal Assets to Your Business

In a sole proprietorship, the Income Tax Act needs the assets transferred at their fair market value (FMV). In other words, CRA considers that you sold the assets, priced at their FMV to the business. If the fair market value is higher than your purchase price, the difference is considered to be a capital gain on your income tax return. On the business side, it will have purchased these assets and the value of the FMV is added to the capital cost allowance (CCA) schedule for income tax.

If you are transferring personal assets to a Canadian partnership or corporation, it works a little differently. The property can be transferred for an “elected” amount. This means that the amount can be chosen by you and does not have to match the fair market value. There is still a capital gain if the purchase price is less than the elected amount but this is the cost to the partnership or corporation.

Learn more and dive into the details on CRA’s website by clicking here. Contact us to speak with an expert at Advanced Tax to make sure your business is on the right track. We make sure you not only comply with tax regulations, but make the most of your tax return. This way, you get the tax savings your business deserves.