Navigating the World of Charity Accounting: A Guide for Non-Profits

Non-profit and charity organizations are held to the highest standards on social, environmental, and financial issues. Making sure that they are financially healthy and transparent is necessary for their success. At the Advanced Tax CPA Firm, we understand the unique challenges that non-profits face. In this blog, we’ll dive into the intricacies of charity accounting and share insights to help these organizations thrive.

Understanding Charity Accounting Standards

This specialized branch of accounting focuses on the financial management and reporting of not-for-profit organizations. The financial statements that are created ensure the organization’s financial situation is accountable, transparent, and credible.

Navigating the Legal Landscape for Charity Accounting

In many countries including Canada, the United Kingdom, and the United States, non-profit organizations and charities operate under specific legal and regulatory frameworks. For Canadian charities, the legal foundation is the Income Tax Act. This legislation outlines the requirements for organizations to qualify as charities, including guidelines for financial reporting. Complying with these Canadian regulations is necessary to maintain non-profit status.

Canadian charities are required to meet specific criteria. This includes operating exclusively for charitable purposes and devoting resources to these activities. On top of that, they need to provide detailed financial information in their annual returns to the Canada Revenue Agency (CRA). Understanding and complying to Canadian tax regulations ensures the charity is maintains their legal not-for-profit standing and displays transparency to donors and stakeholders.

Fund Accounting: What’s the Deal?

Now, let’s talk about the heart of charity accounting – fund accounting. Unlike traditional accounting, which revolves around profit and loss, fund accounting is all about accountability for different funds or donations received. Each fund serves a specific purpose, and it’s vital to meticulously track and report on how these funds are utilized, ensuring transparency for donors and regulatory bodies alike.

Not-for-Profit Accounting Standards

Non-profit organizations adhere to not-for-profit accounting standards. Depending on which country the organization is filing taxes in, different regulatory bodies provide guidance on financial reporting. In Canada, the Accounting Standards Board (AcSB) sets the guidelines and in the United States the Financial Accounting Standards Board (FASB) is responsible for them. For consistency and comparability in financial reporting across non-profit organizations, these guidelines need to be followed.

The Role of Accounting Software for Non-Profits

In today’s digital age, non-profits can greatly benefit from specialized accounting software tailored to their needs. Solutions like QuickBooks Online for non-profits offer user-friendly interfaces and features designed to streamline financial management and reporting. These tools can help non-profits efficiently manage donations, track expenses, and generate accurate financial statements.

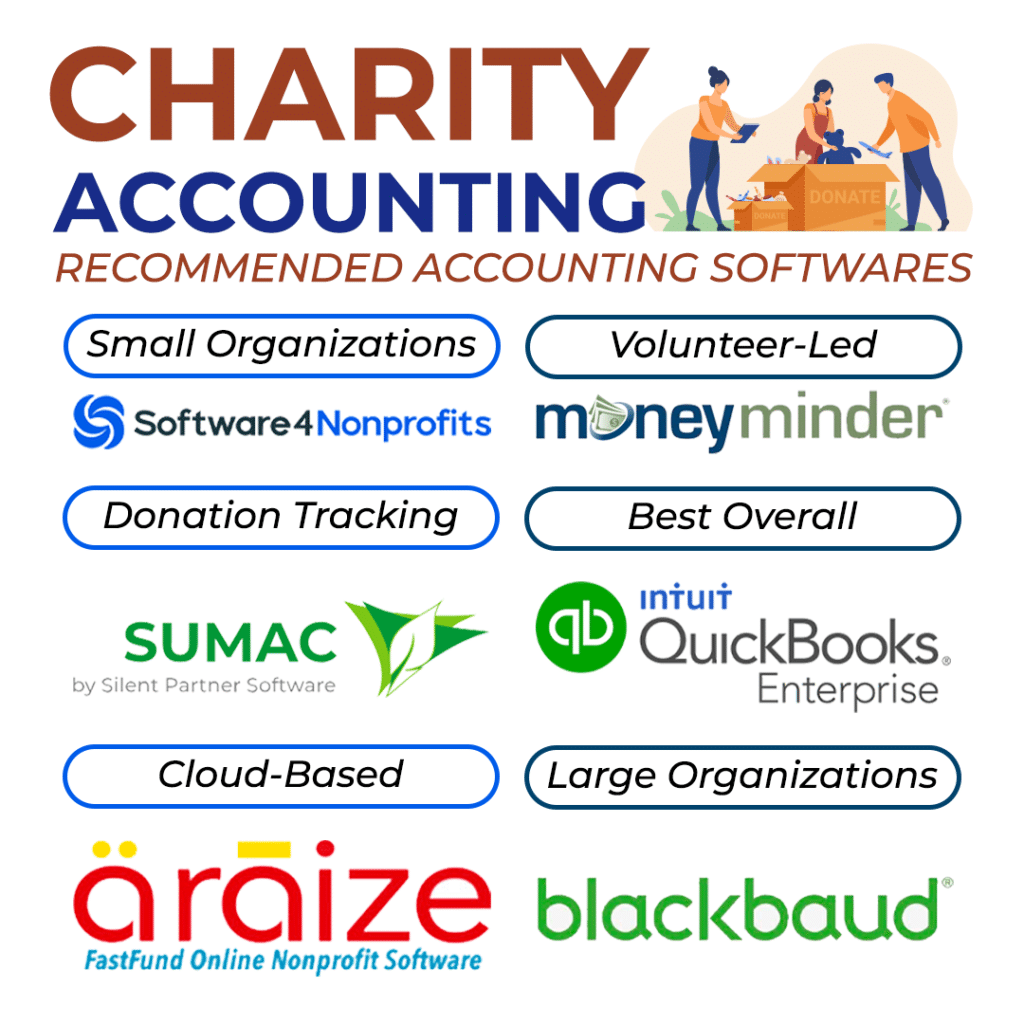

Here are some recommended softwares for charity accounting:

- Small Organizations: ACCOUNTS by Software4Nonprofits

- Volunteer-Led Organizations: MoneyMinder

- Donation Tracking: Sumac from Silent Partner

- Best Overall: Intuit QuickBooks Enterprise Nonprofit

- Cloud-Based: Araize FastFund Accounting

- Large Organizations: Financial Edge from Blackbaud

The Crucial Role of Bookkeeping

Any well-run non-profit organization is based on effective bookkeeping. This includes the recording of all financial transactions, maintaining detailed records of donations, and categorizing expenses based on their respective funds. Accurate bookkeeping leads to accountable financial statements to effectively represent the organization’s financial standing for transparency in financial reporting.

Getting to Grips with Fund Accounting

To summarize, charity accounting for non-profit organizations can be intricate but is crucial. Compliance with specific accounting standards and legal requirements, such as the Income Tax Act in Canada, is essential for maintaining non-profit status and building trust with donors and stakeholders.

Working with a CPA Firm on Your Charity Accounting

Advanced Tax specializes in non-profit accounting and provides tailored solutions to meet every organization’s unique financial needs. Our accountants are experts in fund accounting are committed ensuring compliance to not-for-profit accounting standards. They are proficient in accounting software of all types, including QuickBooks Online for non-profits. These qualities make us an ideal partner to help your organization navigate the complexities of charity accounting.

If you represent a non-profit organization or charity and are looking for expert guidance in accounting, bookkeeping services, and financial reporting, please don’t hesitate to reach out to us. We’re here to support your mission and ensure that your organization can make a difference with the right financial foundation.

Feel free to contact us today to discuss your charity accounting needs to take the first step toward transparent and efficient financial management.