T2200 Form Work From Home Guide: Write Off Your Home Office Expenses

There’s more to working from home than convenience, you may also qualify for valuable home office tax deductions. In this guide, our expert accountants break down everything you need to know about claiming home office expenses to maximize your tax savings.

What is the T2200 Form and Does It Help Me Save Money?

Form T2200, also known as the “Declaration of Conditions of Employment,” is a form completed by your employer to certify that you were required to work from home and incur certain expenses as a condition of your employment. Although this form does not guarantee a tax refund, it allows remote employees to write off home office expenses during tax season, which lowers their taxable income.

2024 Updates for Form T2200

In 2024, CRA made two significant updates to form T2200. These changes made the process for remote or hybrid employees to claim home office expenses easier. Instead of employers manually calculating how much time an employee spent working at home, employers only need to determine if employees spent more than 50% working time at home, for at least 4 consecutive weeks, to be eligible for T2200.

The other change is how employees can claim reimbursements on certain home office expenses. CRA now recommends the detailed method over the flat rate method, where employees must meet the following criteria:

- Employed either full-time or part-time

- Possess a completed and signed T2200 from your employer

- Worked more than 50% of the time at home for at least four consecutive weeks in the year

- Paid for home office expenses out-of-pocket, with no employer reimbursements

Tax Savings Benefits with Form T2200

One of the key savings benefits of working from home is the opportunity to claim tax deductions for eligible expenses during tax season. To do so, employees must qualify under the CRA’s detailed method, which allows them to deduct costs such as utilities, internet, and office supplies like pens and paper. It’s a practical way to offset the personal expenses of maintaining a home office.

Eligible T2200 Expenses for Tax Credits

When it comes to understanding T2200 expenses, it’s important to make the distinction between the different expense categories and your employment type. For more information, refer to the CRA website, but here’s a list of commonly deductible expenses to get you started:

- Accounting and Legal Fees: Legal fees specifically incurred to establish your right to a salary or wages.

- Travel Expenses: Costs for meals, lodging, and transportation (excluding motor vehicle expenses) incurred while performing employment duties.

- Parking: Only eligible when incurred during work-related travel, not for parking at your regular place of employment.

- Office Supplies: Consumable items used directly for work, such as pens, paper, toner, and cleaning supplies.

- Assistant’s Salary: Wages paid to an assistant hired to support your work duties.

- Office Rent: The amount paid to rent a separate workspace or location used to meet with clients or perform work duties.

- Motor Vehicle Expenses: Includes fuel, insurance, maintenance, and a portion of capital cost allowance for eligible vehicle use.

- Home-Work-Space Expenses: A reasonable percentage of home expenses (e.g., utilities, rent) related to the space used to earn employment income.

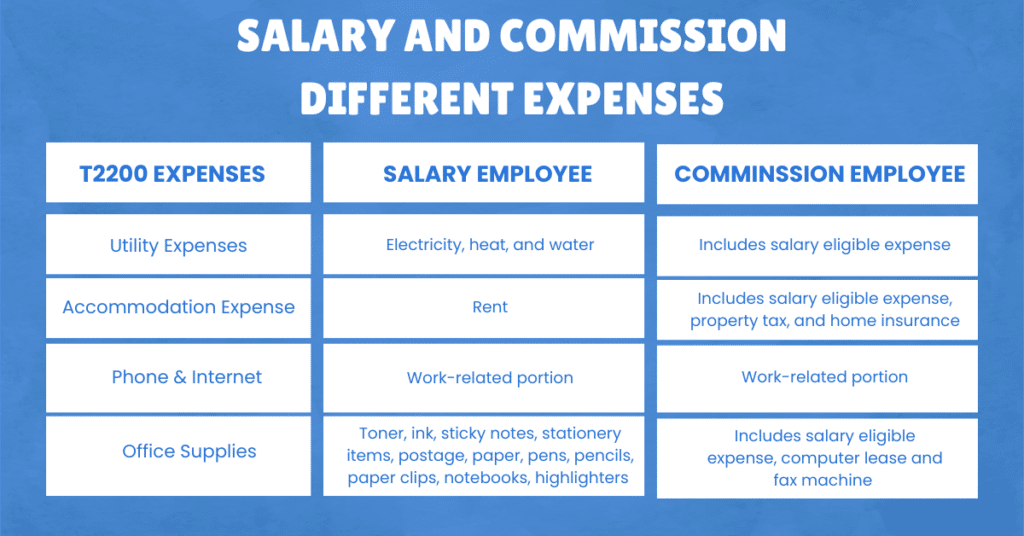

Different Types of Employment Expenses: Salary and Commission Employees

When it comes to claiming employment expenses, the Canada Revenue Agency (CRA) allows different deductions depending on whether you’re a salaried employee or a commission-based employee. While both types must meet eligibility criteria and have a signed T2200 form, commission earners typically have access to a broader range of deductions due to the nature of their performance-based income.

Need help filing your T2200 home office expenses?

Let us help you maximize your savings with your eligible T2200 tax credits

How to Fill Out the CRA T2200 Form

This form must be completed and signed by your employer that confirms if you were required to pay for certain work-related expenses, like using a home office or covering travel costs, as a condition of your employment.

Claiming your T2200 expenses:

- Request the T2200 from your employer if you’re planning to claim employment expenses. An employee does not need to fill anything on this form but keep it as a record if CRA requests this form.

- Enter your employment expenses in form T777, also known as the Statement of Employment Expenses.

- After completing T777, enter your total costs in line 22900 of your T1 tax return.

A quick pro tip: keep a detailed record of your utility bills, rent payments, and internet fees to ensure you have proper documentation in case of a CRA audit.

What’s the Difference Between T2200 and T777?

As mentioned before, the key distinction between T2200 and T777 is that T2200 is a requirement for employers to fill out, not employees. This form confirms that your employment requires certain expenses, like home office supplies or vehicle usage, to complete your job. It’s important to understand that T2200 is not submitted with your tax return but is a recognized letter for CRA if they ask for proof.

Once an employee receives Form T2200, they can choose to fill out T777 to claim any work-related expenses. The employee must calculate the actual expenses incurred and report them in line 22900 of their T1 tax return. To put it simply, T2200 confirms your eligibility, while T777 is where you report your expenses and claim deductions.

How Advanced Tax Helps with Claiming Home Office Expenses

When it comes to claiming home office expenses, many clients turn to us for help identifying which tax deductions they qualify for. Your eligibility depends on factors like your employment type and industry, which is why we have a team of experts specializing in both personal and corporate tax filing. Connect with one of our tax professionals today for personalized guidance on claiming the work-from-home tax credit.