Real Estate Development Accounting: Mastering Financial Precision for Successful Projects

At Advanced Tax, we take immense pride in being your reliable partner in real estate development accounting. Real estate developers face unique financial challenges in their projects. Acquiring the right property, managing development costs, construction expenses, and accurate accounting practices make a strong foundation for a successful real estate venture. Keep reading for more information on the crucial aspects of accounting for real estate developers and the importance of ensuring your company’s finances are precise, accurate, and ready to read when you need them.

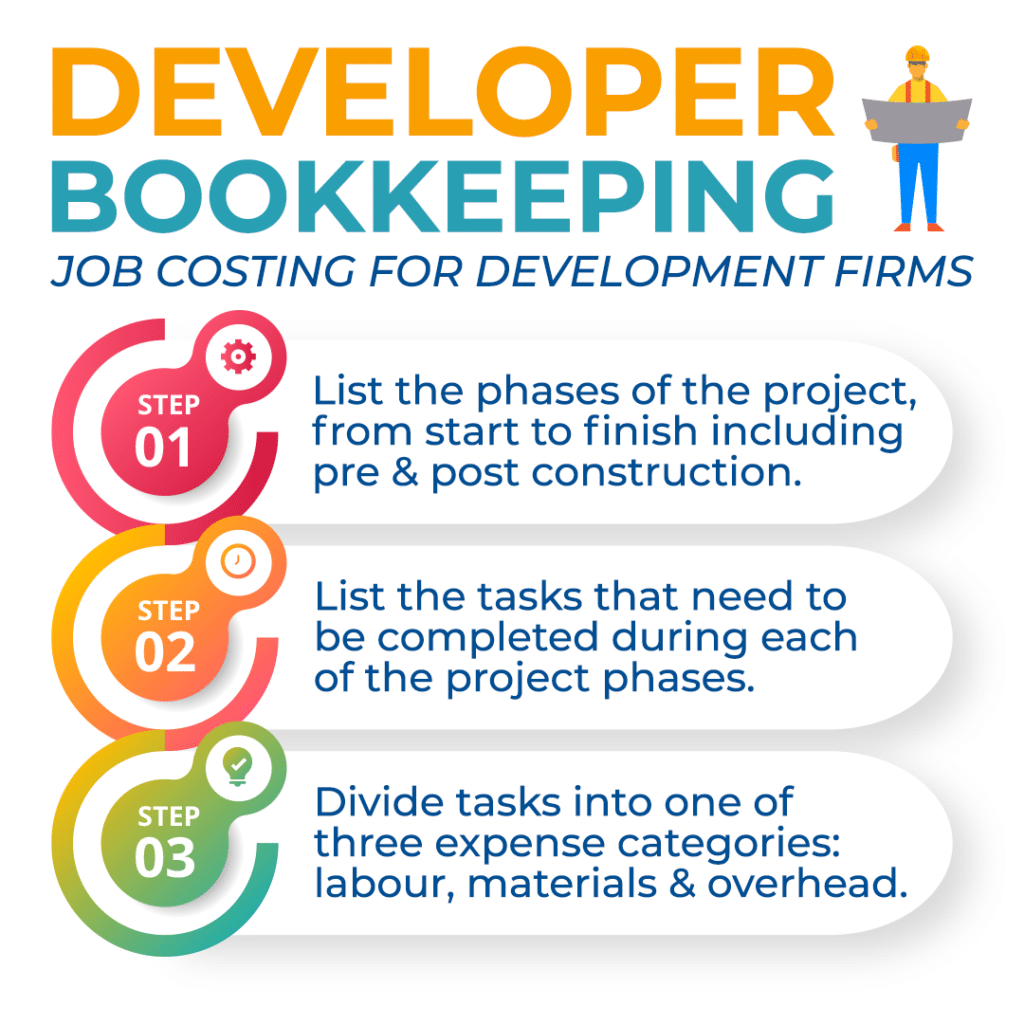

Accounting for Real Estate Development Costs

Real estate developers need to keep a close eye on costs to keep their place in the industry and that is done with proper accounting systems. The right financial tools ensure that your financial picture is clear during every phase of a project. Accurately recording and allocating expenses that come with land acquisition, permits, design, construction, marketing, and sales make sure your job costing is realistic.

Expenses should be categorized into two main categories, direct and indirect costs. Direct costs include materials and labour while indirect costs include administrative and other overhead expenses. This gives decision makers at your company the tools they need to gain valuable insights into your budget and how to optimize resource allocation to get as much value as you can.

Navigating Real Estate Development Accounting

We know that navigating the intricate world of real estate development accounting can be overwhelming. It requires staying informed about industry-specific accounting regulations and compliance standards. Moreover, as your projects progress, accounting methods might need adjustments. Our team of seasoned CPAs has extensive experience in real estate development accounting, and we provide you with the guidance needed to ensure your projects remain financially sound.

Leveraging Real Estate Development Accounting Software

In today’s tech-savvy world, specialized accounting software tailored to the real estate industry can make your life much easier. Real estate development accounting software offers a range of features that address the unique challenges faced by developers. These include cost tracking, project-specific reporting, and budget analysis. By embracing this technology, you gain real-time insights that empower you to make informed decisions, leading to improved financial outcomes. Buildertrend, Knowify, and RedTeam Flex are just some specialized construction accounting softwares. An accountant can help you identify which one is best at meeting your firm’s individual needs.

Accounting at Every Stage: Acquisition, Development, and Construction

At each stage of your real estate project, accounting plays a pivotal role:

- Acquisition: In this initial phase, you need to account for expenses related to property acquisition, feasibility studies, legal due diligence, and financing arrangements. Accurate recording of these costs is essential for calculating the basis of the acquired property.

- Development: During this stage, you’ll need to diligently track costs associated with design, permitting, and planning. Proper allocation of expenses to specific projects ensures better financial control.

- Construction: As construction takes off, your accounting focus shifts to costs related to labor, materials, equipment, and subcontractors. Proactively monitoring costs helps identify potential overruns and deviations from your budget early on.

Tax Considerations in Real Estate Development Accounting

Beyond regular accounting practices, tax planning is a crucial aspect of real estate development. Effective tax planning can lead to significant savings, especially when dealing with taxes related to property transactions, capital gains, and deductions for development expenses. Our experienced CPAs can guide you through various tax strategies, ensuring compliance with tax regulations while maximizing tax benefits.

Keeping Your Company on Track to Success

In the dynamic world of real estate development, accurate accounting serves as the foundation for success. From the initial stages of acquisition and development to the final touches of construction, meticulous cost tracking and allocation are key to determining the profitability of your project.

By partnering with Advanced Tax, you gain access to expert advice, industry-specific knowledge, and cutting-edge accounting software. Together, we will navigate the complexities of real estate development accounting and drive your projects toward triumph. Let us empower you to make informed decisions, optimize financial outcomes, and achieve your real estate development goals. With Advanced Tax by your side, you can confidently embark on your journey to success in the ever-thriving world of real estate.