Unlocking Savings: The New Residential Rental Property GST Rebate Guide

There have been some important updates announced for those who are constructing or purchasing newly constructed rental properties. On September 14, 2023, the Department of Finance announced a significant proposal to enhance the previously enacted GST rental rebate into the New Residential Rental Property rebate.

What’s the Deal with the New Residential Rental Property Rebate (NRRP)?

The existing GST rental rebate has long been a significant resource for landlords, offering a substantial 36% rebate on the GST component for newly constructed rental properties. This rebate faced a gradual phase-out for properties exceeding $350,000 and disappeared completely at the $450,000 mark. For example, take a two-bedroom rental unit that has a value of $500,000. The enhanced GST Rental Rebate would give $25,000 in a tax rebate.

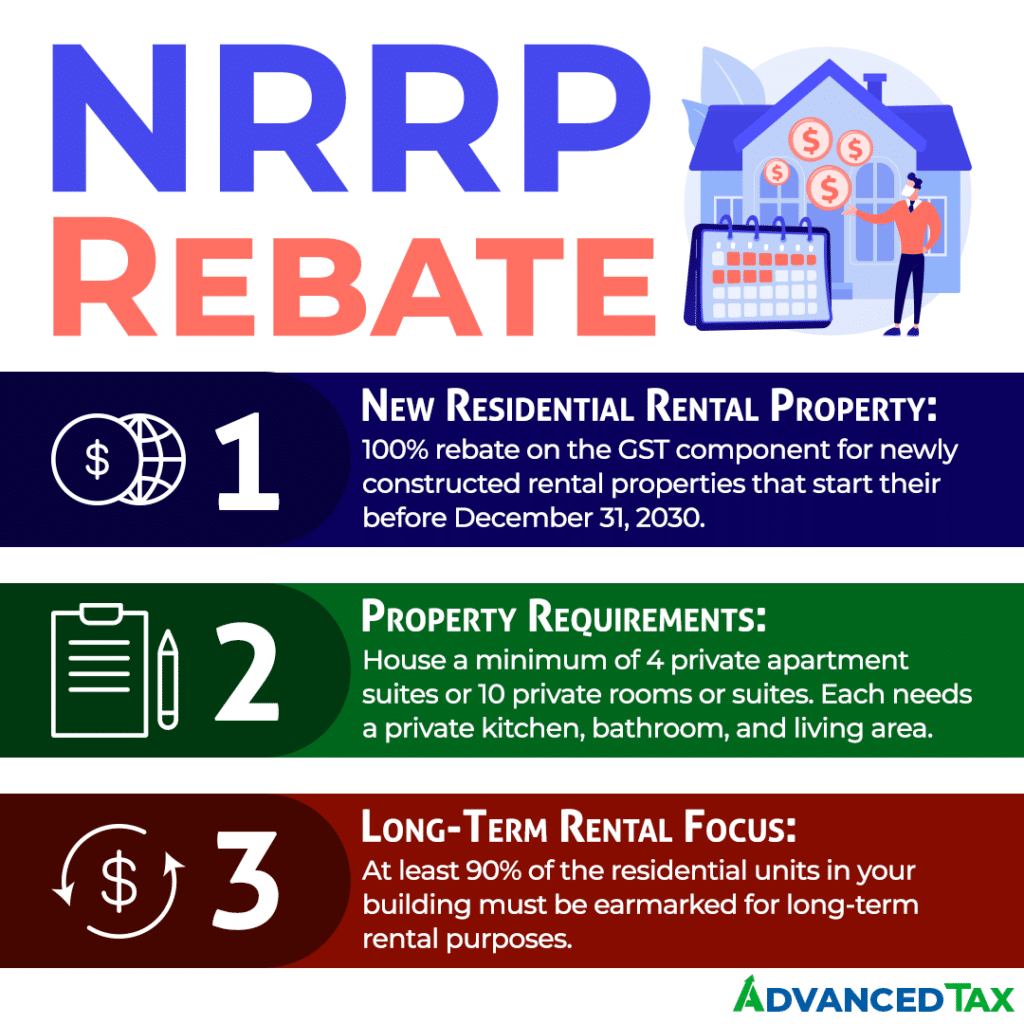

The proposed NRRP aims to boost this rebate from 36% to a whole 100%. Plus, you don’t need to worry about the phase-out thresholds; they’re now a thing of the past for properties valued over $350,000. This update to the rebate is set to benefit certain rental housing projects that start construction between September 14, 2023, and December 31, 2030, inclusive, and wrap up by December 31, 2035.

Qualifying for the Enhanced Rebate

To get your hands on this enhanced rebate, your new residential units must meet the criteria for the existing rental rebate. Here is a breakdown of the criteria your units need to meet to qualify:

- Property Requirements: Your property should house a minimum of four private apartment units or a minimum of ten private rooms or suites. These units must boast a private kitchen, bathroom, and living area.

- Long-Term Rental Focus: At least 90% of the residential units in your building must be earmarked for long-term rental.

On top of that, if you’re transforming non-residential real estate, like an old office building down into a residential complex, you’re still eligible for the rebate. Even public service bodies get access to the enhanced rebate.

Eligibility for the GST/HST New Residential Rental Property Rebate

To be eligible for the New Residential Rental Property rebate, or NRRP, you must be in one of the following situations:

- You are a landlord who:

- Purchased a newly constructed or significantly renovated residential rental property.

- Built your own residential rental property.

- Made an addition to an already existing multiple-unit residential rental complex.

- You are a builder who accounted for the GST/HST under self-supply rules. This is due to selling a residential unit to an individual and leased the related land to them. The land was leased under a single written agreement.

- The availability of this criteria is only if the individual is eligible to claim the new housing rebate.

- You are a person who accounted for the GST/HST under the self-supply or change-in-use rules. This is the case if you made an exempt lease of land used for residential purposes.

- Examples include the rental of a residential lot or a site in a residential trailer park.

What’s Not on the Rebate Menu

Before you start drafting plans for all your rentals, here’s what doesn’t make the cut. The enhanced rebate makes an effect on individually owned condominium units, single-unit housing, duplexes, triplexes, or housing co-ops. Also, keep in mind that substantial renovations of existing residential complexes won’t qualify for the enhanced rebate.

Your Guide to the NRRP

For a comprehensive dive into the New Residential Rental Property Rebate, check out the official guide from the Canada Revenue Agency here. The Department of Finance’s announcement is also a very useful reference and you can find it here. Ready to navigate the rebate application process? The CRA has the information you need to do so at the here.

The New Residential Rental Property Rebate is primed to reshape the landscape for landlords. Get ready to unlock massive savings and get more money out of your rentals. If you need any assistance on learning whether it can apply to your rental properties or how to apply for it, contact us by clicking on the link here. Our accountants have the information you need to make the most out of the New Residential Rental Property rebate.