How to Earn & Pay Accurate Taxes on Rental Income in Canada

What is Rental Income and is it Taxable?

Rental income is the revenue generated by homeowners who rent out part or all their property. This income is taxable and must be reported to the CRA when filing your income tax return each year. For homeowners, rental income is considered another source of income, and the tax rate is based on the marginal tax rate. This means that for every dollar you earn, you pay a certain tax rate based on your income bracket. The more income you earn, the more you pay in taxes.

Tax Deductions for Rental Income

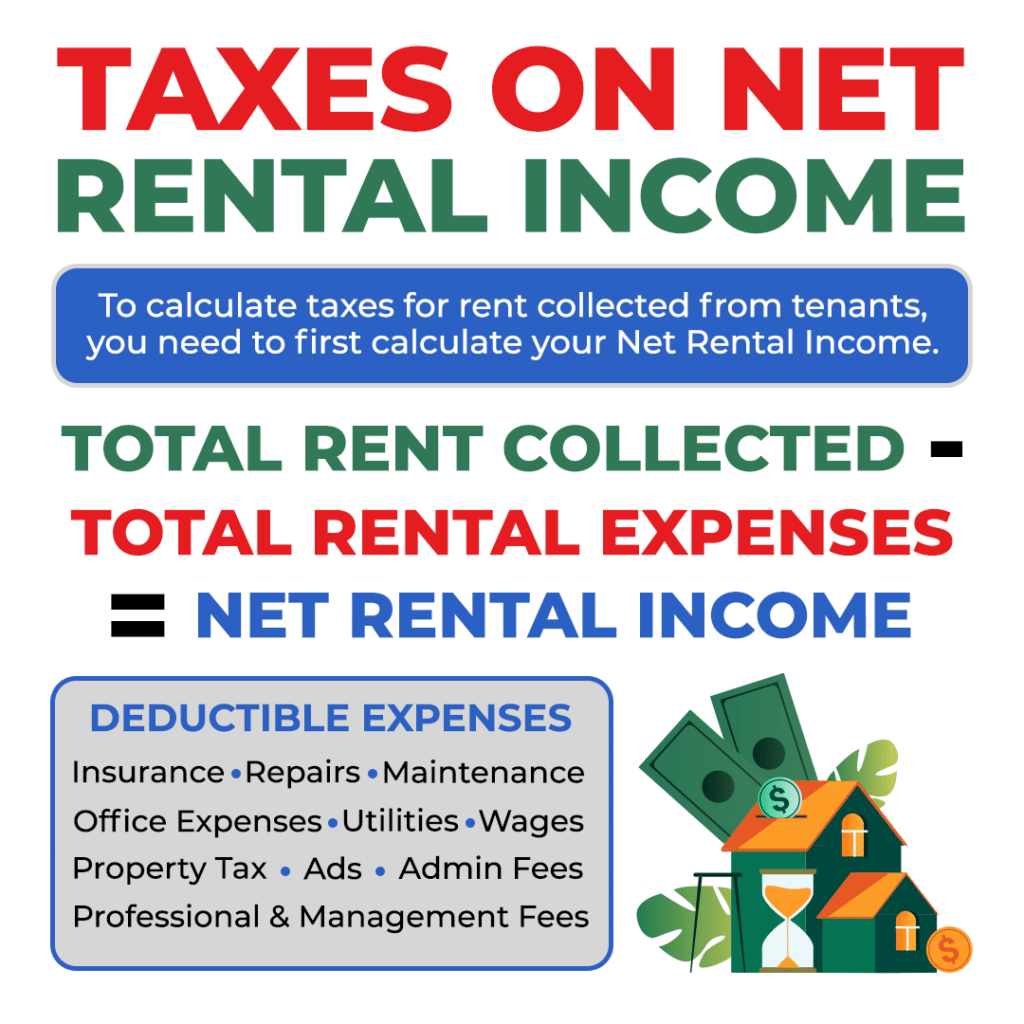

Before paying your income tax, there are certain deductible expenses you can claim to reduce the taxable amount of rental income on your return. These expenses are listed below:

Advertising Costs

Expenses incurred to advertise or promote your rental property are tax deductible, including finder fees. For example, advertising your rental property on paid media networks and through referrals with finder’s fees are all deductible.

Insurance

Your insurance premiums paid on the rental property for the current year are fully tax deductible. If your coverage exceeds more than 1 year, you can claim it in the preceding years.

Interest & Bank Charges

Interest charged on money borrowed to improve or buy rental properties may be claimed as well as interest charges paid to tenants on rental deposits.

Management & Administrative Fees

Fees paid to a third-party person, agent or organization to manage the rental property, collect rent or find tenants are tax deductible and can be claimed under this category.

Motor Vehicle Expenses

If you own one rental property, you can only deduct reasonable motor vehicle expenses if you:

- Receive income from only one rental property that is in the general area in which you live.

- You do all or part of the necessary repairs and maintenance on the property.

- You have motor vehicle expenses to transport tools and materials to the property.

- You can’t deduct motor vehicle expenses incurred to collect rent as they are personal expenses.

If you own two or more rental properties, here are your criteria when deducting motor vehicle expenses:

- Your rental properties have to be located in at least two different sites and away from your principal residence.

- If you use your motor vehicle and incur reasonable expenses to collect rent, supervise repairs, or manage the properties, you may deduct your expenses.

Office Expenses

These expenses are tax deductible for small office items like pens, pencils, stationery, and stamps but do not include cabinets or desks.

Prepaid Expenses

These are expenses paid ahead of time such as insurance. You may use the accrual method or the cash method.

Professional Fees

Any professional services used to prepare lease agreements or rent collection is tax deductible. However, fees associated with purchasing the property are classified as capital costs and are not tax deductible.

These fees include legal costs such as legal services to prepare leases or collection costs for overdue rent. For accounting fees, this would include bookkeeping services or even the cost of preparing your income tax return by an accountant.

Property Tax

Property taxes are deducted based on the period of rental or availability of the property. This is only deductible for the period that the property was available to rent. For example, if the property was only available to be rented for half the year, that proportion of the property taxes is deductible.

Repairs & Maintenance

You can deduct expenses for repairs or ongoing maintenance for the building or land. However, costs that extend the useful life of the property would be classified as a capital cost and are not tax deductible. Your own labour and capital costs are excluded as well.

Salaries, Wages & Benefits

If you hire personnel to look after your property like security or property managers is a tax-deductible expense. Amounts paid to superintendents, maintenance personnel, and others employed to take care of the rental property can be deducted but not the value of your services.

Travel Expenses

Travel expenses incurred to collect rent, supervise repairs, and manage properties are all deductible.

Utilities

Based on the rental agreement, if you are covering gas, hydro, or internet utilities for the rental space, then these costs are tax deductible for the portion applicable to the rental itself.

Other Tax Deductible Rental Income Expenses

Condominium Fees

Not only can you deduct the normal fees for a rental unit but also condominium fees that come from your share of the upkeep, repairs, maintenance and other current expenses.

Landscaping Costs

Landscaping the grounds around the rental property is only applicable in the year you paid the cost regardless of whether you use the accrual of cash method of calculation.

Lease Cancellation Payments

Amounts paid or payable to tenants to cancel their leases are tax deductible.

Vacant Land

Rental income from vacant land can have the operating expenses deducted as well as interest and property taxes.

The limit for the deductions of the interest and property tax is the amount of rental income left after deducting all other expenses but you can’t create or increase a rental loss via interest or taxes.

You also can’t deduct mortgage interest, property taxes, income taxes, profit taxes or transfer taxes if there is no earned income from the land.

Non-Taxable Deductions for Rental Income

Land Transfer Taxes

Land transfer tax (LTT) is a one-time cost that is charged when ownership of the property is transferred from the old title homeowner to the new homeowner. LTT is non-taxable because it’s classified as a non-operating expense but a property cost that increases the purchase price of the property.

Mortgage Principle

The repayments for your mortgage reduce the amount of your borrowed principal. This is non-tax deductible because taxable expenses are attributed to generating income not repayments of a loan.

Penalties

Penalties in nature are designed to punish individuals who break a rule. Tax deductions for penalties would underline these rules, instead of encouraging compliance and that is why penalty fees are different to non-business or legal expenses.

Value of Your Own Labour

If you conduct renovations to your rental property, you cannot deduct the value of your labour for tax purposes. Taxable expenses usually provide an outlay of costs but with your own labour, there is no dollar value assigned.

How to Calculate Your Net Rental Income

Your net rental income is calculated based on your total relevant rental revenue and expenses. The total amount collected for the year in rent would be the revenue and the expenses are a sum of all expenses related to service and maintenance of the rental property.

Try this example:

John has recently bought his first property and he intends to rent it out. He used a realtor to help find a tenant to charge $2,500 a month without utilities. The apartment had a pipe burst that required an immediate plumbing service. When John was filing his tax return he wanted to know what his taxable net income rental was for the year.

- Rental Income Revenue

- $2500 per month for 12 months is a total revenue of $30,000 for the year

- Business Expenses

- Realtor’s Commission as 10% of Total Rent resulted in $3,000 in fees

- Plumbing Services came to $2,000 for the year

- Total expenses come to $5,000

Net Rental Income is the $30,000 of total revenue minus the $5,000 of total expenses, making John’s net income $25,000 in this case.

Not Sure How Much Tax You Owe?

Calculating income tax can get confusing. That’s what our tax accountants are for.

Splitting Your Rental Income Between Spouse and Co-Owners

For rental properties that contain multiple owners, the rental income is split between their equity proportion, when they contributed to the purchase of the property. Co-owners share expenses based on their ownership percentage that is related to the property and are tax deductible.

The Penalty for Not Reporting Rental Income

Filing your income tax return correctly can avoid unnecessary costs in the future from the CRA. However, failing to report income or intentionally misrepresenting tax information can lead to significant financial consequences, often costing more than if taxes were filed correctly from the start.

Repeated Failure to Report Income Penalty

Failing to report income of $500 in the current and last 3 proceeding years will incur a CRA penalty. The penalty is based on the option with the lower penalty fee.

- 10% of the amount that you failed to report or 50% of the difference between the understated tax or overstated tax credits for the amounts that you failed to report

False Statements or Omissions Penalty

Knowingly falsifying your tax return to the CRA, will have severe financial consequences. The penalty will require the constituent to pay 50% of the overstated or understated tax amount with interest on the unpaid amount.

How to Rectify Improper Tax Rental Income

If you discover that you failed to report rental income on a previous year’s tax return, it is important to amend these mistakes to avoid penalties and interest charges. Here are a few ways to amend previous tax resolutions. Find out more via the Canadian Government’s section on the taxation of rental income by clicking here.

File an Amended Tax Return

To correct an omission or previous mistake, submit an amended tax return for the relevant tax year. When preparing your tax return it’s important to mark it as an amended return that includes unreported income and includes any taxes owed.

CRA’s Voluntary Disclosure Program (VDP)

VDP is a program that allows taxpayers to correct errors without a penalty recourse but must meet certain criteria. To qualify, taxpayers must voluntarily disclose their mistake before CRA is aware of the mistake. The unreported income must be fully disclosed and be at least one year overdue with arrangements for when payments will be paid.

Consult a Tax Professional

Navigating the CRA tax system is challenging and confusing. That’s why at AdvancedTax we have a dedicated team that specializes in personal income tax – especially when it comes to maximizing tax savings on your rental income. We’re just a call or message away for assistance on any tax, accounting or bookkeeping situation.