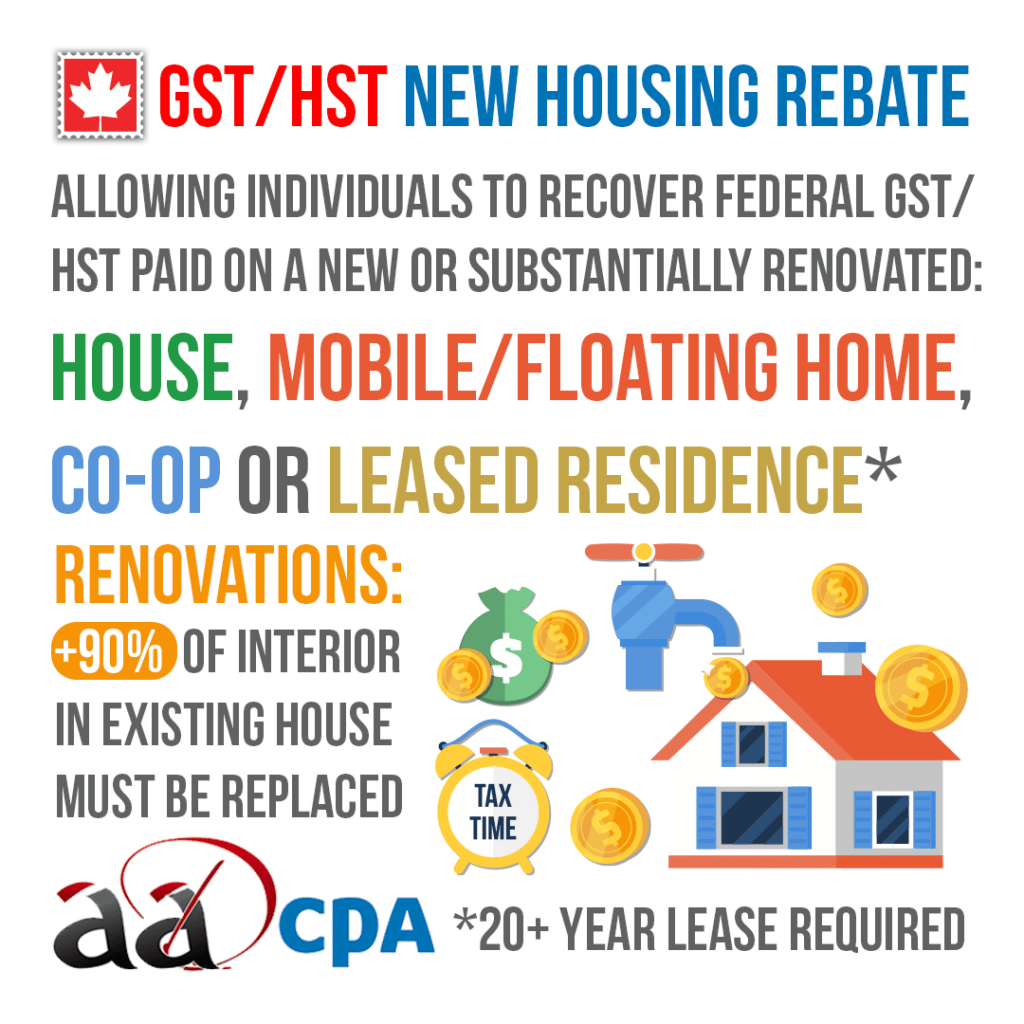

New Housing Rebate on GST/HST in Canada

Did you know that you may be eligible for the GST/HST New Housing Rebate offered by the Canadian government? This allows you to recover some of the GST or the federal portion of the HST paid for the house or renovation as long as it’s a primary place of residence. Corporations or partnerships are not eligible for this rebate.

Eligibility Conditions:

- Purchased a new or substantially renovated house from a builder including housing on leased land for use as your primary place of residence.

- If it’s a lease, then the term must be for at least 20 years, or has the option to buy the land.

- Purchased shares in a co-op to use a unit in a new or substantially renovated cooperative housing complex as your primary place of residence.

- Keep in mind that substantially renovated refers to having at least 90% of the interior of the house being removed or renovated.

- Constructed or substantially renovated your own home for use as your primary place of residence as long as the fair market value of the house is less than $450,000 when the construction is substantially completed.

Houses Purchased from a Builder:

- Purchasing a new or substantially renovated house including the land from a builder.

- Purchasing a new or substantially renovated mobile or floating home from a builder, manufacturer or vendor.

- Purchasing a share of the capital stock of a cooperative housing corporation where the co-op paid tax on a house or renovated house.

- Purchasing a new or renovated house from a builder that you lease the land from in which you may buy the house and/or is longer than 20 years.

Built the house or hired someone else to do so? As long as you meet one of the following requirements, you are also eligible for the rebate.

Owner-Built Houses:

- Building a house on land that you own or lease.

- Renovating your existing house by at least 90% of the interior.

- Developing a major addition to your house that doubles the living space.

- Converting a commercial building you own into your house.

- Purchasing a new or substantially renovated mobile/floating home.

Have any questions? Give us a call at (604) 227-1120 to find out more, email us at info@advancedtax.ca or visit the Government of Canada‘s website to learn more.